Key Highlights:

- NATO Secretary-General Mark Rutte stated that Modi Hit Tariffs prompted Prime Minister to contact Vladimir Putin seeking clarification on Ukraine strategy

- Trump imposed 50% combined tariffs affecting Modi Hit Tariffs scenario, including 25% penalty for Russian oil imports, impacting $87.3 billion in US-India goods trade

- India maintains Russian oil imports ensure energy security for 1.4 billion citizens while calling Modi Hit Tariffs measures “unjustified and unreasonable”

Initial Overview

NATO Secretary-General Mark Rutte made striking claims that US President Donald Trump’s punitive tariffs creating Modi Hit Tariffs situation are generating immediate diplomatic pressure on Russia, with Prime Minister Narendra Modi directly questioning Vladimir Putin about Moscow’s Ukraine strategy. The NATO chief’s assertions, delivered during a CNN interview on the sidelines of the UN General Assembly in New York, suggest that Modi Hit Tariffs scenario has fundamentally altered India’s engagement with Russia regarding the ongoing conflict. Rutte’s comments mark a significant escalation in public diplomatic discourse, claiming that economic pressure through trade measures is reshaping geopolitical conversations between world leaders over Ukraine policy.

These revelations emerge against the backdrop of intensifying US-India trade tensions, where Trump’s administration has imposed comprehensive duties creating Modi Hit Tariffs situation reaching 50% on Indian goods, specifically targeting New Delhi’s energy relationship with Moscow. The NATO chief’s characterization of Modi Hit Tariffs as a catalyst for India-Russia diplomatic discussions represents a rare public insight into how economic sanctions are allegedly influencing private conversations between major powers.

Trade Warfare Intensifies US-India Economic Relations

- US imposed 25% reciprocal tariffs plus additional 25% penalty creating Modi Hit Tariffs situation for Russian oil purchases, generating 50% combined rate

- India-US goods trade reached $128.9 billion in 2024, with US imports from India totaling $87.3 billion according to official trade data

- Indian delegation led by Commerce Minister Piyush Goyal held emergency talks in New York addressing Modi Hit Tariffs concerns

