Key Highlights:

- US Treasury Secretary Scott Bessent urged G7 tariffs on India and China Over Russian oil measures ranging from 50-100% during September 13, 2025 finance ministers meeting

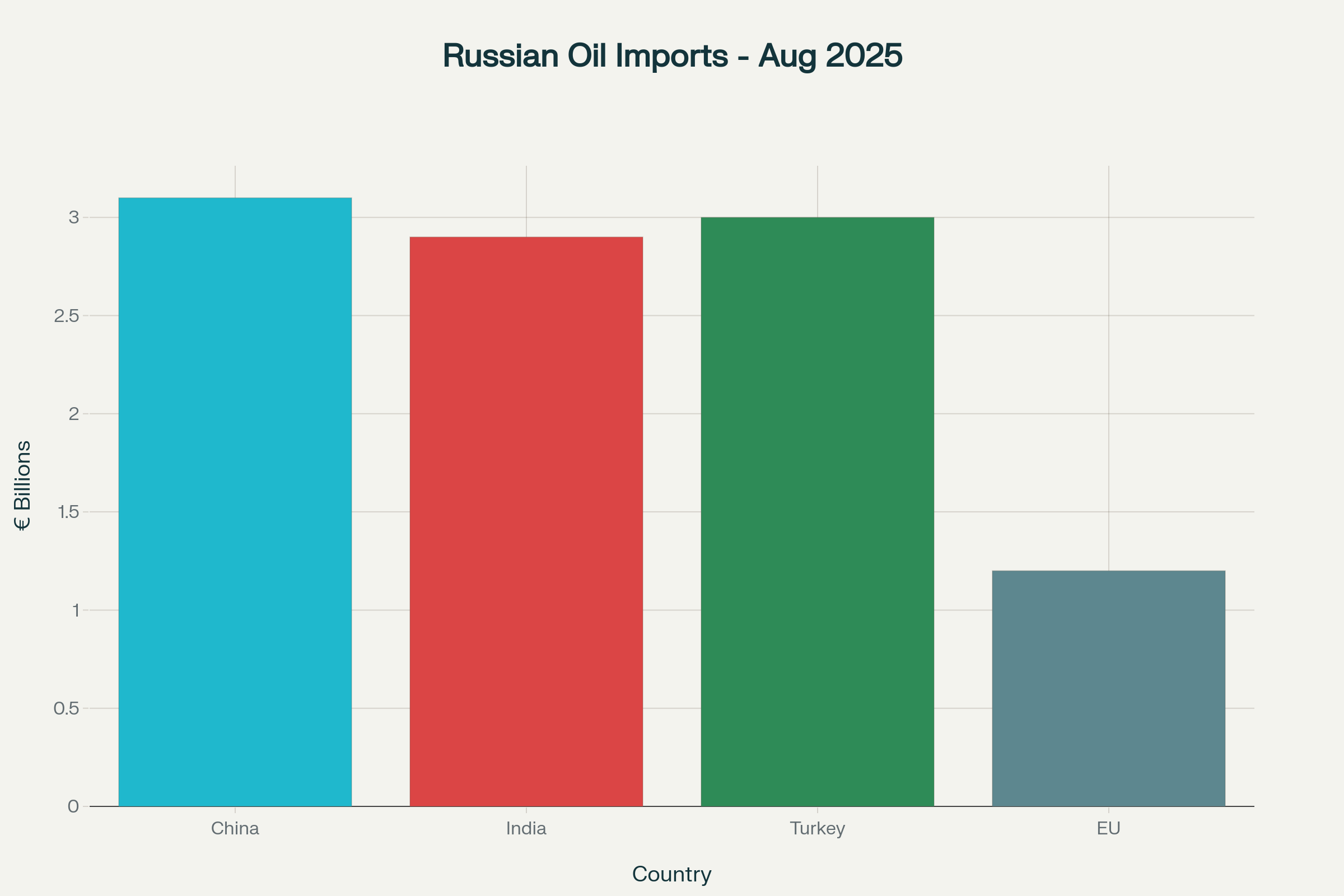

- India’s Russian crude imports reached €2.9 billion in August 2025, nearly matching China’s €3.1 billion despite existing US tariffs

- European Union officials expressed reluctance to implement G7 tariffs on India and China Over Russian oil proposals, citing economic and diplomatic concerns

Opening Overview

The Trump administration has escalated its diplomatic offensive by pressing G7 allies to impose punitive G7 tariffs on India and China Over Russian oil measures, marking Washington’s most aggressive attempt to economically isolate Moscow’s energy revenue streams since the Ukraine conflict began. During a virtual G7 finance ministers meeting on September 13, 2025, Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer emphasized that only unified G7 tariffs on India and China Over Russian oil action could effectively cut off funding for Putin’s war machine.

🚨 BREAKING: Trump urges G7 nations to slap tariffs on countries buying Russian oil, including India & China!

