Key Highlights:

- Ashley J. Tellis urges US to stop “singling out” India over Trump’s Russian oil charges amid Ukraine peace efforts

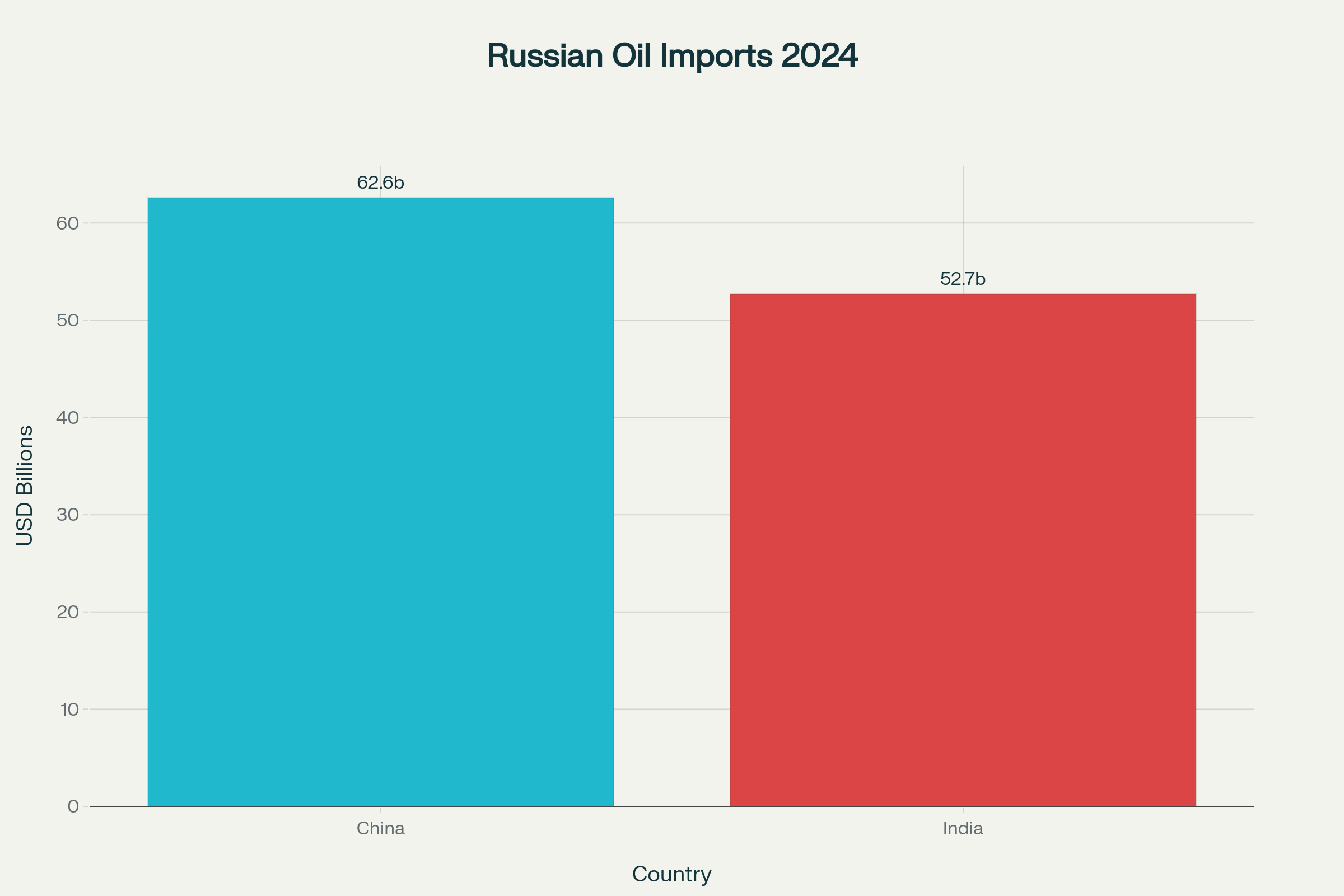

- China imported $62.6 billion in Russian oil compared to India’s $52.7 billion in 2024, yet Trump’s Russian oil charges target India specifically

- Trump’s Trade Advisor Peter Navarro controversially labeled the Russia-Ukraine conflict as “Modi’s war” in context of Trump’s Russian oil charges

Opening Text

The ongoing diplomatic tensions between Washington and New Delhi over Trump’s Russian oil charges have drawn sharp criticism from a prominent US strategic affairs expert. Ashley J. Tellis, a respected voice in American foreign policy circles, has publicly challenged the Trump administration’s approach of targeting India specifically through Trump’s Russia oil charges related to energy imports from Moscow. His remarks come as the US has imposed punitive 50% tariffs on Indian goods following Trump’s Russia oil charges, the highest rate applied to any major trading partner except Brazil.

