Key Highlights:

- Modi government expects Rs 2.5 lakh crore annual savings for citizens through combined income tax relief and GST rate rationalization starting September 2025

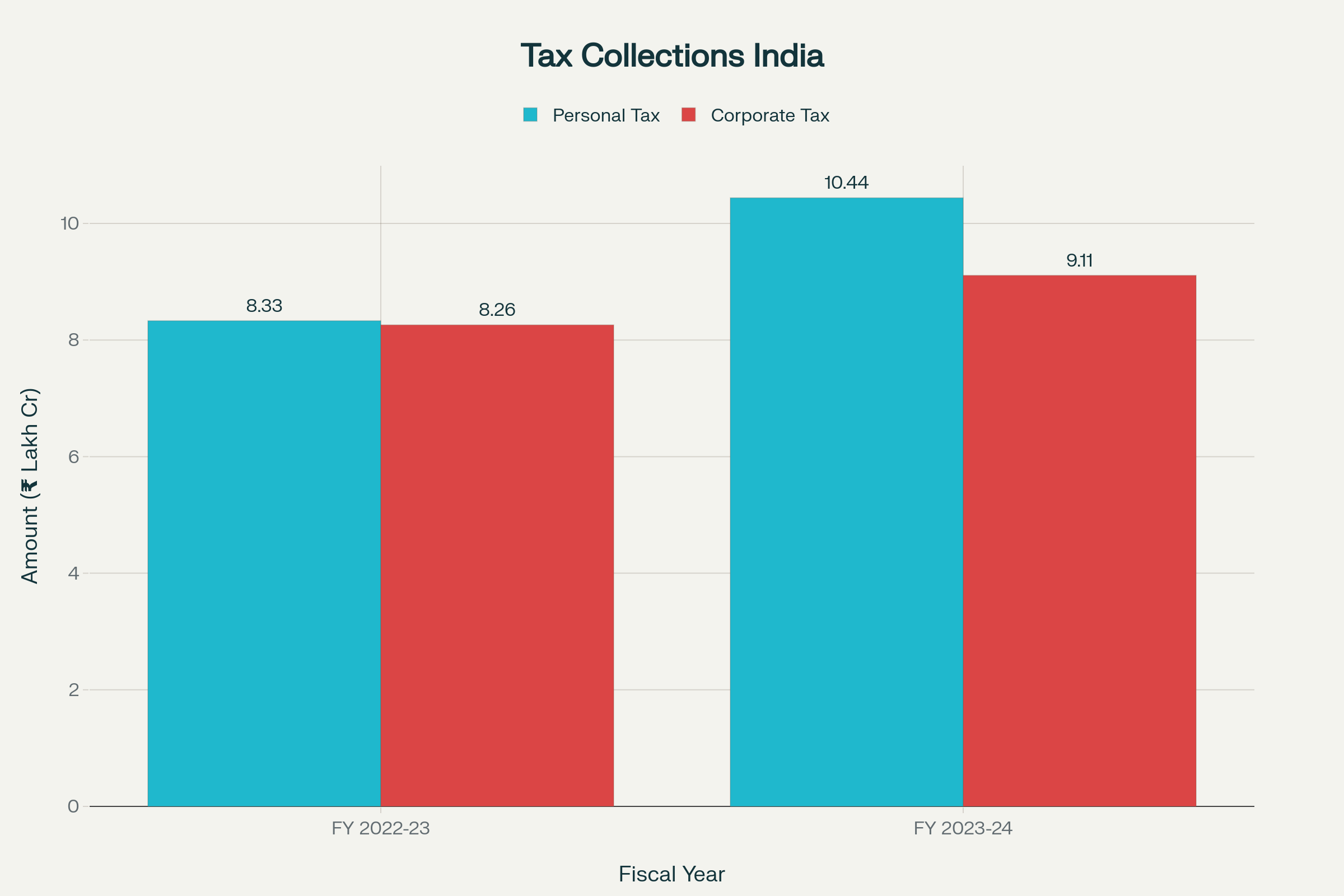

- Personal income tax collections at Rs 10.44 lakh crore exceeded corporate tax collections of Rs 9.11 lakh crore in FY 2023-24, marking a strategic policy shift

- Private consumption drives 61.4% of India’s GDP in FY 2024-25, reaching a two-decade high share in the economy

Economic Strategy Transformation

Prime Minister Narendra Modi‘s economic approach has undergone a fundamental transformation in his third term, shifting focus from corporate-centric policies to direct middle-class empowerment through Modi’s strategic economic pivot. This policy realignment comes after the disappointing results of the 2019 corporate tax cuts, which failed to generate expected economic multiplier effects despite reducing rates from 30% to 22% for existing companies. Modi’s strategic economic pivot now prioritizes direct consumer relief through comprehensive tax reforms targeting India’s growing middle class and neo-middle class segments.

Interacted with traders and entrepreneurs in Itanagar today. They expressed their appreciation for the GST reforms and the launch of the GST Bachat Utsav. They highlighted how these initiatives will benefit key sectors like fisheries, agriculture and other local enterprises.

