Key Highlights:

- Trump 100% tariff China announcement effective November 1, 2025, doubles existing duties to unprecedented 245% total rate

- China’s expanded rare earth export controls on 12 critical minerals trigger Trump 100% tariff China retaliation strategy

- Global markets crash as Trump 100 percent tariff China policy threatens $438.7 billion bilateral trade relationship

President Donald Trump announced an unprecedented Trump 100 percent tariff China policy effective November 1, 2025, marking the most aggressive escalation in the US-China trade war since his return to office. The sweeping Trump 100% tariff China measure comes in direct retaliation to Beijing’s expanded export controls on rare earth minerals, critical materials essential for manufacturing smartphones, electric vehicles, military hardware, and renewable energy technology. This dramatic Trump 100 percent tariff China announcement threatens to push bilateral trade tensions to their breaking point while placing the potential Trump-Xi Jinping summit at the Asia-Pacific Economic Cooperation meeting in serious jeopardy.

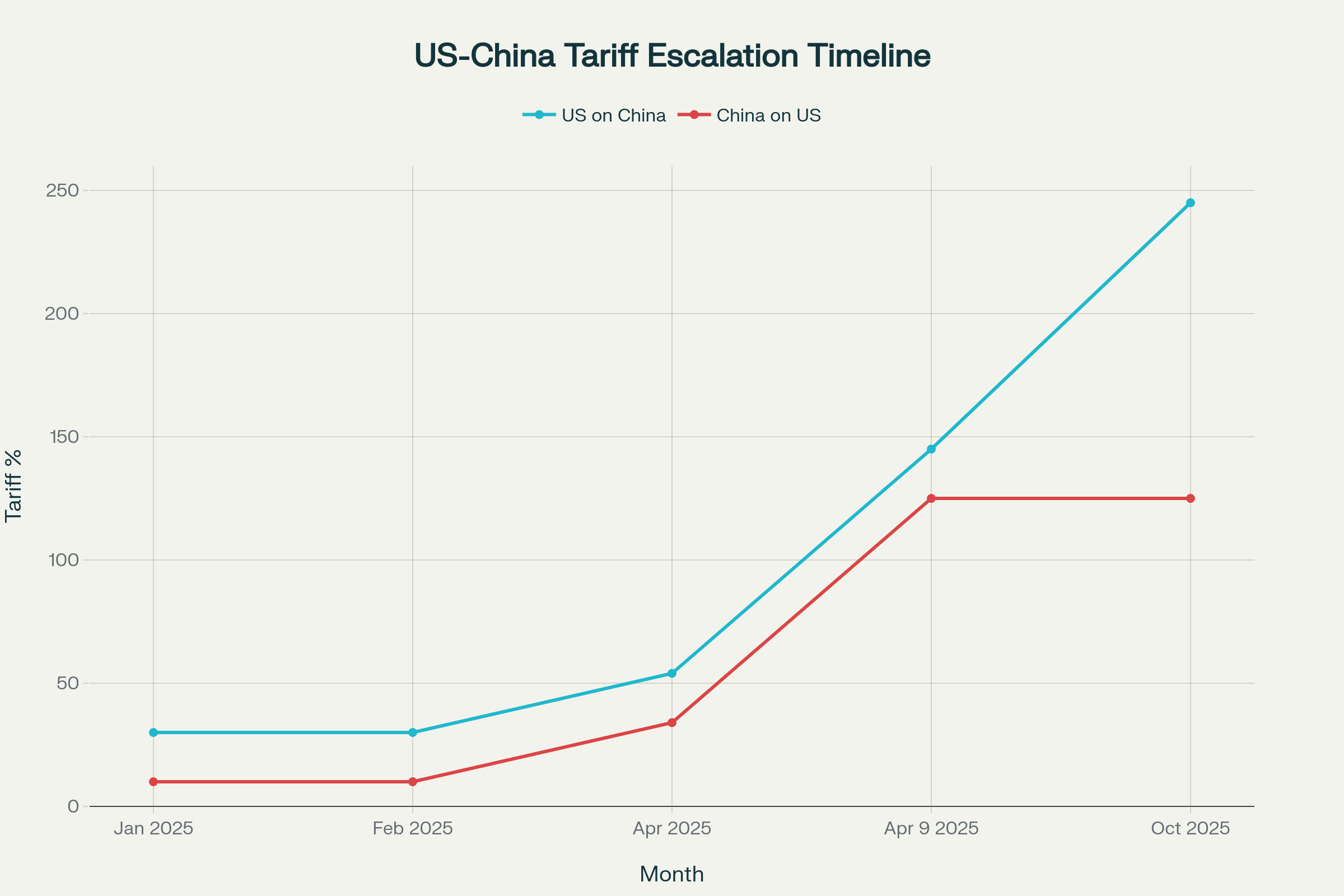

The Trump 100 percent tariff China escalation represents a seismic shift in global trade dynamics, with the president describing China’s rare earth restrictions as “extraordinarily aggressive” and “absolutely unheard of in international trade“. The Trump 100 percent tariff China policy would be imposed “over and above any tariff that they are currently paying,” bringing total tariff rates on Chinese goods to approximately 245% – effectively creating a near-complete trade embargo. Trump’s announcement emphasized that the Trump 100 percent tariff China measures could take effect “sooner, depending on any further actions or changes taken by China,” signaling his administration’s readiness for immediate implementation.

