Key Highlights:

- Trump imposes unprecedented 50% tariffs on India, the highest globally, citing trade imbalance and Russian oil purchases

- India’s Commerce Minister Piyush Goyal declares India will not “bow down” and focus on capturing new markets amid growing tensions

- US Court of Appeals rules Trump’s tariff authority illegal, though duties remain in place pending Supreme Court appeal

Opening Overview

US President Donald Trump has claimed that India has offered to reduce its tariffs on American goods to zero, stating “it’s getting late” and characterizing the bilateral trade relationship as a “one-sided disaster” amid escalating India US tariff tensions. This development comes as the Trump administration has imposed the highest tariff rates globally on Indian imports at 50%, combining reciprocal duties with additional penalties for India’s continued oil purchases from Russia.

— JD Vance (@JDVance) September 1, 2025

The India US tariff tensions have reached unprecedented levels since Trump’s return to the White House in January 2025, fundamentally altering the strategic partnership between the world’s largest democracies. With India serving as America’s top export destination at $87.3 billion in 2024, the trade war has created significant economic and diplomatic challenges for both nations. Trump’s latest statements on Truth Social platform underscore the administration’s hardline approach toward addressing the $45.8 billion trade deficit with India.

This escalation reflects broader shifts in global trade dynamics, where the India US tariff tensions have become emblematic of Trump’s “America First” policy implementation across multiple trading partnerships.

Unprecedented Tariff Structure Creates Economic Battleground

The current India US tariff tensions stem from a complex layered duty structure that has evolved throughout 2025:

- Combined tariff structure: 10% baseline duty + 25% reciprocal tariff + 25% additional penalty = 50% total

- Implementation timeline: Initial 25% tariffs began August 1, with additional 25% imposed August 27, 2025

According to the US Trade Representative’s office, the 50% tariff rate places India alongside Brazil as facing the highest duties globally, exceeding China’s 30% rate and Vietnam’s 20% rate. The India US tariff tensions have particularly impacted key sectors, with textiles, gems and jewelry, leather, marine products, chemicals, and auto components bearing significant exposure.

Critical exemptions apply to pharmaceuticals, semiconductors, energy resources, and critical minerals, recognizing India’s strategic role in global supply chains. India’s generic drug exports, representing 50% of the US pharmaceutical market, remain protected from the tariff escalation. These selective exemptions highlight the complex balancing act between economic pressure and strategic dependencies in the India US tariff tensions.

The trade data reveals the magnitude of economic stakes involved. US goods imports from India totaled $87.3 billion in 2024, representing a 4.5% increase from 2023, while US exports to India reached $41.5 billion, creating the disputed trade deficit.

