Key Highlights:

- Central government proposes reducing GST on cars from 28% to 18%, potentially cutting prices by 8-10%

- Entry-level cars could see price reductions of Rs 30,000-36,000, while two-wheelers may drop by Rs 6,000-7,000

- Mass market manufacturers like Maruti Suzuki, Hyundai and Tata Motors expected to benefit most from the proposed GST on cars reform

Opening Overview

The automobile industry stands at the brink of a transformative change as the Group of Ministers (GoM) formed by India’s GST Council has approved a comprehensive tax rationalization plan targeting GST on cars. This momentous development, announced during Prime Minister Modi’s Independence Day speech as a “double Diwali gift,” proposes to reduce GST on cars from the current 28% to 18%, marking one of the most significant automotive policy reforms since GST implementation.

The proposed GST on cars reduction represents more than just tax relief – it signals the government’s commitment to boosting consumption, making vehicles affordable for middle-class families, and simplifying India’s complex indirect tax structure. Currently, the automobile sector faces a multi-layered tax burden with GST on cars ranging from 28% plus additional compensation cess of up to 22%, resulting in total tax incidence as high as 50% for luxury SUVs.

Industry experts anticipate that this GST on cars reform could provide the much-needed stimulus to India’s automotive sector, which has experienced sluggish growth in recent quarters. With passenger vehicle sales growing only 2% in FY25 compared to 8% the previous year, the proposed changes to GST on cars could revitalize demand, particularly in the price-sensitive entry-level segment where affordability remains a key concern for first-time buyers.

Planning to buy a new car or home appliance? WAIT!

— StockGro (@stockgro) August 21, 2025

This Independence Day, PM Modi announced a possible GST rate cut by Diwali 2025.

✅Current GST on cars = 28%

✅Proposed new GST = 18% (if passed)-

✅Savings: Up to ₹1–1.5 Lakh on a ₹10 Lakh car!

