Key Highlights:

- Urban Company’s ₹1,900 crore IPO opens September 10-12, 2025, with price band of ₹98-103 per share and strong 13.47x oversubscription

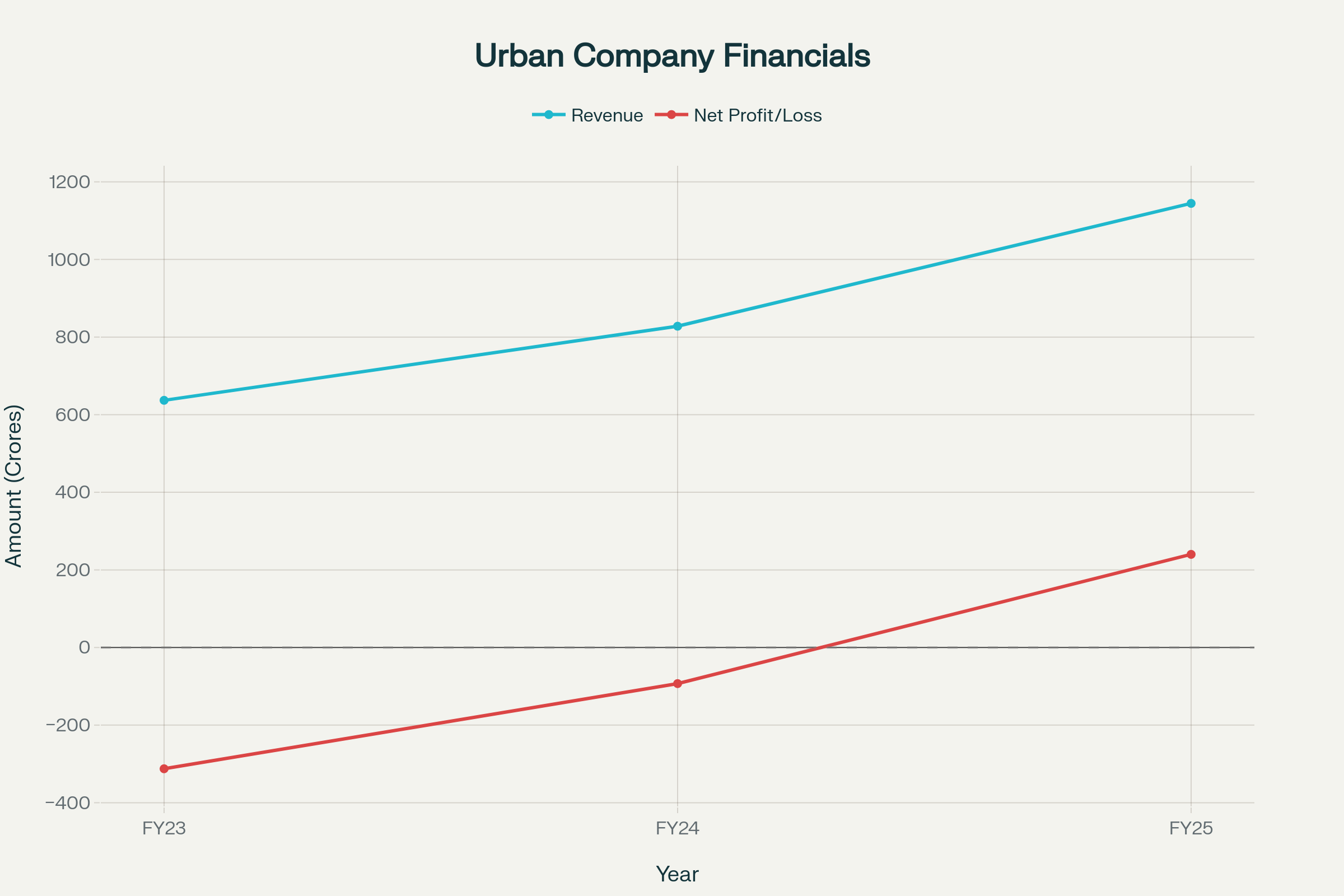

- Company achieved remarkable turnaround with ₹240 crore profit in FY25 versus ₹312 crore loss in FY23, driven by 34% revenue CAGR

- Platform serves 6.8 million annual customers across 51 cities with 48,000 active service partners and industry-leading 82% repeat customer rate

Opening Overview

The Urban Company IPO marks a significant milestone for India’s organized home services sector, as the country’s leading tech-enabled marketplace prepares for its public market debut. Urban Company IPO details reveal a comprehensive ₹1,900 crore offering that has captured exceptional investor interest, receiving 13.47x oversubscription by closing day. The Urban Company IPO represents more than just another public offering – it symbolizes the maturation of India’s gig economy and the transformation of traditionally unorganized home services into a tech-driven, scalable business model.