— Siddharth (@Siddharth_00001) September 13, 2025

"Only with a unified effort that cuts off the revenues funding Putin’s war machine…will we be able to apply sufficient economic pressure to end the senseless killing."… pic.twitter.com/Zp1F7G1zFY

The push for comprehensive G7 tariffs on India and China Over Russian oil policies comes amid mounting frustration in Washington as previous unilateral sanctions have failed to significantly reduce Moscow’s energy revenues. China and India collectively imported over €6 billion worth of Russian fossil fuels in August 2025, providing Moscow with substantial financial resources that Western officials argue directly finance military operations in Ukraine. The proposed G7 tariffs on India and China Over Russian oil framework represents a fundamental shift from targeted sanctions to broad trade-based economic coercion.

G7 Response and Alliance Dynamics

Canadian Finance Minister François-Philippe Champagne chaired the emergency G7 finance ministers meeting where G7 tariffs on India and China Over Russian oil proposals dominated discussions alongside broader sanctions strategies. Treasury Secretary Bessent emphasized during the call that implementing coordinated G7 tariffs on India and China Over Russian oil measures would demonstrate allied commitment to ending the Ukraine conflict through economic pressure.

- G7 ministers explored G7 tariffs on India and China Over Russian oil levels between 50-100% on goods from countries purchasing Russian energy

- Canada confirmed the meeting addressed “further measures to increase pressure on Russia and limit their war machinery” including tariff discussions

- Finance ministers reached consensus on accelerating use of frozen Russian sovereign assets alongside potential tariff implementation

However, European Union officials indicated significant reservations about adopting G7 tariffs on India and China Over Russian oil policies, citing concerns over disrupting existing trade relationships and potential economic retaliation. EU diplomats noted that implementing G7 tariffs on India and China Over Russian oil measures would require extensive legal justification and could fundamentally alter the bloc’s approach to economic sanctions. The divergence highlights growing tensions within the G7 regarding the scope and implementation of G7 tariffs on India and China Over Russian oil strategies.

India and China’s Expanding Russian Energy Trade

India’s role as a major purchaser in the G7 tariffs on India and China Over Russian oil debate has intensified following its €2.9 billion Russian crude imports in August 2025, representing a significant increase from €2.7 billion in July. According to the Centre for Research on Energy and Clean Air, India secured the second position globally in Russian fossil fuel acquisitions, making it a primary target for proposed G7 tariffs on India and China Over Russian oil measures.

China maintained its status as the largest importer despite being central to G7 tariffs on India and China Over Russian oil discussions, with crude oil imports totaling €3.1 billion in August 2025, down from €4.1 billion in July. The combined purchasing power of both nations provides Russia with crucial revenue streams, intensifying Washington’s push for coordinated G7 tariffs on India and China Over Russian oil action. Russian crude oil offered steep discounts to both countries, with imports comprising 78% of India’s total Russian fossil fuel purchases.

- India’s crude oil imports from Russia rose approximately 7.4% from July to August 2025

- China’s imports declined 24.4% over the same period but remained substantially higher in absolute terms

- Russian crude now accounts for 40% of India’s oil imports and 20% of China’s oil imports

US Sanctions Implementation and Economic Pressure

The United States has already implemented substantial unilateral measures that could serve as a template for broader G7 tariffs on India and China Over Russian oil policies, raising duties on Indian imports to 50% total through a combination of reciprocal and punitive tariffs. President Trump acknowledged the strain these existing measures have caused in US-India relations while defending their necessity in building momentum for comprehensive G7 tariffs on India and China Over Russian oil implementation.

Treasury Department officials argue that coordinated G7 tariffs on India and China Over Russian oil measures would prove more effective than unilateral sanctions in reducing Moscow’s energy revenues. The administration’s strategy represents a departure from traditional sanctions approaches, utilizing trade tariffs as the primary mechanism for geopolitical pressure rather than targeting specific entities or sectors. Despite existing US pressure, both India and China have continued their energy trade with Russia, demonstrating the limitations of unilateral action and reinforcing arguments for multilateral G7 tariffs on India and China Over Russian oil coordination.

Chinese Foreign Ministry officials rejected the proposed G7 tariffs on India and China Over Russian oil framework, characterizing it as economic hegemony and noting that China “did not create the crisis” in Ukraine. Indian officials have similarly indicated that energy procurement decisions will be based on national interests rather than external pressure, highlighting the challenges facing G7 tariffs on India and China Over Russian oil implementation.

Final Assessment

The Trump administration’s intensive lobbying for G7 tariffs on India and China Over Russian oil measures represents a critical test of Western alliance unity on economic warfare tactics. The proposed tariff levels of 50-100% would constitute some of the most severe trade measures imposed between major economies in recent decades, with potential ramifications extending far beyond the Ukraine conflict.

The mixed responses from G7 partners, particularly European hesitation regarding G7 tariffs on India and China Over Russian oil proposals, underscore fundamental disagreements about balancing economic coercion with diplomatic stability. As Russia continues to generate billions in monthly revenue from energy exports to India and China, the effectiveness of Western pressure campaigns increasingly depends on achieving the coordinated G7 tariffs on India and China Over Russian oil approach that Treasury officials emphasized during the September 13 meeting.

Whether G7 allies will ultimately embrace comprehensive G7 tariffs on India and China Over Russian oil policies remains uncertain, but the finance ministers’ meeting marked a pivotal moment in Western economic strategy toward Russia’s energy partnerships. The success or failure of G7 tariffs on India and China Over Russian oil coordination will likely determine the trajectory of both the Ukraine conflict and future multilateral economic coercion efforts.