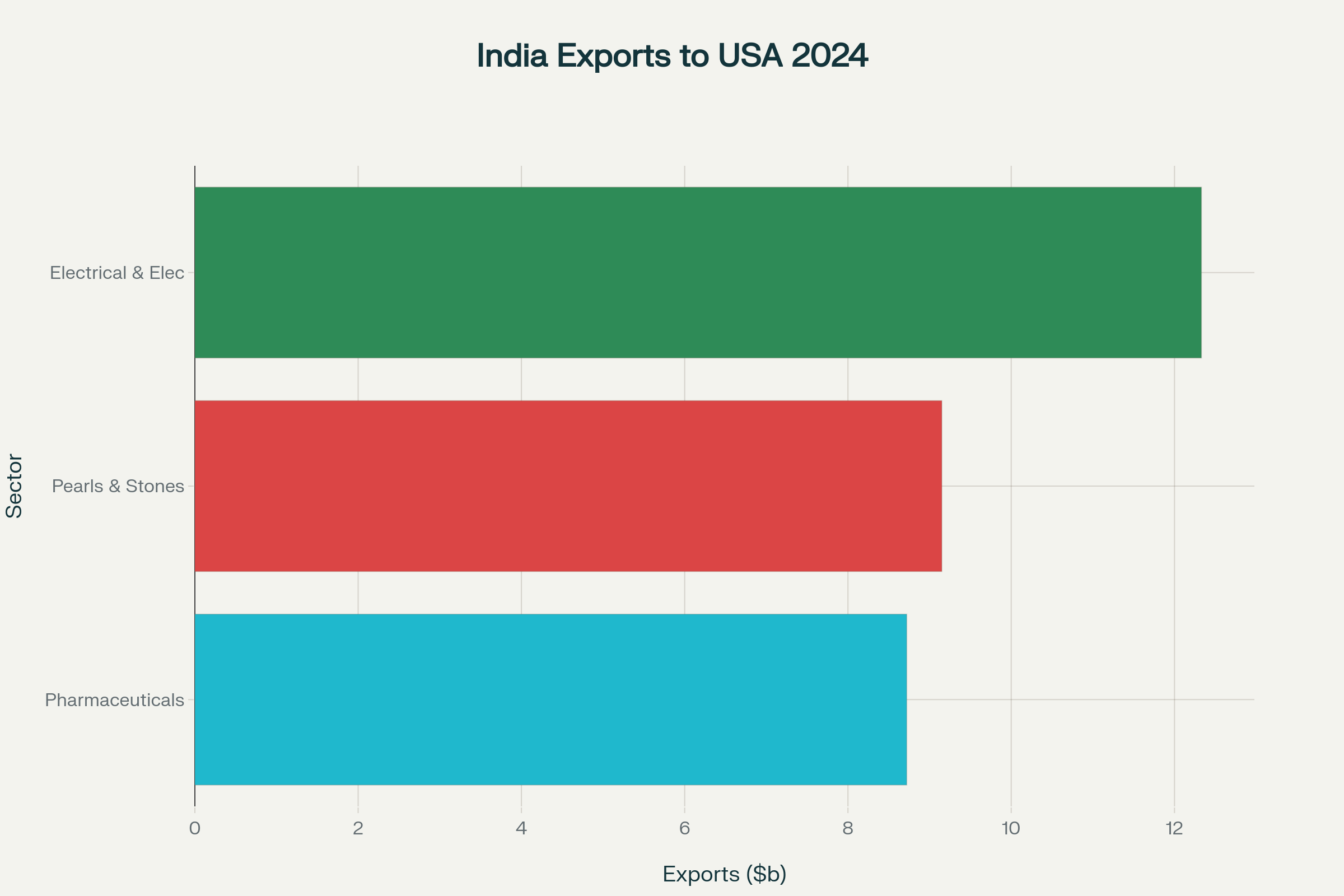

India’s Key Export Sectors to the USA in 2024 (USD Billion)

Legal Challenges Threaten Trump’s Tariff Authority

A significant legal development has emerged in the India US tariff tensions, with the US Court of Appeals for the Federal Circuit ruling 7-4 against Trump’s tariff authority under the International Emergency Economic Powers Act (IEEPA):

- Constitutional challenge: Court determined Congress, not the President, holds constitutional power to impose tariff measures

- Timeline impact: Current tariffs remain in effect until October 14, 2025, pending Supreme Court appeal

The appeals court’s August 29, 2025 ruling specifically addressed five Executive Orders imposing duties on trade partners, including the measures affecting India. Legal experts suggest this creates uncertainty in the India US tariff tensions, as the Supreme Court’s conservative majority could potentially overturn the appeals court decision.

Dr. Rajan Sudesh Ratna from UN ESCAP noted this represents a “moral victory for all other countries against Trump’s tariff policy,” though Indian exporters will continue facing 50% duties until at least December 2025. The legal challenge adds another layer of complexity to the India US tariff tensions, potentially requiring congressional backing for future tariff implementations.

If the Supreme Court upholds the lower court ruling, it could fundamentally reshape presidential authority over trade policy and provide relief to countries caught in the India US tariff tensions crossfire.

Agricultural and Dairy Disputes Remain Core Sticking Points

The India US tariff tensions extend beyond manufactured goods into sensitive agricultural and dairy sectors, where cultural and economic factors create seemingly insurmountable barriers:

- Religious and cultural constraints: India maintains strict certification requirements ensuring dairy imports come from cows not fed animal-based products

- Farmer protection concerns: India’s 80 million dairy farmers, primarily smallholders, face potential displacement from US imports

Trade talks have repeatedly stalled over agriculture, with India maintaining high protective tariffs: 30% on cheese, 40% on butter, and 60% on milk powder. The structural differences between farming systems exacerbate the India US tariff tensions, as Indian farms average 1.08 hectares compared to 187 hectares in the United States.

India’s Department of Animal Husbandry and Dairying mandates veterinary certification for food imports, requiring verification that dairy products originate from animals not fed bovine-derived feed. This requirement, rooted in religious beliefs of India’s large vegetarian population, represents what government sources describe as a “non-negotiable red line” in addressing the India US tariff tensions.

Despite pressure from Washington, which has criticized these measures at the WTO as unnecessary trade barriers, India has refused concessions on dairy market access. Prime Minister Modi’s government views protecting the agricultural sector as essential, given that while agriculture contributes only 16% to India’s $3.9 trillion economy, it sustains nearly half the country’s 1.4 billion population.

India’s Strategic Response and Market Diversification

India’s response to the India US tariff tensions demonstrates a multi-pronged strategy combining diplomatic engagement with economic diversification:

- Diplomatic outreach: External Affairs Minister S. Jaishankar has consistently defended India’s energy purchases from Russia, arguing for consistent standards applied to all nations

- Market diversification: Commerce Minister Piyush Goyal’s statement that India will not “bow down” signals a shift toward alternative markets

The India US tariff tensions have prompted India to reassess its export strategy, with officials emphasizing the need to reduce dependence on the US market despite America representing India’s largest export destination. According to CEIC data, India’s monthly exports to the US reached $7.017 billion in December 2024, the highest since March 2022.

India’s response strategy includes supporting Micro, Small and Medium Enterprises (MSMEs) affected by the tariffs while avoiding direct retaliation measures. The government has condemned the tariffs as “unfair, unjustified and unreasonable,” while seeking diplomatic solutions to the India US tariff tensions.

The broader geopolitical context, including India’s participation in the Shanghai Cooperation Organisation summit with Russia and China, adds complexity to resolving the India US tariff tensions. Trump’s criticism of India’s energy and military purchases from Russia reflects deeper strategic concerns beyond pure trade metrics.

Closing Assessment

The India US tariff tensions represent a fundamental shift in one of the world’s most important strategic partnerships, with Trump’s claim of India’s zero-tariff offer suggesting potential diplomatic flexibility amid escalating economic warfare. However, the 50% tariff imposition, legal challenges to presidential authority, and deep-seated disagreements over agricultural market access indicate prolonged bilateral friction ahead.

The economic stakes remain substantial, with 55% of India’s $87.3 billion in US-bound exports at risk from the current tariff structure. While exemptions for critical sectors like pharmaceuticals and semiconductors preserve essential supply chain relationships, the India US tariff tensions threaten to reshape global trade patterns and force both nations to reconsider their economic interdependence.

The Supreme Court’s eventual ruling on tariff authority could either validate Trump’s aggressive trade approach or force a congressional review of trade policy implementation. Either outcome will significantly influence how the India US tariff tensions evolve and whether diplomatic solutions can emerge from the current economic confrontation between these democratic powers.