Founded in 2014 as UrbanClap, Urban Company has evolved from a startup connecting customers with local service providers to India’s dominant platform for home and beauty services. The Urban Company IPO timing coincides with the company’s first profitable year, having posted ₹240 crore net profit in FY25 compared to ₹312 crore loss in FY23. This financial turnaround, combined with consistent revenue growth and market leadership, positions the Urban Company IPO as a compelling opportunity for investors seeking exposure to India’s burgeoning digital services economy. The Urban Company IPO price band of ₹98-103 per share values the company at approximately $1.7 billion, reflecting investor confidence in its business model and growth prospects.

IPO Structure and Subscription Details

Urban Company IPO structure demonstrates strong institutional confidence with comprehensive participation across investor categories and optimal pricing strategy.

- The IPO consists of ₹472 crore fresh issue for company operations and ₹1,428 crore offer for sale from existing investors

- Retail investors showed exceptional interest with 22.29x oversubscription, while non-institutional investors subscribed 31.29x

| Urban Company IPO Details | Specification |

|---|---|

| Price Band | ₹98 – ₹103 per share |

| Lot Size | 145 shares |

| Minimum Investment | ₹14,935 (retail) |

| Issue Size | ₹1,900 crore |

| Fresh Issue | ₹472 crore |

| Offer for Sale | ₹1,428 crore |

| Bidding Period | September 10-12, 2025 |

| Allotment Date | September 15, 2025 |

| Listing Date | September 17, 2025 |

Urban Company IPO subscription status reflects overwhelming market confidence, with the issue receiving 13.47x overall subscription by closing. The Urban Company offering attracted participation from qualified institutional buyers at 1.6x, demonstrating measured institutional interest, while retail and high net worth individuals showed extraordinary enthusiasm. Book-running lead managers include Kotak Mahindra Capital, Morgan Stanley India, Goldman Sachs India Securities, and JM Financial, providing credible institutional backing for the Urban Company IPO. The company’s decision to list on both NSE and BSE ensures broad market accessibility and liquidity for Urban Company IPO investors.

Financial Performance Drives Urban Company IPO Success

Urban Company‘s remarkable financial transformation forms the cornerstone of its IPO appeal, with the company achieving profitability while maintaining robust growth across key metrics.

- Revenue grew at 34% compound annual growth rate from FY23-FY25, reaching ₹1,144.5 crore in FY25

- The company achieved net profit of ₹240 crore in FY25 including ₹211 crore deferred tax credit, with core profit of ₹28.5 crore

| Urban Company Financial Performance | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue from Operations (₹ crore) | 637 | 828 | 1,144.5 |

| Net Profit/Loss (₹ crore) | (312.5) | (93) | 240 |

| Revenue Growth (%) | 45% | 30% | 38.2% |

| Repeat Customer Rate (%) | 76.4% | – | 82% |

| Total Assets (₹ crore) | – | 1,631 | 1,638 |

Urban Company’s Financial Turnaround: Revenue Growth and Path to Profitability (FY23-FY25)

Urban Company‘s financial performance demonstrates the scalability of its marketplace model, with operating leverage improving significantly as the platform matured. The Urban Company IPO prospectus reveals exceptional cost discipline, as expenses grew at only 9% while revenues increased 34% annually. This operational efficiency becomes evident in training expenses, which decreased from ₹12 crore in FY23 to ₹8 crore in FY25 despite platform expansion. The company’s cash generation from operating activities and improved working capital management support Urban Company IPO investor confidence in sustainable profitability.

Business Model and Market Position Strengthen Urban Company IPO Appeal

Urban Company’s comprehensive marketplace strategy and dominant market position create significant competitive advantages that enhance the Urban Company IPO investment proposition.

