Summary

- The ₹22,919 crore Electronics Component Manufacturing Scheme aims to attract ₹59,350 crore in investment and generate over 91,000 direct jobs.

- Incentives are now tailored to Indian manufacturers, helping overcome barriers in key components like PCBs, camera modules, and Li-ion cells.

- Experts see this as a strategic pivot from import substitution to export-led growth, aligning India with global electronics supply chains.

A New Chapter in India’s Tech Ambitions

For years, India’s electronics manufacturing strategy was reactive: plug the gaps, substitute the imports, and stabilize domestic production. But with its latest move, the government is flipping the model. The Electronics Component Manufacturing Scheme India, approved by the Union Cabinet with a funding of ₹22,919 crore, is more than another incentive—it’s a structural reset.

The six-year scheme is designed not just to fund factories but to fuel a full-spectrum electronics ecosystem. It sets out to attract over ₹59,000 crore in investment, generate products worth ₹4.56 lakh crore, and provide direct employment to more than 91,000 people. For a sector that has seen its domestic output grow from ₹1.90 lakh crore in FY 2014-15 to ₹9.52 lakh crore in FY 2023-24, this is a transformative bet on scale.

Yet what makes this initiative stand out isn’t just its size, but its specificity. The Electronics Component Manufacturing Scheme India targets the underdeveloped heart of the tech supply chain—components and sub-assemblies that quietly make up 15–20% of the bill of materials in every device we use, from smartphones to medical scanners.

And it’s not just import replacement the scheme aims for. As Union IT Minister Ashwini Vaishnaw put it, “The focus must shift from import substitution to export-led growth.” This is India’s attempt to leap from laggard to leader in high-value electronics—while also building a resilient foundation beneath its semiconductor and finished-product sectors.

Electronics Component Manufacturing Scheme, will attract large investments in the ecosystem.

— Ashwini Vaishnaw (@AshwiniVaishnaw) March 28, 2025

This will lead to:

– Investment: ₹59,350 crore

– Production: ₹4,56,500 crore

– Employment: 91,600 (direct)#CabinetDecision pic.twitter.com/unoOzXVgxa

Why This Scheme Is a Break From the Past

- Incentives are no longer solely production-linked—they now account for capital expenditure and employment generation.

- Indian firms get differentiated support tailored to the challenges in sub-assemblies and bare components.

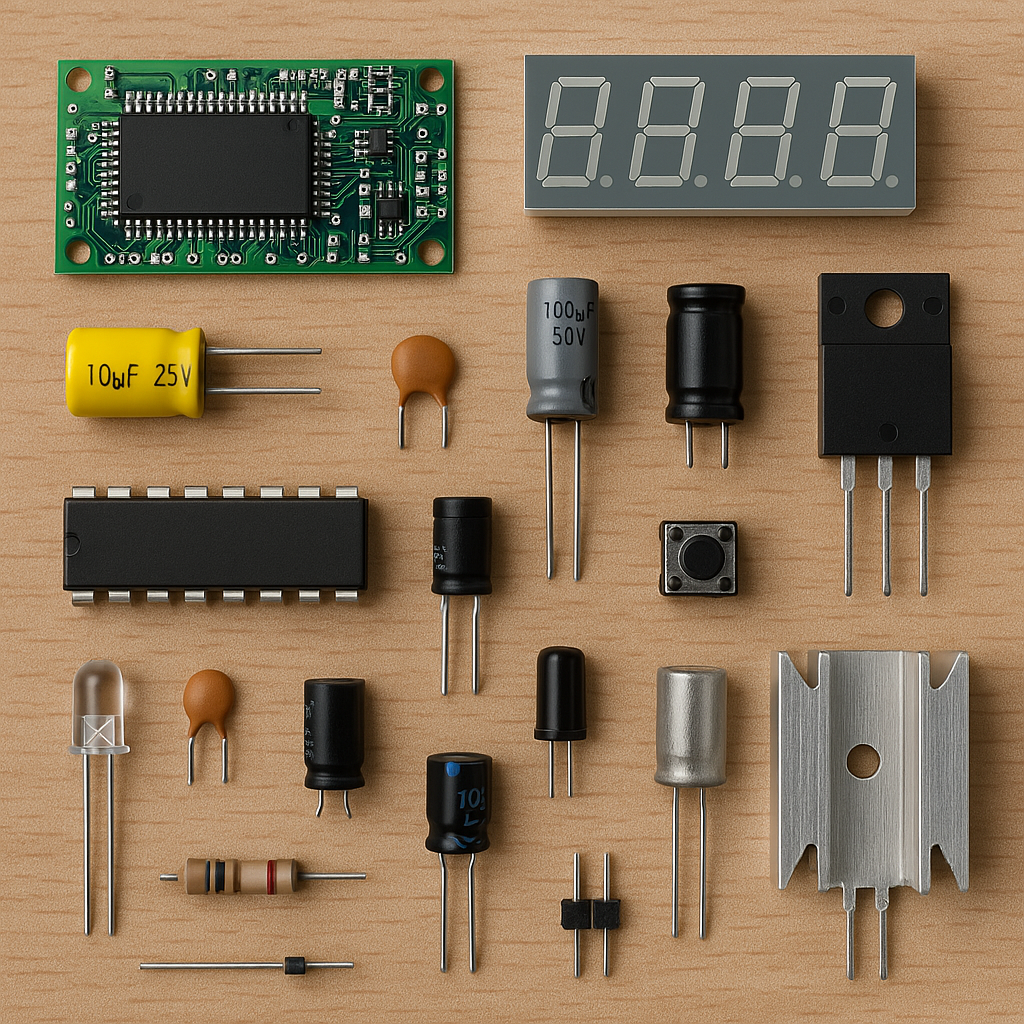

- The scheme targets critical areas like printed circuit boards (PCBs), camera modules, display modules, Li-ion cells, and enclosures.