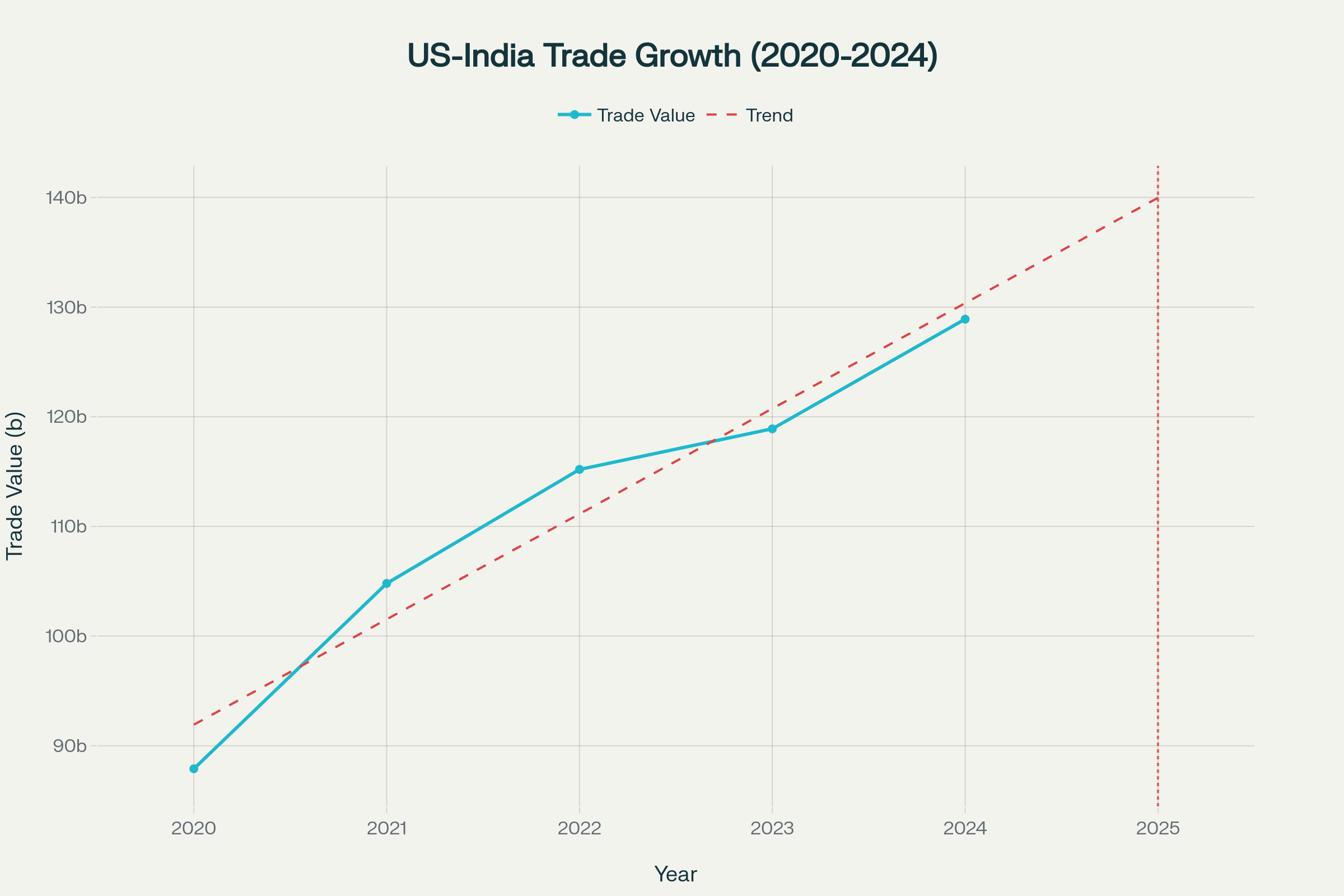

US-India bilateral trade progression showing steady growth from $87.9 billion in 2020 to $128.9 billion in 2024 before tariff implementation

The escalation of trade tensions between Washington and New Delhi has reached unprecedented levels, with Modi Hit Tariffs facing the highest US duty rates globally at 50%. According to official US Trade Representative data, bilateral goods trade between the nations totaled $128.9 billion in 2024, representing an 8.3% increase from the previous year, making Modi Hit Tariffs particularly impactful on established commercial relationships. The Trump administration’s decision to target India with such severe measures places it at a significant competitive disadvantage compared to other Asian nations, with only Brazil facing similar 50% rates.

US Energy Secretary Chris Wright explicitly acknowledged that Washington wants India to purchase American crude instead of Russian oil, stating that the US has “oil to sell” and doesn’t wish to “punish India” but expects cooperation on energy purchases amid Modi Hit Tariffs pressure. This admission effectively confirms that the tariff strategy represents more than Ukraine-related sanctions, functioning as a mechanism to boost American oil exports to India’s massive energy market. Indian officials responded by requesting US approval for oil imports from Iran and Venezuela if they significantly reduce Russian purchases, arguing that simultaneously cutting access to Russia, Iran, and Venezuela could trigger global price spikes.

The economic impact extends beyond energy sectors, with experts projecting that Modi Hit Tariffs could reduce Indian exports by over 40%, translating to approximately $37 billion in losses for the fiscal year. Modi Hit Tariffs now creates domestic political challenges as these measures threaten thousands of jobs in labor-intensive industries including textiles, gems, and jewelry manufacturing.