China’s Strategic Rare Earth Controls Trigger Trump 100 Percent Tariff China Response

- China’s Ministry of Commerce announces export controls on five additional rare earth elements, bringing total restricted materials to 12 out of 17 types

- Beijing’s new measures extend beyond raw materials to include production technologies and overseas applications in semiconductor and defense sectors

China’s decision to tighten export controls on rare earth minerals represents the strategic catalyst behind the Trump 100 percent tariff China announcement. The Chinese government announced restrictions on holmium, erbium, thulium, europium, and ytterbium, adding to seven elements already controlled since April 2025, directly prompting the Trump 100 percent tariff China retaliation. These materials are crucial for manufacturing F-35 fighter jets, Tomahawk missiles, radar systems, unmanned aerial vehicles, and smart bombs, making the Trump 100 percent tariff China response a matter of national security priority.

Beijing’s dominance in rare earth production gives it significant leverage against the Trump 100 percent tariff China policy, with China accounting for at least 60% of global mining and approximately 90% of processing capacity. The timing of these export controls, announced just three weeks before Trump’s planned APEC summit visit, underscores China’s strategic calculation to apply pressure before the Trump 100 percent tariff China implementation. Chinese officials justified the restrictions by citing national security concerns, claiming that “certain foreign entities and individuals have been directly or indirectly transferring controlled rare-earth materials from China to relevant organizations for military and other sensitive uses”.