Not just cars—big-ticket… pic.twitter.com/8114IQLLHw

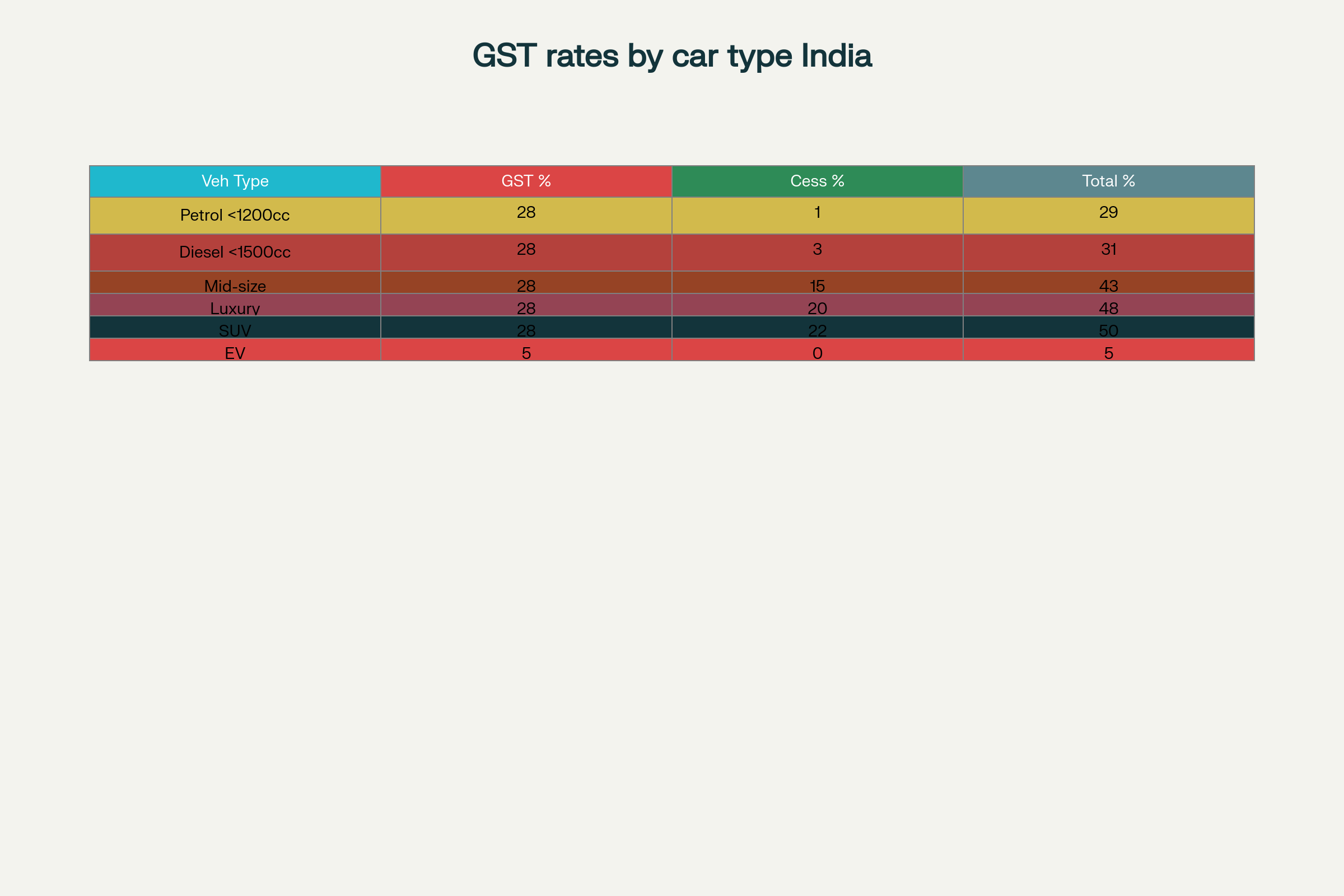

Current GST Structure Creates Complex Tax Burden for Automobile Sector

- Cars currently attract 28% GST plus compensation cess ranging from 1% to 22% depending on engine capacity

- Total effective tax rates vary from 29% for small petrol cars to 50% for large SUVs

- Electric vehicles enjoy preferential treatment with only 5% GST and no additional cess

The existing GST on cars follows a complex classification system based on engine capacity, vehicle length, and fuel type. Small petrol cars under 1200cc with less than 4 meters length attract 28% GST plus 1% compensation cess, resulting in a total tax burden of 29%. This relatively moderate rate escalates significantly for larger vehicles – mid-sized cars face 43% total tax, while luxury cars and SUVs can attract up to 48-50% combined GST and cess.

This intricate tax framework has created numerous classification disputes over the years, as manufacturers and tax authorities often disagree on vehicle categorization. The compensation cess system adds another layer of complexity, with rates varying from zero for small two-wheelers to 22% for large SUVs. These disputes have led to litigation and uncertainty in the automobile sector, hampering smooth business operations.

The only bright spot in the current GST on cars structure is the treatment of electric vehicles, which benefit from a concessional 5% GST rate with no compensation cess. This preferential treatment reflects the government’s commitment to promoting clean mobility and achieving its environmental sustainability goals.

Current GST rates on cars in India by vehicle type and engine capacity (2025)

Proposed Two-Tier GST Framework Promises Significant Tax Relief

- Government plans to eliminate 12% and 28% tax slabs, retaining only 5%, 18%, and 40% rates

- Small cars and two-wheelers under 350cc engine capacity likely to move to 18% GST slab

- Luxury vehicles may face new 40% tax bracket, potentially offsetting benefits for premium segment

- Classification disputes expected to reduce with simplified engine capacity-based categorization

The proposed GST on cars rationalization represents a fundamental shift toward simplification and consumer benefit. Under the new framework, the government plans to eliminate the existing 12% and 28% tax slabs, creating a streamlined three-tier structure with rates of 5%, 18%, and 40%. This reform directly addresses the complexity that has plagued the current system and promises to reduce administrative burden on both taxpayers and authorities.

Small cars under 1200cc engine capacity and two-wheelers with engines below 350cc are expected to benefit from the reduced 18% GST rate. This represents a substantial 10 percentage point reduction from the current 28% rate, before considering the elimination of compensation cess. The simplified classification system will likely reduce disputes by focusing primarily on engine capacity rather than multiple parameters like vehicle length and body type.

However, luxury cars and large SUVs may face a different trajectory under the proposed GST on cars structure. These premium vehicles are expected to be placed in the new 40% tax bracket, which could potentially result in higher overall tax burden compared to current rates. This differential treatment aligns with the government’s policy objective of making essential transportation affordable while maintaining higher taxes on luxury consumption.

