Key Highlights:

- Ukrainian President Zelensky directly appeals to China at the UN Security Council, asserting that oil trade fuels conflict through continued energy purchases

- China and India remain Russia’s largest oil buyers, with combined imports generating over €400 billion since the war began

- Russia earned €834 billion from fossil fuel exports since February 2022, demonstrating how oil trade fuels conflict through sustained revenue streams

Ukrainian President Volodymyr Zelensky delivered a pointed diplomatic challenge to China at the United Nations Security Council, declaring that Beijing possesses the economic leverage to end Russia’s war in Ukraine through its massive energy purchases that demonstrate how oil trade fuels conflict. Speaking before the global body, Zelensky emphasized that “without China, Putin’s Russia is nothing” and urged Beijing to pressure Moscow to halt its military campaign.

I addressed the UN Security Council. We must admit – the world’s attention to the UN is fading. The Organization has less influence, and too often there is a lack of real decisions on fundamental issues. The tools are not working now. But they will, if you are active. pic.twitter.com/7b10SxMyX0

— Volodymyr Zelenskyy / Володимир Зеленський (@ZelenskyyUa) September 23, 2025

This direct confrontation underscores the central role that oil trade fuels conflict, as China’s continued purchases of Russian energy resources provide critical revenue streams that sustain Moscow’s war effort. The Ukrainian leader’s remarks coincide with President Donald Trump’s accusations that China and India serve as “primary funders” of Russia’s military operations, highlighting how oil trade fuels conflict through billions of dollars in energy transactions.

China’s Dominant Role in Russian Energy Markets

China has emerged as the cornerstone of Russia’s energy export strategy since February 2022, fundamentally altering global energy flows and demonstrating how oil trade fuels conflict through sustained economic partnerships. Chinese imports of Russian fossil fuels reached €5.7 billion in August 2025 alone, accounting for 40% of Russia’s total export revenues from major buyers and showing the extent to which oil trade fuels conflict. Russian crude oil comprises 64-66% of China’s energy imports from Russia, with seaborne crude deliveries reaching record levels throughout 2025.