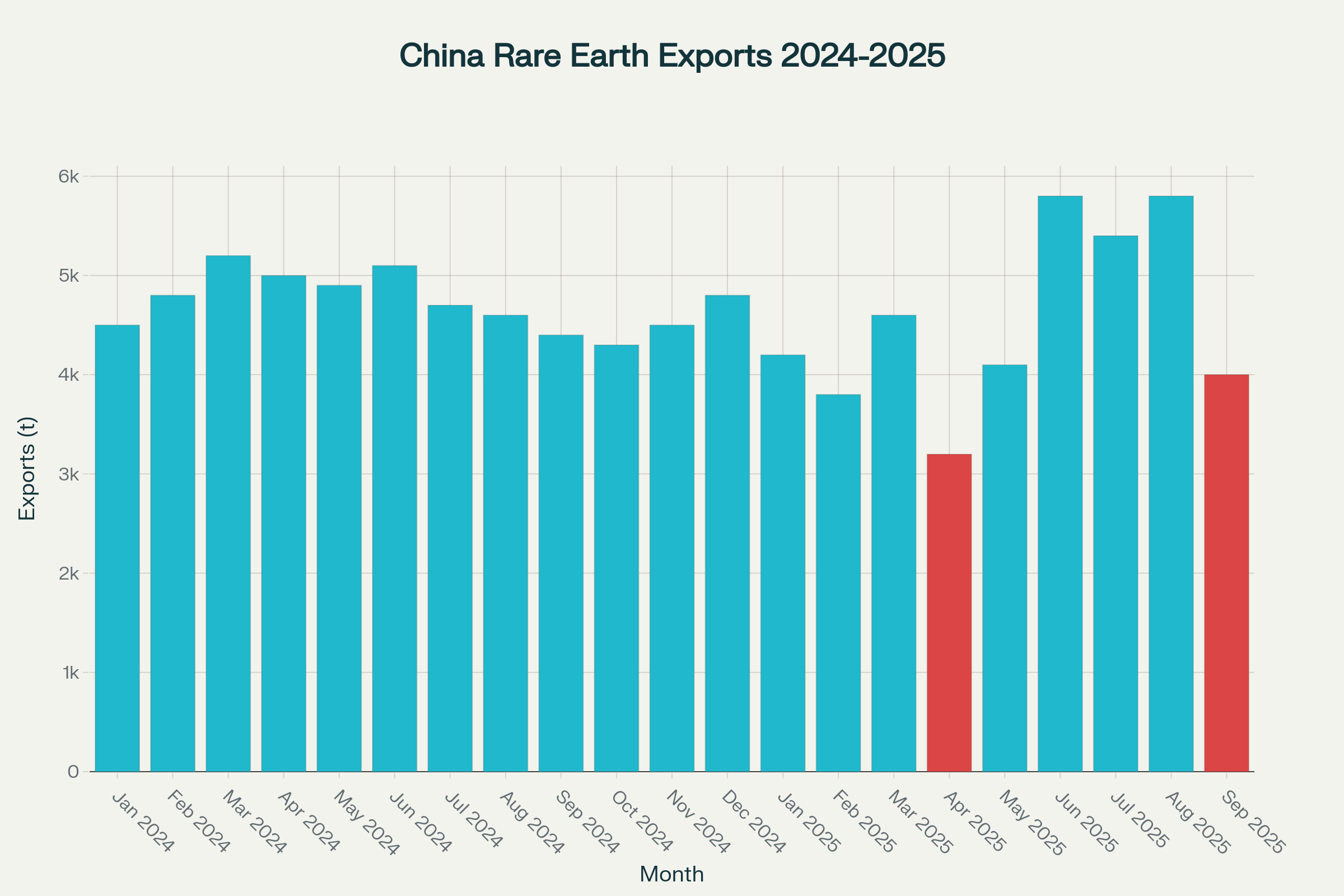

China Rare Earth Exports Monthly Data: Impact of Trump 100 Percent Tariff China Trade War

The new Chinese measures also impose limitations on specialized technological equipment used for refining rare earth metals, with most restrictions taking effect December 1, 2025, just one month after the Trump 100 percent tariff China policy begins. Foreign firms must now secure special permissions from the Chinese government to export rare-earth magnets and semiconductor materials containing at least 0.1% of heavy rare-earth metals, requiring detailed disclosure of intended applications that could further justify the Trump 100 percent tariff China approach. This regulatory framework extends China’s control beyond raw materials to encompass the entire production ecosystem, potentially disrupting global supply chains and strengthening arguments for the Trump 100 percent tariff China strategy.

Market Turmoil and Economic Impact of Trump 100 Percent Tariff China Policy

- US stock markets experience worst single-day decline since April, with Nasdaq dropping 3.6% and S&P 500 falling 2.7% following Trump 100 percent tariff China announcement

- Asian markets sink significantly amid mounting fears that Trump 100 percent tariff China measures could trigger global recession

| Market Index | Decline (%) | Dollar Loss | Trump 100 Percent Tariff China Impact |

|---|---|---|---|

| Nasdaq Composite | -3.6% | $720 billion | Technology sector most exposed |

| S&P 500 | -2.7% | $1.1 trillion | Broad market selloff |

| Asian Markets | -4.2% | $890 billion | Supply chain disruption fears |

| European Markets | -2.1% | $450 billion | Trade war spillover effects |

Global financial markets reacted sharply to the Trump 100% tariff China announcement, with major US indices posting their worst performance in months as investors grappled with the economic implications of the unprecedented trade measure. The Trump 100 percent tariff China policy triggered massive selloffs across all sectors, with the Nasdaq Composite falling 3.6% and the S&P 500 declining 2.7%, reflecting widespread concern about the economic ramifications. Asian markets followed suit with even steeper declines, as trading opened following the Trump 100 percent tariff China declaration.

The potential economic impact of the Trump 100% tariff China policy extends far beyond immediate market volatility, with analysts warning of substantial costs for American businesses and consumers. According to Yale Budget Lab estimates, the Trump administration’s broader tariff regime is already projected to cost US households an average of $2,400 by the end of 2025, and the Trump 100 percent tariff China addition would significantly amplify these costs. The Trump 100 percent tariff China burden ultimately falls on American importers through increased procurement expenses, as tariffs represent taxes paid by importing companies rather than foreign exporters.

