Key Highlights

- Infosys board approves ₹18,000 crore share buyback at ₹1,800 per share, offering 19% premium to shareholders

- Company plans to repurchase 10 crore equity shares representing 2.41% of total paid-up capital through tender offer route

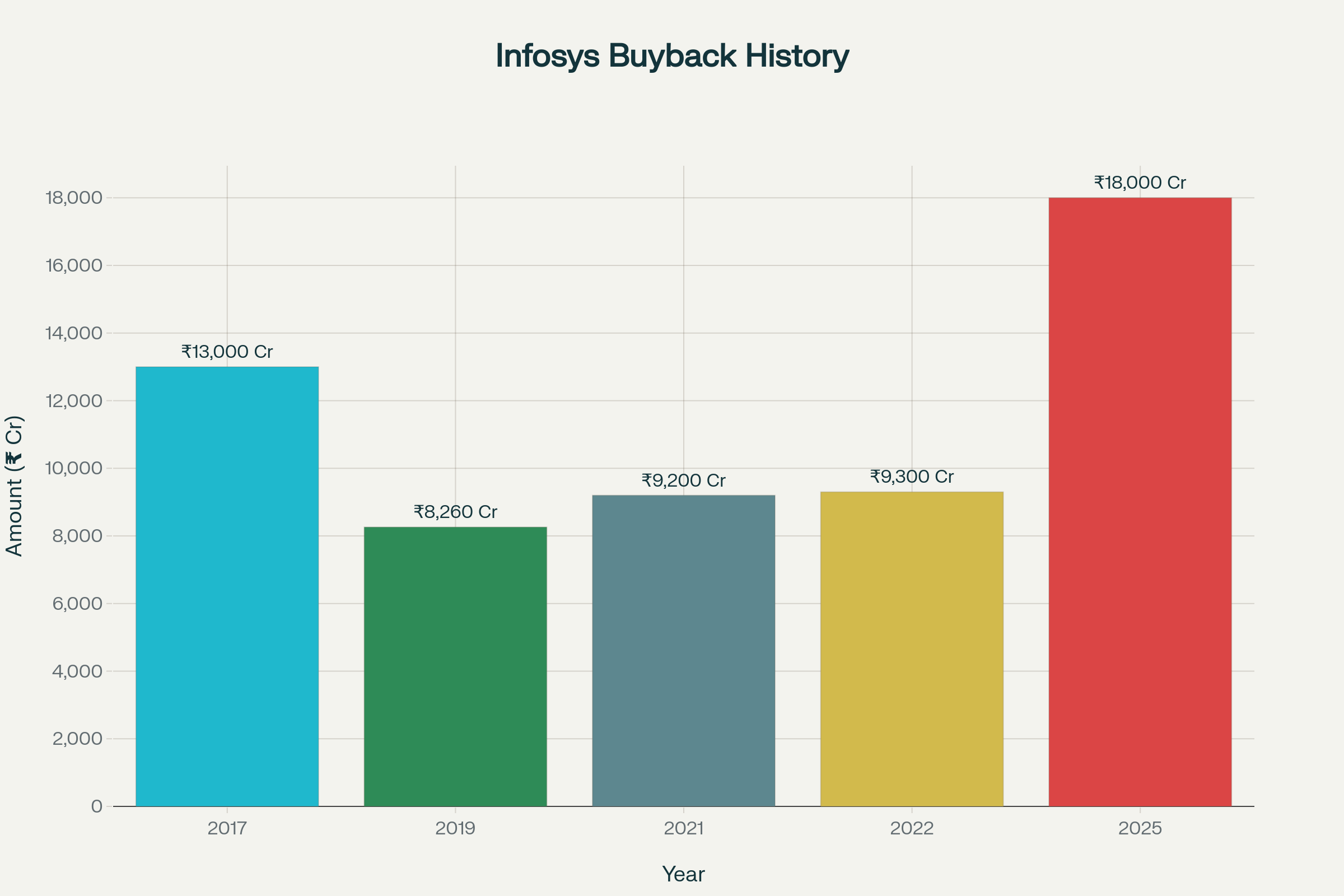

- This marks the IT giant’s largest buyback since inception, surpassing previous record of ₹13,000 crore in 2017

Opening Overview

The Infosys board approves record buyback decision signals strong confidence in the company’s financial position and future growth prospects. On September 11, 2025, India’s second-largest IT services company announced its most ambitious capital return program, with the Infosys board approves record buyback worth ₹18,000 crore at ₹1,800 per share. This substantial Infosys board approves record buyback offer represents a significant 19% premium over the stock’s closing price of ₹1,509.50 on September 11, 2025.