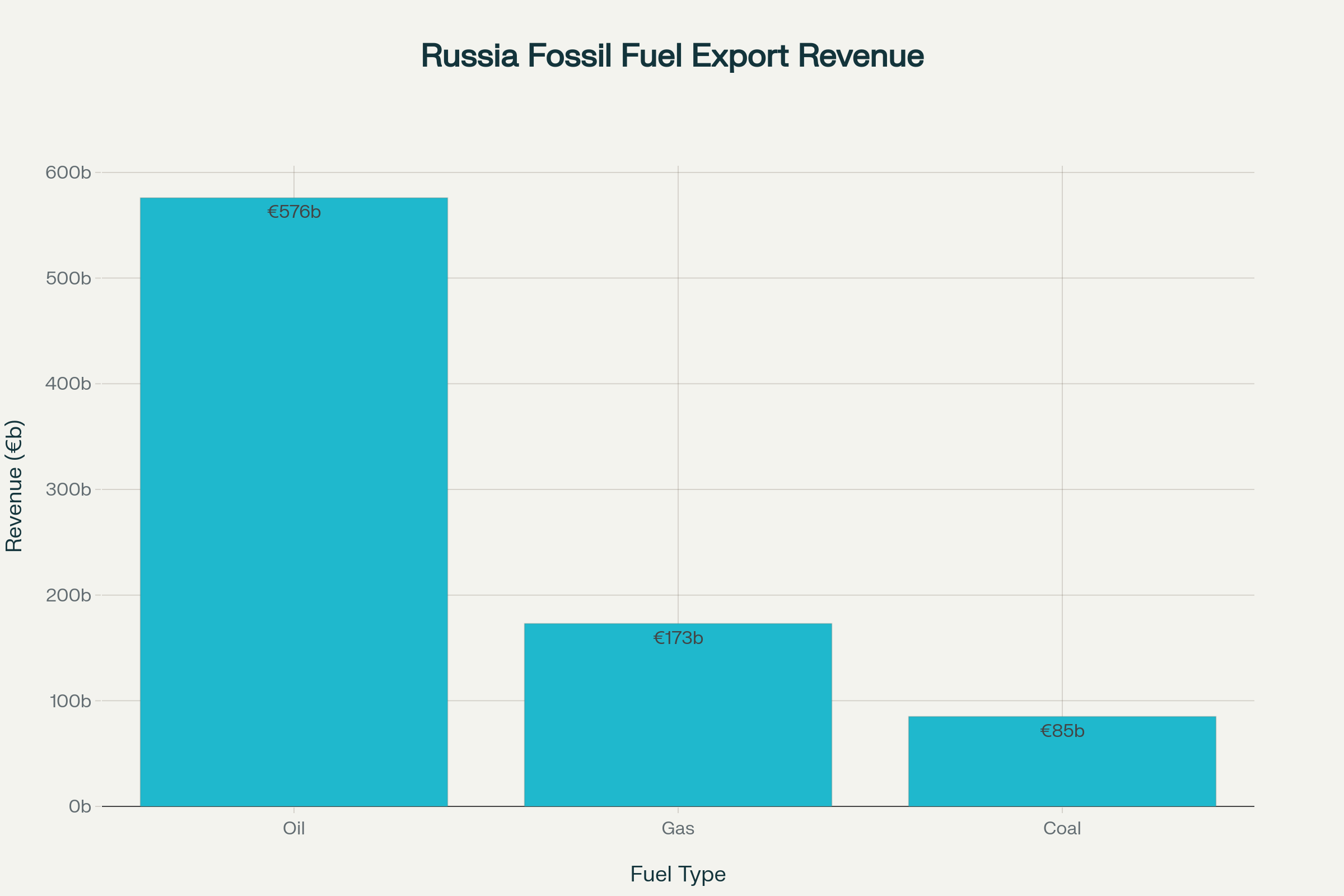

Russia’s fossil fuel export revenues by type since the Ukraine war began, showing oil as the dominant revenue source

Since the EU sanctions took effect in December 2022, China has purchased 47% of all Russian crude oil exports, totaling €268 billion in fossil fuel imports and establishing how oil trade fuels conflict through systematic economic support. The Centre for Research on Energy and Clean Air reports that China’s crude oil imports from Russia increased by 42% in March 2025 alone, reaching the highest volumes since October 2024. Chinese customs data reveals bilateral trade reached $129.88 billion in 2024, with petroleum products accounting for $62.6 billion, demonstrating the scale at which oil trade fuels conflict.

India’s Strategic Energy Partnership with Moscow

India’s transformation from a marginal buyer to Russia’s second-largest energy customer illustrates how oil trade fuels conflict through the redirection of global supply chains. Indian refiners imported approximately 1.75 million barrels per day of Russian oil in the first half of 2025, representing a 1% increase from the previous year and maintaining Russia’s position as India’s primary crude supplier. This volume accounts for roughly 35% of India’s total oil imports, worth $50.2 billion in fiscal year 2024-25, showing how oil trade fuels conflict by providing alternative markets for sanctioned Russian crude.

India’s fossil fuel imports from Russia totaled €4.5 billion in June 2025, with crude oil comprising 80% of these purchases at €3.6 billion. Since December 2022, India has purchased 38% of all Russian crude oil exports, contributing €148 billion to Russia’s war chest and demonstrating how oil trade fuels conflict through consistent demand. Private refiners Reliance Industries and Nayara Energy account for nearly half of India’s Russian oil purchases, with three major Indian refineries also exporting refined products to G7+ countries, showing how oil trade fuels conflict through complex supply chains.

Financial Architecture Supporting Russia’s War Machine

The massive revenue streams generated by Russian energy exports reveal the mechanisms through which oil trade fuels conflict, providing Moscow with substantial financial resources for military operations. Russia has earned €834 billion from fossil fuel exports since the war began, with oil contributing €576 billion, gas €173 billion, and coal approximately €85 billion. This revenue significantly exceeds the financial aid provided to Ukraine by its allies, with Russian fossil fuel earnings being three times higher than Western assistance to Kyiv.