Electric vehicles are expected to retain their preferential 5% GST rate, continuing the government’s support for clean mobility adoption. This consistency ensures that the green vehicle transition remains economically attractive for consumers and manufacturers alike.

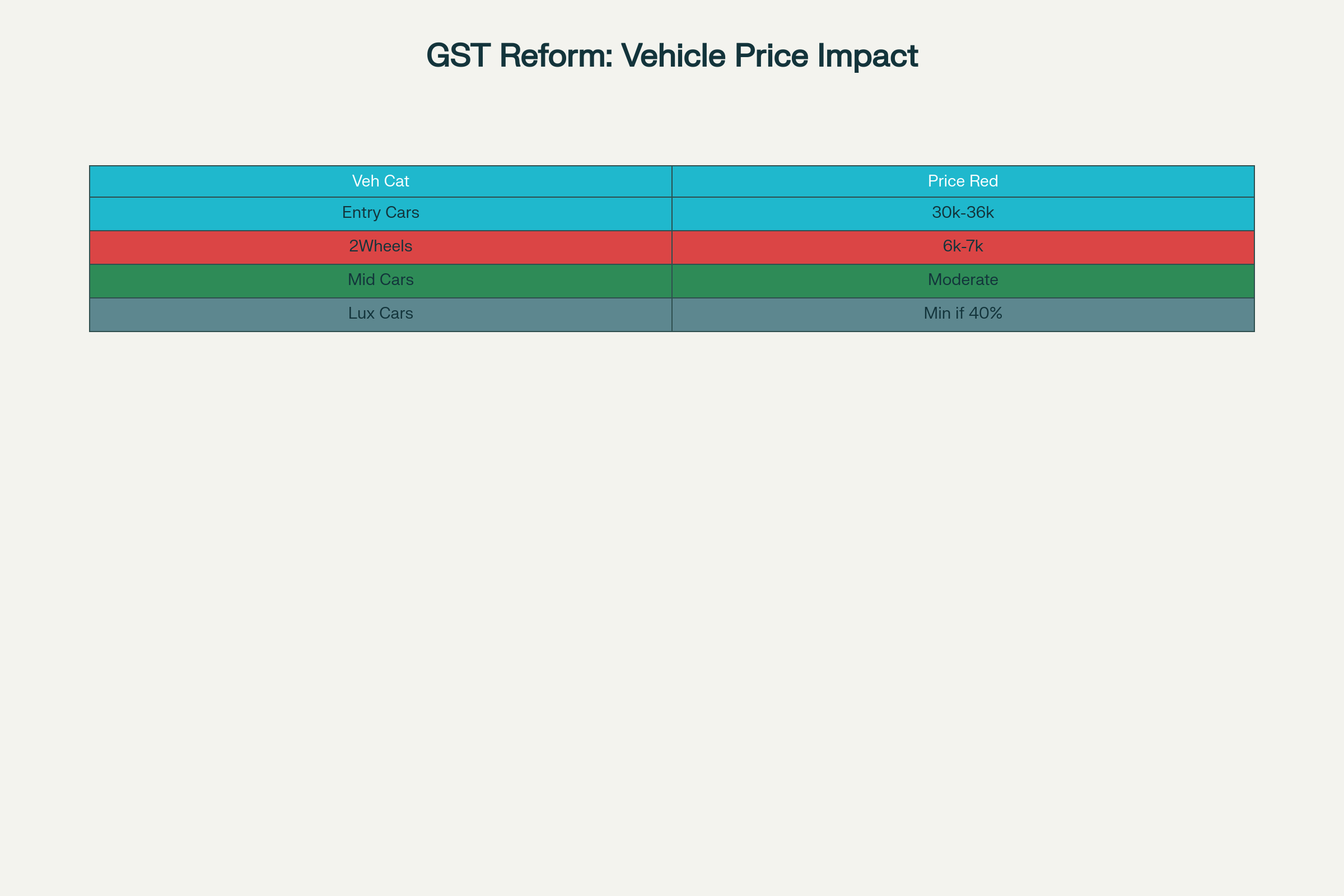

Price Impact Analysis Reveals Substantial Consumer Benefits

- Entry-level cars could become cheaper by Rs 30,000-36,000 according to industry estimates

- Two-wheeler prices may drop by Rs 6,000-7,000, boosting accessibility for middle-class families

- Small car prices expected to decrease by 8-10%, enhancing affordability for first-time buyers

- Mid-sized vehicles likely to see moderate price relief depending on final classification

The anticipated price reductions from GST on cars reform could significantly impact consumer purchasing decisions across vehicle segments. Industry analysis suggests that entry-level cars, which form the backbone of India’s passenger vehicle market, could see price reductions ranging from Rs 30,000 to Rs 36,000. This substantial decrease could make car ownership accessible to thousands of middle-class families who have been priced out of the market.