The announcement comes at a crucial time when the IT sector faces global economic headwinds and uncertainties surrounding potential policy changes. With cash and cash equivalents exceeding ₹42,000 crore and robust free cash flow generation of over ₹20,000 crore in FY25, Infosys demonstrates its commitment to returning value to shareholders through this Infosys board approves record buyback initiative.

Strong Financial Foundation Enables Massive Capital Return

The Infosys board approves record buyback program is underpinned by the company’s exceptional financial performance and healthy cash position. According to official Q1 FY26 financial results, Infosys reported consolidated revenue from operations of ₹42,279 crore, marking an 8% year-over-year growth from ₹39,315 crore in Q1 FY25. The company’s net profit for the quarter stood at ₹6,924 crore, representing a 9% increase from ₹6,374 crore in the corresponding quarter of the previous year.

- Free cash flow generation of over ₹20,000 crore in FY25 provides substantial liquidity for shareholder returns

- Total cash and cash equivalents position exceeds ₹42,000 crore, ensuring financial flexibility

The Infosys board approves record buyback aligns with the company’s capital allocation policy of returning 85% of free cash flow over five years through dividends and repurchases. This disciplined approach to capital management has consistently rewarded shareholders, with the company paying a final dividend of ₹22 per share for FY25, approved in the Annual General Meeting held on June 25, 2025. The Infosys board approves record buyback represents the continuation of this shareholder-friendly approach, demonstrating management’s confidence in sustainable cash generation capabilities.

Strategic Buyback Structure and Regulatory Compliance Framework

The comprehensive Infosys board approves record buyback proposal involves repurchasing 10 crore fully paid-up equity shares of face value ₹5 each, representing up to 2.41% of the total paid-up equity share capital. The buyback will be executed through the tender offer route, the only mechanism currently permitted by SEBI after the complete phase-out of open market buybacks. This Infosys board approves record buyback structure ensures fair participation opportunities for all eligible shareholders.

- Buyback committee comprising Chief Financial Officer, Chief Legal Officer, and Company Secretary will oversee execution

- A.G.S. Manikantha, Company Secretary, appointed as Compliance Officer for the proposed buyback program

The Infosys board approves record buyback requires shareholder approval through special resolution via postal ballot by remote e-voting, ensuring democratic participation in the decision-making process. Given the company’s global presence and US ADR listings, Infosys will seek exemptive relief from the US Securities and Exchange Commission due to conflicting regulatory requirements between Indian and US laws for tender offer buybacks. The Infosys board approves record buyback demonstrates the company’s commitment to maintaining compliance across multiple jurisdictions while maximizing shareholder value.

Market Impact and Sector-Wide Implications

The announcement that Infosys board approves record buyback has generated significant positive market sentiment, with shares gaining over 2% in early trading sessions following the disclosure. Market experts view this Infosys board approves record buyback as a catalyst for renewed investor confidence in the IT sector, which has faced challenges from global economic uncertainties and geopolitical tensions. The substantial premium offered through this Infosys board approves record buyback program provides attractive arbitrage opportunities for existing shareholders.

- Stock price reaction demonstrates market appreciation for the substantial premium offered in the buyback proposal

- Analysts expect the buyback to create positive spillover effects across other IT stocks

The timing of the Infosys board approves record buyback coincides with improving sectoral outlook, driven by continued digitalization trends and expected recovery in discretionary IT spending. After experiencing a 7% decline in hiring during 2024 due to adverse macroeconomic conditions, the IT sector anticipates growth in 2025, led by demand for artificial intelligence and machine learning skills. The Infosys board approves record buyback reinforces the company’s position as a sector leader committed to delivering consistent shareholder returns while investing in future growth capabilities.

Closing Assessment and Future Outlook

The Infosys board approves record buyback represents a landmark decision that underscores the company’s financial strength and strategic vision for capital allocation. This unprecedented ₹18,000 crore program significantly exceeds the company’s previous buyback initiatives, including the ₹13,000 crore buyback in 2017 and subsequent programs in 2019, 2021, and 2022. The Infosys board approves record buyback demonstrates management’s confidence in the company’s ability to generate sustainable cash flows while maintaining operational excellence.

The substantial premium offered through this Infosys board approves record buyback program reflects the board’s commitment to maximizing shareholder value during a period of market volatility. With the record date yet to be announced and shareholder approval pending, the Infosys board approves record buyback is expected to set new benchmarks for corporate capital return programs in the Indian IT sector. This strategic initiative positions Infosys to continue delivering value to its 26 lakh shareholders while maintaining financial flexibility for future growth investments and acquisitions.