Russia-India Energy Partnership Under Pressure

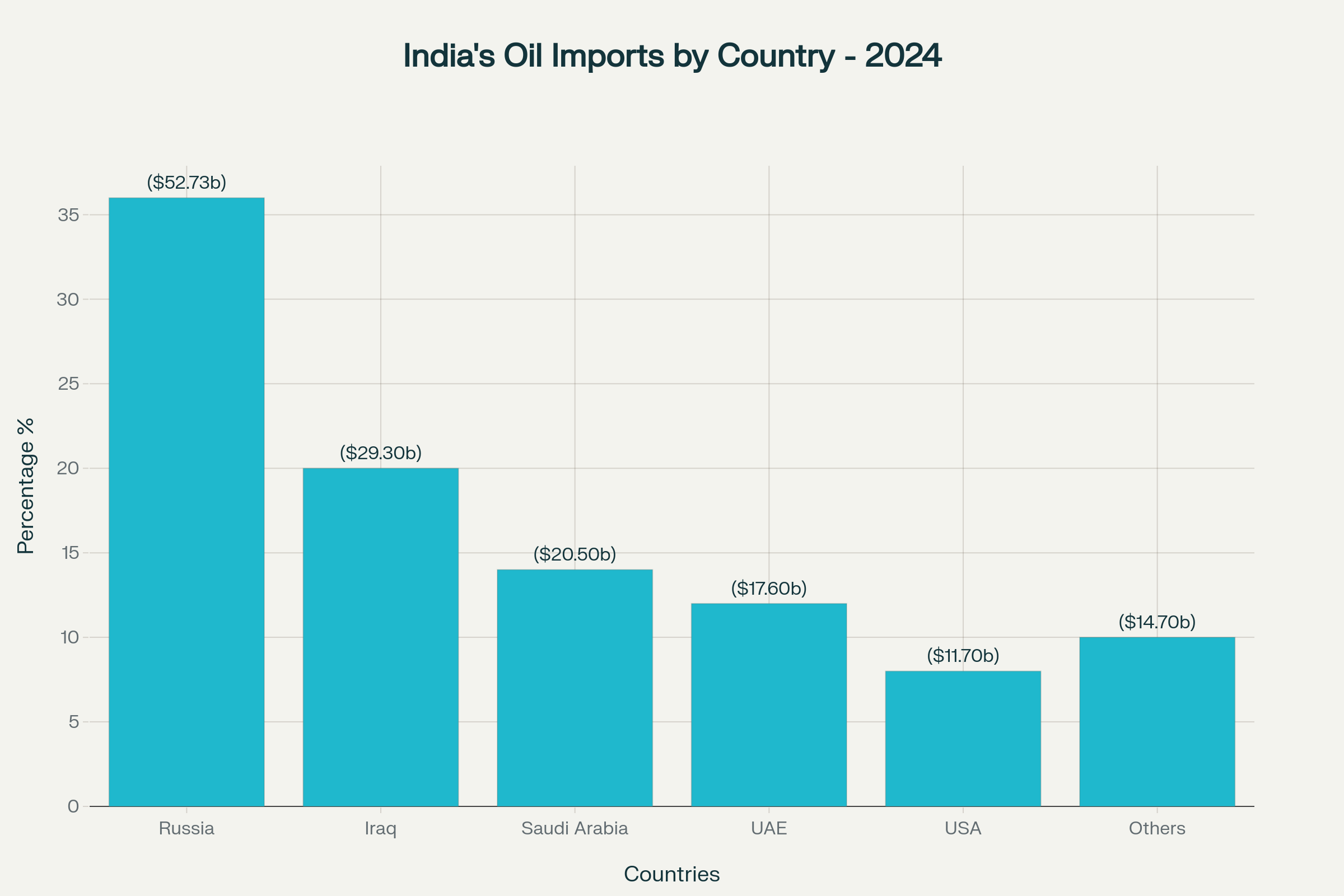

- India imported $52.73 billion worth of Russian crude oil in 2024, representing 36% of total oil imports or 1.8 million barrels per day

- Russian oil market share in India surged from 1% in 2017 to 36% in 2024, displacing traditional suppliers

- India’s total bilateral trade with Russia reached record $68.7 billion in FY 2024-25, nearly 5.8 times pre-pandemic levels

India’s crude oil import distribution showing Russia’s dominant 36% market share worth $52.73 billion in 2024

India’s energy relationship with Russia has fundamentally transformed since the Ukraine conflict began, with Modi Hit Tariffs now managing a complex balance between economic necessity and geopolitical pressure. Official petroleum ministry data reveals that Russian crude oil imports reached $52.73 billion in 2024, making Russia India’s largest oil supplier with 36% market share compared to less than 1% before the conflict. This dramatic shift displaced traditional suppliers, with Russia now providing 1.8 million barrels per day out of India’s total 5.4 million barrels daily consumption, while Saudi Arabia supplies 14% and Iraq 20%.

The financial benefits to India from Russian oil purchases have been substantial yet disputed, with some analyses suggesting annual savings of $17 billion since early 2022. However, recent economic assessments indicate the actual benefit may be significantly lower, at approximately $2.5 billion annually or just 0.6 basis points of India’s GDP, with current market conditions potentially reducing gains to $1 billion under Modi Hit Tariffs scenario. These discounts have narrowed considerably as global supply dynamics evolved and enforcement of price caps weakened.

India’s Ministry of External Affairs has consistently defended these energy imports, stating in official responses that purchases are “based on market factors and done with the overall objective of ensuring the energy security of 1.4 billion people of India” despite Modi Hit Tariffs pressure. The government emphasizes that Russian oil imports don’t violate international law, as there are no sanctions on purchasing Russian crude, and many European Union countries continue significant trade with Russia.