Two-wheeler buyers, representing the largest vehicle segment in India, stand to benefit from estimated price drops of Rs 6,000 to Rs 7,000. Given that two-wheelers serve as primary transportation for millions of Indian families, this reduction could stimulate significant demand growth, particularly in rural and semi-urban markets where price sensitivity is highest.

The percentage impact varies by segment, with small cars potentially experiencing 8-10% price reductions if GST on cars drops from 28% to 18%. This reduction becomes even more significant when considering that it affects the ex-showroom price, which forms the base for calculating insurance, registration, and other charges. The cascading effect could result in even greater overall on-road price benefits.

Mid-sized cars are expected to receive moderate relief, though the exact quantum depends on how these vehicles are classified under the new GST on cars system. If they remain in the 18% bracket, owners could see meaningful price reductions, but classification in higher slabs could limit benefits.

Estimated price reduction impact of proposed GST reform on vehicle categories in India

Industry Winners and Market Implications of Tax Reform

- Mass market manufacturers like Maruti Suzuki, Hyundai, and Tata Motors positioned as primary beneficiaries

- Two-wheeler companies including Hero MotoCorp, Honda, TVS, and Bajaj expected to gain from increased affordability

- Luxury car segment may face challenges if moved to 40% tax bracket

- Overall automobile sector could see demand revival, particularly in entry-level segments

The proposed GST on cars changes create clear winners and potential losers across India’s automotive landscape. Mass market manufacturers with strong portfolios in the entry-level and small car segments stand to benefit most significantly. Maruti Suzuki, which dominates India’s small car market with models like Alto, Wagon R, and Swift, could see substantial volume growth as reduced prices make their vehicles accessible to a broader customer base.

Hyundai Motor India, with popular models like Grand i10 and Santro in the small car category, along with Tata Motors’ entry-level offerings including Tiago and Tigor, are similarly positioned to capitalize on increased affordability. These manufacturers have built their strategies around volume sales in price-sensitive segments, making them natural beneficiaries of any price reduction initiative.

The two-wheeler industry presents another significant opportunity. Hero MotoCorp, India’s largest two-wheeler manufacturer, along with Honda Motorcycle, TVS Motor, and Bajaj Auto, could see increased demand for their scooter and motorcycle models. The Rs 6,000-7,000 price reduction could be particularly impactful in expanding market reach to first-time buyers and replacement purchasers.

However, luxury car manufacturers may face headwinds if the proposed 40% tax bracket applies to their products. Premium brands could see their vehicles become relatively more expensive compared to mass market alternatives, potentially impacting demand in the luxury segment. This outcome aligns with the government’s policy objective of supporting mass mobility while maintaining revenue from luxury consumption.

Closing Assessment

The proposed GST on cars reform represents a watershed moment for India’s automobile industry, promising to reshape market dynamics and consumer accessibility. By reducing tax rates from 28% to 18% for small cars and two-wheelers, the government addresses a critical affordability challenge that has constrained vehicle ownership among middle-class families. The estimated price reductions of Rs 30,000-36,000 for entry-level cars and Rs 6,000-7,000 for two-wheelers could unlock significant latent demand.

The timing of this GST on cars reform appears strategically calibrated to provide economic stimulus through increased consumption. With passenger vehicle sales growing at merely 2% in FY25, down from 8% the previous year, the automobile sector needs policy support to regain momentum. The proposed changes to GST on cars offer precisely this catalyst, potentially reviving the fortunes of mass market manufacturers while supporting the government’s broader economic growth objectives.

While implementation details await final approval from the GST Council, the proposed GST on cars framework signals a clear shift toward simplification and consumer benefit. The elimination of complex classification disputes and reduction in tax burden could transform India’s automotive landscape, making the dream of vehicle ownership attainable for millions of aspiring middle-class buyers.