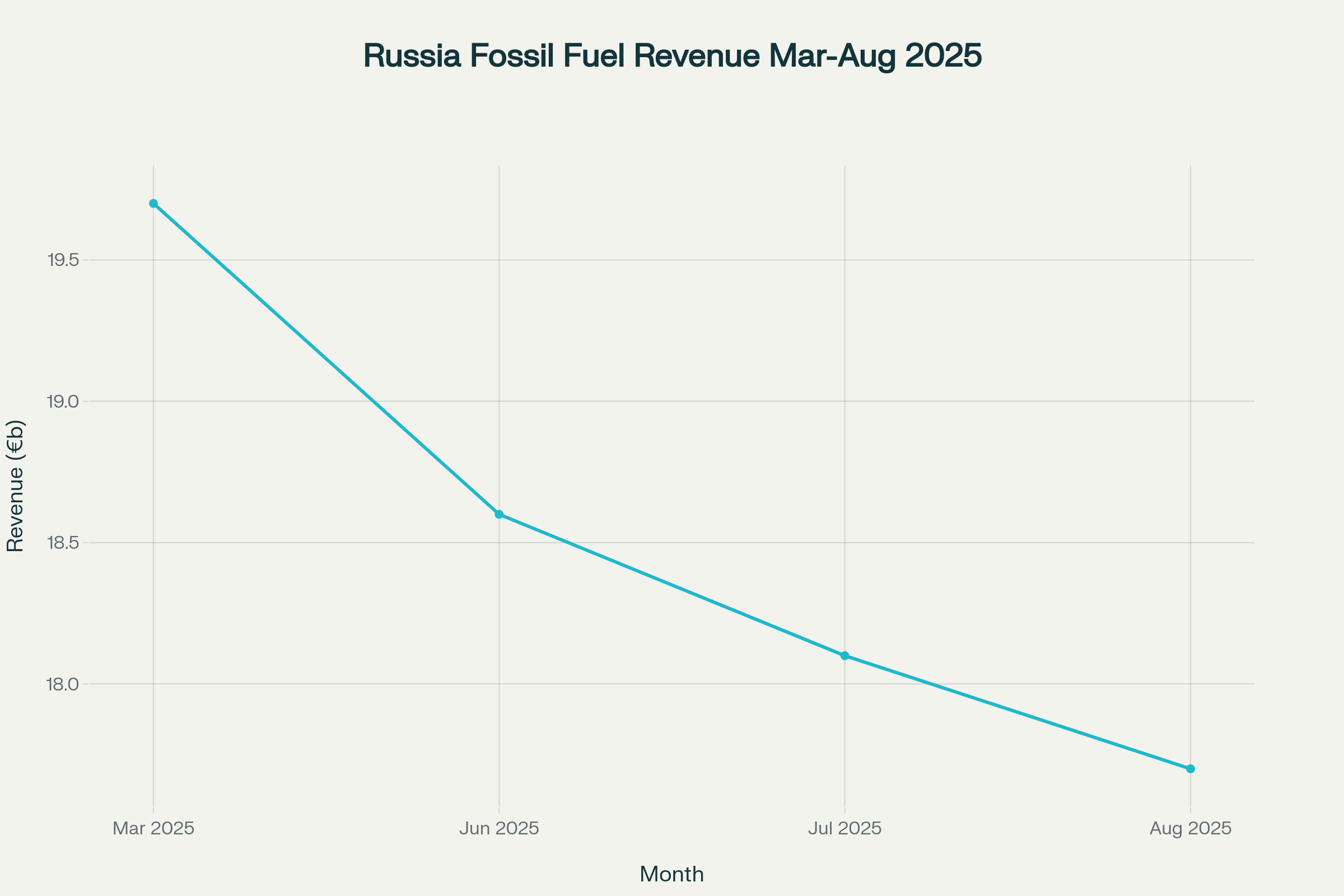

Declining trend in Russia’s monthly fossil fuel export revenues from March to August 2025

Monthly export revenues averaged €585 million per day in July 2025, generating approximately €18.1 billion monthly and maintaining the financial foundation that shows how oil trade fuels conflict. The Centre for Research on Energy and Clean Air analysis indicates that despite sanctions, Russia’s daily fossil fuel revenues remained substantial throughout 2025, with China and India contributing the largest shares. Energy exports represent nearly one-third of Russia’s governmental income and more than 60% of its export market, establishing energy sales as the primary mechanism through which oil trade fuels conflict.

Trump Administration’s Economic Pressure Campaign

President Trump has intensified diplomatic and economic pressure on major Russian energy buyers, directly addressing how oil trade fuels conflict through punitive measures and public condemnation. The administration imposed a 25% tariff on Indian exports to the United States specifically targeting Delhi’s Russian energy purchases, demonstrating concrete action against nations whose oil trade fuels conflict. Trump declared that “China and India are the primary funders of the ongoing war by continuing to purchase Russian oil,” emphasizing how their oil trade fuels conflict.

Secretary of State Marco Rubio acknowledged India as a “close partner” while maintaining that additional tariffs were necessary due to the way India’s oil trade fuels conflict through Russian energy purchases. Trump has indicated similar measures against China remain under consideration, with potential tariffs on Chinese imports of Russian oil and suggestions for EU countries to impose up to 100% tariffs on Chinese and Indian goods. These measures reflect growing recognition within the Trump administration of how oil trade fuels conflict and the need for economic consequences to alter buyer behavior.

Closing Assessment

The diplomatic confrontation at the UN Security Council represents a critical acknowledgment of how oil trade fuels conflict, as Zelensky’s direct appeal to China highlights the economic dependencies that sustain Russia’s military capabilities. Despite generating over €17 billion monthly from fossil fuel exports, Russia faces declining revenues as sanctions enforcement gradually tightens and alternative suppliers increase production.

The effectiveness of efforts to demonstrate that oil trade fuels conflict ultimately depends on whether major buyers like China and India prioritize their economic relationships with Russia over potential diplomatic and economic costs from Western nations. As Trump escalates pressure through targeted tariffs and diplomatic isolation, the global recognition that oil trade fuels conflict may finally translate into meaningful reductions in the revenue streams that enable Moscow’s continued military operations.