The expert’s intervention highlights growing concerns within American policy circles about the administration’s strategy of focusing Trump’s Russia oil charges primarily on India while China continues to purchase even larger volumes of Russian crude oil.

Strategic Affairs Expert Defends India’s Position on Trump’s Russian Oil Charges

Ashley J. Tellis delivered a pointed critique of Trump’s Russian oil charges during an exclusive interview with NDTV, emphasizing that multiple actors share responsibility for complicating the US peace initiative in Ukraine. The strategic affairs expert stressed that India should not bear the sole burden of Trump’s Russia oil charges for challenges facing Trump’s diplomatic efforts in the region.

- Tellis argued that many countries and actors contribute to making “Trump’s life difficult” regarding Ukraine peace negotiations beyond Trump’s Russia oil charges

- The expert specifically called for ending the practice of treating India as “the only author of his misfortunes” in the peace process through Trump’s Russia oil charges

“Stop singling out India as the author of all the complications for Trump’s peace initiative in Ukraine,” Tellis stated emphatically. He emphasized that numerous parties bear responsibility for the challenges facing American diplomatic efforts, making it unfair to focus Trump’s Russia oil charges predominantly on New Delhi. The expert’s comments reflect broader concerns within US policy circles about the effectiveness of targeting India through Trump’s Russia oil charges while other major importers of Russian energy face less scrutiny.

Tellis further elaborated that neither Prime Minister Modi nor President Trump possess the unilateral capacity to engineer peace in Ukraine as long as President Putin maintains his original objectives, regardless of Trump’s Russia oil charges. This assessment underscores the complexity of the geopolitical situation and suggests that resolution requires broader international cooperation beyond pressure through Trump’s Russia oil charges on individual countries like India.

Examining the Numbers Behind Trump’s Russian Oil Charges

Official trade statistics reveal a significant discrepancy between Trump’s Russia oil charges rhetoric and actual import volumes, with China maintaining its position as the world’s largest purchaser of Russian crude oil. In 2024, China imported approximately $62.6 billion worth of Russian oil, substantially exceeding India’s $52.7 billion in purchases during the same period, raising questions about the fairness of Trump’s Russia oil charges.

- China’s Russian oil imports in 2024 totaled 2.17 million barrels per day, representing an annual record high despite Trump’s Russia oil charges

- India’s imports from Russia began increasing significantly only after the February 2022 invasion of Ukraine, predating Trump’s Russia oil charges

- Moscow accounted for less than 2% of India’s oil imports before the conflict but now represents over one-third of total purchases

Comparative Russian Oil Imports by India and China in 2024 (USD Billion)

The data demonstrates that while India has indeed become a major importer of Russian crude, its purchases remain substantially lower than China’s volume, calling into question the targeting approach of Trump’s Russian oil charges. According to official Chinese customs data, Beijing’s refiners continued purchasing lower-priced Russian barrels throughout 2024, with imports rising by 1% to reach the record-high daily average. This trend occurred even as China’s overall crude imports fell for the first time in two decades, excluding the COVID period, highlighting the strategic importance of discounted Russian energy beyond the scope of Trump’s Russian oil charges.

India’s transition to increased Russian oil imports occurred rapidly following the Ukraine invasion, when Western sanctions created opportunities for discounted purchases that later became subject to Trump’s Russia oil charges. Analysis by The Indian Express reveals that Indian refiners saved approximately $12.6 billion over 39 months through these discounted purchases. The average landed price of Russian crude for Indian refiners was $83.24 per barrel in 2022-23, about $13 lower than the average price from other suppliers, representing a 13.6% discount that now faces Trump’s Russian oil charges.

Controversial Labeling and Trade Advisor’s Role in Trump’s Russian Oil Charges

The diplomatic friction intensified significantly following controversial statements by Trump’s Trade Advisor Peter Navarro, who provocatively labeled the Russia-Ukraine conflict as “Modi’s war” in the context of Trump’s Russian oil charges. This characterization has drawn widespread criticism for its inflammatory nature and apparent disconnect from the complex geopolitical realities surrounding Trump’s Russian oil charges.