- Capital equipment and supply chain infrastructure are included, addressing long-standing gaps in India’s electronics base.

- It responds to calls from industry stakeholders seeking deeper localization and ecosystem-level support.

Unlike previous electronics schemes that rewarded output volume, the Electronics Component Manufacturing Scheme India rewards structural depth. Manufacturers will receive incentives based on capex, turnover, and employment milestones—not just product value. This change acknowledges that sectors like multi-layer PCBs or passive components often require high upfront investment but yield modest short-term returns.

The scheme’s architecture also addresses a long-standing complaint from Indian firms: global players often benefit from generic subsidies, but domestic players need tailored support to overcome ecosystem bottlenecks. This scheme directly incentivizes technologies like HDI (High-Density Interconnect) PCBs, SMD passive components, and sub-assemblies like camera and display modules—segments where India still depends heavily on imports.

There’s also a focus on job creation beyond headline investments. A portion of incentives is directly linked to employment targets—further anchoring the scheme in India’s broader economic strategy.

And for the first time, capital equipment and infrastructure used in component manufacturing are eligible for support. This could significantly ease the cost burden of setting up fab-like facilities, even if semiconductors are not directly covered under this initiative.

What the Industry Thinks—and Why It Matters

- Industry veterans like HCL’s Ajai Chowdhry and IESA’s Ashok Chandak say the scheme enables high-value addition within India.

- The electronics industry has welcomed the employment-linked incentive model, which encourages local design and production.

- Domestic PCB and sub-assembly makers see this as a long-awaited push to make India globally competitive.

- The scheme complements the existing PLI program, semiconductor mission, and export promotion policies.

- Experts believe it could help integrate India more deeply into global value chains (GVCs), boosting its credibility in high-tech exports.

Across India’s electronics industry, the mood is upbeat. HCL founder Ajai Chowdhry called the initiative “a transformative milestone,” one that will allow just-in-time manufacturing and enable startups to innovate with local inputs. For years, companies designing system-level products have struggled to find domestic suppliers for core components. That may finally change.

Ashok Chandak, president of the India Electronics and Semiconductor Association (IESA), highlighted how India continued to import passive components, display modules, and PCBs despite building momentum in device assembly. “This scheme will accelerate the Make in India initiative,” he said, calling it a logical next step to complement existing programs like the PLI for finished products and the India Semiconductor Mission.

Industry players say the Electronics Component Manufacturing Scheme India will also help unlock capital for mid-sized manufacturers who couldn’t previously scale due to low margins and high risk. By shifting incentives to capex and job creation, the government is signaling that value creation—not just volume—is now the end goal.

Critically, this scheme is expected to catalyze greater integration into global value chains. With Apple, Samsung, and other tech giants expanding manufacturing in India, a strong local component ecosystem could tilt supply chain decisions toward Indian suppliers.

From Import Substitution to Global Dominance?

- India’s electronics exports have grown at a CAGR of 20% over the past decade, reaching ₹2.41 lakh crore in FY 2023-24.

- The component scheme builds on that momentum by targeting value-chain segments that unlock export potential.

- Sectors like telecom, automotive, medical devices, and power are expected to benefit from local component availability.

- Global electronics demand is projected to surge, and India aims to capture a major share through ecosystem-led growth.

- The Electronics Component Manufacturing Scheme India is a foundational step toward long-term self-reliance and export resilience.

India’s electronics journey is no longer about catching up. It’s about setting the pace.

From ₹0.38 lakh crore in electronics exports in FY 2014-15 to ₹2.41 lakh crore in FY 2023-24, the growth trajectory is undeniable. But most of that value has come from assembling imported components—not from owning the core manufacturing value.

That’s what this scheme intends to change.

By boosting local capacity in Li-ion cells (for electronics, not EVs), high-layer PCBs, enclosures, and SMD passive components, the scheme lays the groundwork for a future where Indian factories don’t just screw devices together—they make the devices work.

Sectors like 5G telecom, electric mobility, medical instrumentation, and next-gen computing will all benefit from a resilient and scalable component base. And as India ramps up its chip-fabrication ambitions through the semiconductor mission, a strong component pipeline becomes even more essential.

The Electronics Component Manufacturing Scheme India could also help reduce trade deficits. Component imports account for a significant portion of India’s electronics import bill. By localizing even a fraction of this demand, the country can improve its current account position while building a base for long-term innovation.

A Quiet Revolution in Circuits

India’s future as a global electronics power won’t be shaped by splashy smartphone launches or mega semiconductor fabs alone. It will be defined by what happens in the circuit layers, solder joints, and sub-assemblies that rarely make headlines.

The Electronics Component Manufacturing Scheme India is not just a funding vehicle—it’s a vision. A vision where India doesn’t just assemble the world’s tech—it builds the parts that power it.