- The platform maintains 6.8 million annual transacting customers with 48,000 monthly active service professionals across 51 cities

- Service partners earn average ₹26,407 monthly with top 20% earning ₹40,000 per month net of all costs

| Urban Company Business Metrics | FY23 | FY24 | FY25 |

|---|---|---|---|

| Annual Transacting Customers (millions) | – | – | 6.8 |

| Cities Covered | – | – | 51 |

| Active Service Partners (monthly) | – | – | 48,000 |

| Average Partner Earnings (₹/month) | 32,000 | – | 26,407 |

| Customer Satisfaction Rating | 4.82/5 | – | – |

| Services Revenue Share (%) | – | – | 73.4% |

| Native Products Revenue Share (%) | – | – | 26.6% |

Urban Company operates as a full-stack marketplace rather than a simple aggregator, providing end-to-end control over the customer experience from service discovery to post-service warranty. This comprehensive approach differentiates the Urban Company IPO from typical platform businesses, as the company actively recruits, trains, and certifies service partners while providing branded tools, insurance coverage, and performance tracking systems. The Urban Company business model generates revenue through multiple streams including 20-30% commission fees on transactions, subscription plans, and Native product sales with 72% year-over-year growth.

The company’s geographic expansion supports Urban Company IPO growth prospects, with operations spanning India, UAE, Singapore, and Saudi Arabia. Urban Company’s serviceable addressable market in India reaches ₹1,770-1,850 billion, representing significant opportunity within the total ₹5,100-5,210 billion home services market. The Urban Company IPO benefits from this expansion strategy, as the company targets India’s top 200 cities by FY2030, addressing approximately 53 million households with annual incomes exceeding ₹5 lakh.

Investment Considerations and Competitive Landscape for Urban Company IPO

Urban Company IPO investors must evaluate several key factors including market competition, regulatory challenges, and valuation metrics that could impact future performance.

- The IPO is priced at approximately 11.4x FY25 EV/Sales, representing reasonable valuation for market leader with strong fundamentals

- Grey market premium of ₹36-37 indicates 35-37% potential listing gains based on current investor sentiment

Urban Company faces emerging competitive threats that could affect Urban Company IPO returns, particularly from Swiggy’s new AI-powered platform Pyng, which leverages deep pockets and extensive customer base for rapid scaling potential. The Urban Company IPO must also consider regulatory risks from gig worker classification disputes, as labor unions have challenged the independent contractor model, seeking employee benefits and protections. These regulatory changes could increase operational costs and compress margins for Urban Company operations going forward.

Despite competitive and regulatory challenges, Urban Company maintains significant first-mover advantages that support the Urban Company IPO investment thesis. The company holds the largest market share among organized home services players in India, with no direct national competitor matching its scale and brand recognition. The Urban Company IPO subscription response reflects this market confidence, with exceptional demand across all investor categories demonstrating strong belief in the business model. However, potential Urban Company IPO investors should note risks including customer disintermediation and low 1% operating profit margins due to losses in newer ventures like Native products and international operations.

Final Assessment of Urban Company IPO Opportunity

The Urban Company IPO represents a compelling investment opportunity in India’s rapidly digitalizing services economy, supported by strong financial performance, market leadership, and significant growth potential. Urban Company’s transformation from a loss-making startup to a profitable market leader demonstrates the viability of its full-stack marketplace model and operational excellence in executing complex service delivery at scale.

The Urban Company IPO timing appears optimal, coinciding with the company’s first profitable year and strong momentum across key business metrics including customer retention, partner earnings, and revenue diversification. Urban Company IPO investors gain exposure to a proven business model with clear competitive advantages, substantial market opportunity, and management team with demonstrated execution capabilities. The exceptional Urban Company IPO subscription response, achieving 13.47x oversubscription, reflects broad market confidence in the company’s prospects and business fundamentals.

However, Urban Company IPO success will ultimately depend on the company’s ability to navigate competitive pressures, regulatory changes, and operational challenges while maintaining growth momentum and profitability. The Urban Company IPO valuation at 11.4x sales appears reasonable for a market leader with strong fundamentals, though investors should carefully consider their risk tolerance and investment horizon when evaluating this opportunity in India’s evolving digital services landscape.