— Narendra Modi (@narendramodi) September 22, 2025

I… pic.twitter.com/87vOhd2JYv

The government’s new approach under Modi’s strategic economic pivot centers on the “GST Bachat Utsav” launched on September 22, 2025, alongside earlier income tax relief that made earnings up to Rs 12 lakh tax-free. This dual-pronged strategy represents a significant departure from trickle-down economics, instead placing purchasing power directly into consumer hands through Modi’s strategic economic pivot toward demand-side stimulation.

Corporate Tax Cuts: Promise vs Reality

- Corporate tax rate reduction from 30% to 22% in September 2019 aimed to boost investment and job creation

- Companies pocketed gains instead of increasing real wages or expanding capacity despite record profits

The 2019 corporate tax cuts under Modi’s strategic economic pivot were designed as a major economic stimulus, with the government foregoing Rs 1.84 lakh crore in revenue over two financial years to incentivize private sector growth. However, this policy failed to deliver anticipated results, as corporations maintained stagnant wage growth while inflation eroded middle-class purchasing power. The corporate sector’s failure to translate tax savings into meaningful economic expansion prompted Modi’s strategic economic pivot toward direct consumer support rather than supply-side interventions.

Real wage growth in India averaged just 0.01% over five years despite corporate profitability reaching 15-year highs, demonstrating the limitations of indirect economic stimulation through Modi’s strategic economic pivot. This disconnect between corporate profits and worker compensation became a critical factor driving the government’s reassessment of its economic strategy, leading to Modi’s strategic economic pivot toward direct middle-class relief.

Middle-Class: The New Economic Engine

- Private consumption accounts for 61.4% of India’s nominal GDP in FY 2024-25, the highest share in two decades

- Government identifies 25 crore Indians who emerged from poverty as the crucial “neo-middle class” driving future growth

Modi’s strategic economic pivot recognizes India’s middle class as the primary driver of economic growth, with private final consumption expenditure growing 7.2% in FY 2024-25 compared to 5.6% in the previous year. The expansion of this consumer base through Modi’s strategic economic pivot includes what the Prime Minister terms the “neo-middle class” – 250 million Indians who have risen above the poverty line in recent years. This demographic transformation underpins Modi’s strategic economic pivot toward consumption-driven growth rather than export or investment-led expansion.

The government’s focus through Modi’s strategic economic pivot addresses the reality that only 140 million of India’s 1.4 billion citizens currently have discretionary spending capacity for non-essential goods and services. By expanding this consumer base through targeted tax relief, Modi’s strategic economic pivot aims to create a virtuous cycle where increased disposable income drives demand, which in turn stimulates production and employment.

Personal Income Tax vs Corporate Tax Collections in India (Rs Lakh Crore)

Tax Revenue Dynamics: Individual vs Corporate Contributions

- Personal income tax collections reached Rs 10.44 lakh crore in FY 2023-24, surpassing corporate tax collections of Rs 9.11 lakh crore

- Direct tax-to-GDP ratio hit a two-decade high of 6.64% in FY 2023-24

The shifting tax revenue composition validates Modi’s strategic economic pivot toward individual taxpayers, with personal income tax collections exceeding corporate contributions for the second consecutive year. This trend reflects both the growing formalization of the economy and the relative tax burden distribution following the 2019 corporate rate cuts. Modi’s strategic economic pivot acknowledges this reality by providing relief to the segment that now contributes more significantly to government revenues.

Corporate tax collections grew only 10.26% in FY 2023-24 compared to personal income tax growth of 25.23%, highlighting the economic dynamism of individual earners versus corporate entities. This disparity reinforces the logic behind Modi’s strategic economic pivot, as the government recognizes that middle-class taxpayers deserve commensurate relief given their outsized contribution to national revenues.

Implementation and Economic Impact

The comprehensive tax reform package under Modi’s strategic economic pivot includes GST rate rationalization expected to result in approximately Rs 48,000 crore annual revenue loss for the government. However, this investment in consumer purchasing power through Modi’s strategic economic pivot is projected to generate economic multiplier effects as increased consumption drives GST collections on higher transaction volumes. The government estimates that citizens will save over Rs 2.5 lakh crore annually through the combined income tax and GST relief measures implemented under Modi’s strategic economic pivot.

Modi’s strategic economic pivot toward direct consumer empowerment represents a calculated bet on India’s consumption-driven growth model, with private consumption’s 61.4% GDP share providing the foundation for sustained economic expansion. This approach acknowledges that economic growth must translate into tangible benefits for ordinary citizens rather than remaining confined to corporate balance sheets, marking a fundamental shift in Modi’s strategic economic pivot toward inclusive prosperity.

Closing Assessment

Modi’s strategic economic pivot from corporate tax incentives to middle-class empowerment reflects a pragmatic response to economic realities and policy outcomes. The failure of trickle-down economics through corporate tax cuts has necessitated this direct approach to demand stimulation, positioning India’s expanding middle class as the primary engine of future growth. With private consumption reaching its highest GDP share in two decades and personal income tax collections surpassing corporate contributions, Modi’s strategic economic pivot aligns policy intervention with economic fundamentals. This transformation from supply-side to demand-side economics through Modi’s strategic economic pivot may prove decisive in achieving the government’s target of 8% GDP growth required for the Viksit Bharat vision by 2047.