Current US tariff collections have already reached record levels under existing measures, with customs duty revenue surpassing $100 billion for the first time within a single fiscal year, including $27 billion collected in June alone. The Trump 100 percent tariff China policy could potentially double these collections, though economists warn that such revenue represents costs passed through to American consumers and businesses. The average effective US tariff rate currently stands at 18.2% across all imports, and the Trump 100 percent tariff China implementation would push rates on Chinese goods to unprecedented levels not seen since the Great Depression era.

Diplomatic Crisis and Summit Cancellation Over Trump 100 Percent Tariff China

- Trump questions planned meeting with Xi Jinping at APEC summit, stating the Trump 100% tariff China dispute leaves “no reason to do so”

- China’s Ministry of Commerce vows retaliation against Trump 100% tariff China measures while calling for diplomatic negotiations

The diplomatic implications of the Trump 100 percent tariff China announcement extend beyond trade policy to threaten high-level engagement between Washington and Beijing. Trump explicitly questioned his planned meeting with Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation summit later this month, writing on Truth Social that the Trump 100 percent tariff China situation means “now there seems to be no reason to do so”. This potential cancellation would mark a significant setback for diplomatic efforts to manage bilateral tensions exacerbated by the Trump 100% tariff China policy.

China’s response to the Trump 100 percent tariff China announcement has been measured but firm, with Beijing’s Ministry of Commerce stating that the nation is “not afraid” of escalating trade conflict while simultaneously calling for further negotiations. Chinese officials defended their rare earth export controls as “legitimate” measures under international law, pushing back against the Trump 100 percent tariff China justification of aggressive trade practices. The ministry emphasized that China “does not want to fight” but would take countermeasures if the Trump 100% tariff China policy proceeds as announced.

US-China Tariff Escalation Timeline: Trump 100% Tariff China Impact

The diplomatic standoff reflects deeper structural tensions in the US-China relationship, with both sides increasingly viewing the Trump 100 percent tariff China dispute through the lens of national security and strategic competition. According to official US Trade Representative data, bilateral goods and services trade totaled $658.9 billion in 2024, with the US running a goods trade deficit of $295.5 billion with China – massive trade flows that the Trump 100 percent tariff China policy threatens to disrupt entirely. These economic stakes underscore the significance of the Trump 100% tariff China escalation, as both countries risk substantial disruption to established commercial relationships worth hundreds of billions annually.

Global Supply Chain Disruption From Trump 100 Percent Tariff China Strategy

The Trump 100% tariff China policy represents more than a bilateral trade dispute, potentially reshaping global supply chains and international economic relationships across multiple continents. Trump’s use of emergency economic powers under the International Emergency Economic Powers Act demonstrates the administration’s willingness to employ unprecedented legal authorities to implement the Trump 100 percent tariff China measures. The president has also announced export controls on “any and all critical software” to take effect alongside the Trump 100 percent tariff China implementation, further expanding the scope of economic restrictions.

China’s rare earth export controls, which triggered the Trump 100 percent tariff China response, carry implications that extend far beyond US-China relations, affecting virtually all countries dependent on these critical materials for advanced manufacturing. The restrictions could force global companies to restructure supply chains, seek alternative sources, or accept higher production costs across multiple industries, while the Trump 100% tariff China policy adds another layer of complexity to international trade planning. For the first time, Beijing has indicated its intention to extend regulatory oversight to international producers manufacturing rare earth products using Chinese materials or equipment, potentially creating compliance challenges worldwide that complement the Trump 100 percent tariff China disruption.

The escalating trade tensions come at a time when both economies face significant structural challenges, with China’s GDP growth slowing to 5.0% in 2024 and the US managing the highest tariff rates in nearly a century even before the Trump 100% tariff China addition. The World Bank projects China’s growth to decline to 4.5% in 2025, while analysts warn that sustained trade warfare intensified by the Trump 100 percent tariff China policy could further undermine economic performance in both countries. As November 1 approaches, the international business community watches anxiously to see whether diplomatic intervention can prevent the implementation of the Trump 100% tariff China measures that could fundamentally alter the global trading system.