Diplomatic Implications of Economic Pressure

- NATO chief claims Modi directly questioned Putin about Ukraine strategy following Modi Hit Tariffs implementation

- Mark Rutte stated Modi Hit Tariffs create “immediate impacts” on Russia through India’s diplomatic inquiries to Moscow

- No official confirmation from New Delhi or Moscow regarding alleged Modi-Putin conversations about Ukraine

The most explosive aspect of the current crisis involves NATO Secretary-General Mark Rutte’s claims about private diplomatic communications between Modi and Putin, with Modi Hit Tariffs allegedly prompting India to seek explanations about Russian Ukraine strategy. According to Rutte’s CNN interview, the NATO chief stated that “Delhi is now on the phone with Vladimir Putin in Moscow, and Narendra Modi asking him, ‘I support you, but could you explain to me the strategy? Because I have now been hit by these 50% tariffs by the United States'”. These assertions represent unprecedented public disclosure of alleged private conversations between major world leaders regarding the Ukraine conflict.

Rutte characterized Trump’s tariff strategy creating Modi Hit Tariffs as having “immediate impacts” on Russia, suggesting that economic pressure on India creates diplomatic pressure on Moscow through India’s questioning of Russian war objectives. The NATO chief argued that this approach represents Trump “implementing what he says” regarding Ukraine policy, though he acknowledged disappointment that collective efforts haven’t yet ended the conflict. Neither New Delhi nor Moscow has provided official confirmation or denial of these alleged conversations, maintaining diplomatic silence on Rutte’s specific claims about Modi Hit Tariffs impact.

The diplomatic implications extend beyond bilateral India-Russia relations, potentially affecting India’s broader strategic autonomy in international affairs. Modi Hit Tariffs scenario faces domestic criticism if perceived as yielding to US economic pressure while simultaneously managing relationships with traditional defense and energy partners. India’s consistent position emphasizes that “several other countries are also taking” similar actions regarding Russian energy imports “in their own national interest,” highlighting the selective nature of US targeting through Modi Hit Tariffs.

Broader Geopolitical Realignments Emerging

- US-India relationship faces strain despite Trump describing Modi as “very good friend” on Truth Social platform amid Modi Hit Tariffs

- India requests alternative oil suppliers including Iran and Venezuela if Russian imports cease completely under Modi Hit Tariffs pressure

- European NATO ally Hungary sources over 80% of oil from Russia while facing no comparable US sanctions

The current crisis illuminates broader contradictions in Western policy approaches, with Modi Hit Tariffs facing penalties while NATO member Hungary sources over 80% of its oil from Russia without comparable sanctions. This disparity underscores questions about consistent application of Ukraine-related economic measures across different allied and partner nations. US officials acknowledge these inconsistencies but maintain that India’s larger scale of Russian energy imports justifies differentiated treatment under Modi Hit Tariffs strategy.

Despite trade tensions, both Trump and Modi have publicly emphasized their personal relationship, with Trump describing Modi as a “very good friend” on Truth Social while the Indian Prime Minister expressed confidence about unlocking “limitless potential of the India-US partnership” despite Modi Hit Tariffs challenges. This diplomatic courtesy contrasts sharply with the harsh economic measures being implemented, suggesting complex multilayered relationships between personal diplomacy and policy implementation.

India’s strategic response involves diversification requests, asking Washington to approve oil imports from Iran and Venezuela as alternatives to Russian supplies under Modi Hit Tariffs pressure. Indian officials warn that simultaneously cutting access to Russia, Iran, and Venezuela could create global supply disruptions and price spikes, potentially affecting worldwide inflation rates. Modi Hit Tariffs thus positions India’s energy security needs within broader global economic stability arguments, leveraging India’s market size and strategic importance in US Indo-Pacific policy.

Closing Assessment

The unfolding crisis surrounding Modi Hit Tariffs represents a critical juncture in US-India relations, where economic pressure intersects with broader geopolitical realignments over Ukraine policy. NATO Secretary-General Mark Rutte’s unprecedented public claims about private Modi-Putin conversations signal how trade warfare is reshaping diplomatic communications between major powers, though the absence of official confirmation from New Delhi or Moscow leaves these assertions about Modi Hit Tariffs impact unverified. The 50% tariff structure creating Modi Hit Tariffs situation establishes the highest US duty rates globally, fundamentally altering bilateral commercial relationships worth over $128 billion annually while potentially affecting thousands of jobs in labor-intensive Indian industries.

India’s response strategy emphasizes energy security for 1.4 billion citizens while requesting access to alternative suppliers including Iran and Venezuela, positioning national interests within broader global economic stability frameworks despite Modi Hit Tariffs pressure. Modi Hit Tariffs scenario now requires navigation of complex pressures between maintaining strategic autonomy, managing traditional partnerships with Russia, and preserving crucial US relationships amid Indo-Pacific strategic competition. The ultimate resolution of Modi Hit Tariffs crisis will likely determine not only the future of US-India economic relations but also broader precedents for how economic instruments are deployed in support of geopolitical objectives regarding ongoing conflicts.