- Navarro claimed New Delhi’s continued Russian energy purchases directly power Moscow’s military aggression, justifying Trump’s Russian oil charges

- The trade advisor stated “the road to peace runs, in part, through New Delhi” during a Bloomberg Television interview discussing Trump’s Russian oil charges

- Tellis criticized Navarro for damaging US-India relations through Trump’s Russian oil charges and forcing India into positions where it has “few other choices”

Navarro’s rhetoric represents a particularly aggressive approach to diplomatic pressure through Trump’s Russia oil charges, suggesting that India bears primary responsibility for prolonging the conflict through its energy purchases. His statement that “Modi’s war” exists because of New Delhi’s continued purchase of Russian energy has been widely viewed as diplomatically provocative and factually questionable given China’s larger import volumes, raising questions about the fairness of Trump’s Russian oil charges.

The trade advisor’s approach through Trump’s Russian oil charges has drawn criticism even from within American policy circles, with Tellis noting that Navarro has “damaged” the bilateral relationship and created a situation where India finds itself “cavorting with some of America’s enemies” due to limited alternatives created by Trump’s Russian oil charges. This assessment suggests that the confrontational approach through Trump’s Russian oil charges may be counterproductive to broader US strategic interests in the Indo-Pacific region.

Beyond the oil issue, Tellis identified what he described as Trump’s “deeper grievance” regarding perceived lack of credit for helping de-escalate the India-Pakistan conflict in May 2025, which may influence the intensity of Trump’s Russian oil charges. This underlying tension may explain the administration’s focus on India through Trump’s Russian oil charges despite objective data showing China’s larger role in Russian oil purchases.

Economic Impact and India’s Response Strategy to Trump’s Russian Oil Charges

Trump’s Russian oil charges materialized through the August 27 implementation of 50% tariffs on Indian goods, representing the most aggressive trade action taken against any major partner except Brazil. These measures under Trump’s Russian oil charges target approximately 55% of India’s $87 billion in annual exports to the United States, potentially affecting critical sectors including textiles, gems and jewelry, leather goods, marine products, and chemicals.

- Trump’s Russian oil charges structure combines a baseline 10% duty with a 25% reciprocal tariff and an additional 25% penalty for Russian oil purchases

- Key sectors like pharmaceuticals, semiconductors, energy resources, and critical minerals remain exempt from Trump’s Russian oil charges

- India’s textile industry faces particular vulnerability under Trump’s Russian oil charges given its significant exposure to the American market

New Delhi has responded by terming Trump’s Russian oil charges “unjustified and unreasonable,” emphasizing that Russian oil imports began when traditional supplies were diverted to Europe. Indian officials have pointed out that the Biden administration previously encouraged increased Russian oil imports to maintain global energy market stability following the February 2022 invasion, contradicting the current rationale for Trump’s Russian oil charges.

The economic calculus for India involves balancing the benefits of discounted Russian crude against the costs of Trump’s Russian oil charges on manufactured exports. CLSA estimates that oil prices could jump from current levels of around $65 per barrel to $90-100 if India stops importing Russian oil due to Trump’s Russian oil charges, as much of that supply would struggle to find alternative buyers. This potential price spike would significantly impact India’s annual oil import bill, which totaled $162.21 billion in 2022-23, making Trump’s Russian oil charges economically complex for New Delhi to navigate.

India maintains its position of purchasing oil from sources offering the best commercial terms, provided they are not under international sanctions, despite Trump’s Russian oil charges. The government continues to emphasize its strategic autonomy in energy decisions while navigating the complex geopolitical pressures from Trump’s Russian oil charges. Public sector refiners have indicated they will continue Russian oil purchases as long as they remain economically viable and commercially attractive, regardless of Trump’s Russia oil charges.

Closing Assessment

The expert intervention by Ashley J. Tellis highlights fundamental flaws in Trump’s Russia oil charges approach to addressing Russian oil imports through selective pressure on India. The strategic affairs expert’s call to “stop singling out India” reflects broader concerns about diplomatic effectiveness and fairness in targeting a partner that purchases substantially less Russian oil than China through Trump’s Russia oil charges. The controversy underscores how Trump’s Russian oil charges and geopolitical objectives can become entangled in ways that potentially damage important bilateral relationships. As the US continues pursuing its Ukraine peace initiative, the challenge remains balancing pressure tactics like Trump’s Russian oil charges with maintaining crucial partnerships in the Indo-Pacific region where India represents a key strategic ally.