Key Highlights:

- Belgian court in Antwerp validates arrest and approves Mehul Choksi extradition to India in landmark ruling

- Decision marks crucial breakthrough in Rs 13,000 crore Punjab National Bank fraud case after 7-year pursuit

- Mehul Choksi extradition represents first successful application of modernized India-Belgium treaty signed in 2020s3.amazonaws

A Belgian court delivered a landmark ruling on Friday, approving the Mehul Choksi extradition to India in connection with the massive Rs 13,000 crore Punjab National Bank fraud case. The Court of Appeals in Antwerp validated the fugitive diamantaire’s April 2025 arrest by Belgian authorities, marking the first successful implementation of the India-Belgium extradition treaty signed in 2020. This decisive judicial action represents a significant milestone in India’s seven-year pursuit of the 66-year-old diamond trader, who fled the country in January 2018 shortly before the PNB scam was exposed.

The Belgian court’s determination that the accused posed a legitimate flight risk justified his continued detention, while confirming that all charges against him meet the dual criminality requirement under international law. The Mehul Choksi extradition approval demonstrates strengthening international cooperation in pursuing economic fugitives across borders.

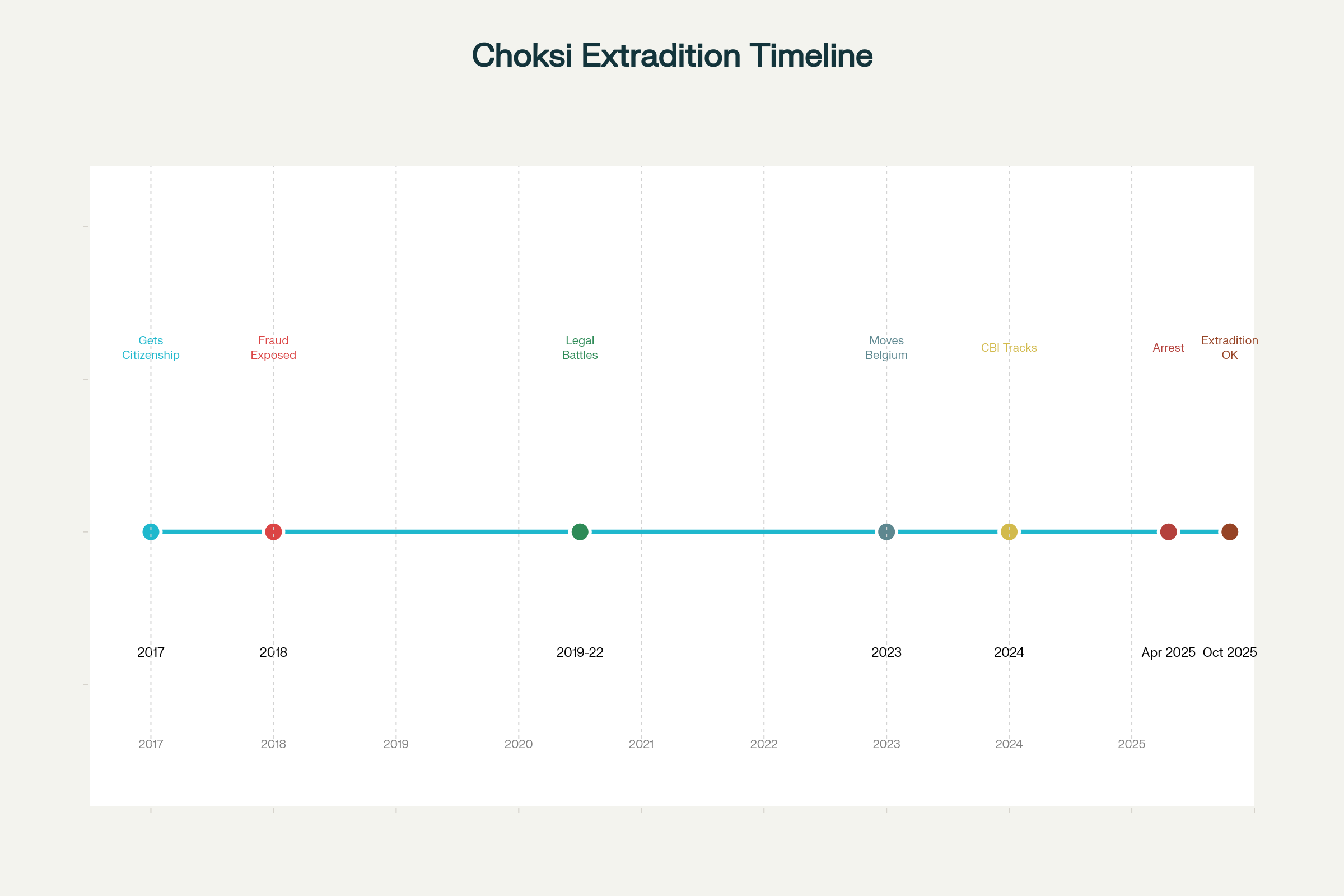

Timeline of Mehul Choksi Extradition Case: From PNB Fraud to Belgian Court Approval (2017-2025)

Legal Framework Supporting Extradition Decision

The Belgian court’s ruling establishing grounds for Mehul Choksi extradition rests on the robust legal foundation of the India-Belgium extradition treaty, which traces its origins to the 1901 British-Belgian agreement and was formally modernized in 2020. India’s request for Mehul Choksi extradition successfully demonstrated dual criminality by establishing that the accused’s alleged offenses under Indian Penal Code Sections 120B (criminal conspiracy), 201 (destruction of evidence), 409 (criminal breach of trust), 420 (cheating), and 477A (falsification of accounts), along with Prevention of Corruption Act provisions, constitute punishable crimes under Belgian law as well.

The Central Bureau of Investigation deployed teams to Belgium on three separate occasions, presenting comprehensive evidence packages and engaging a European private law firm to strengthen the case for Mehul Choksi extradition. Belgian federal prosecutors supported India’s position during court proceedings, while the defense team mounted unsuccessful opposition to the Mehul Choksi extradition request.

- India cited international conventions including UNTOC and UNCAC to reinforce legal arguments for Mehul Choksi extradition

- Belgian authorities validated all documentary evidence and witness statements provided by CBI teams supporting the case

- Court proceedings confirmed that the alleged financial crimes meet European legal standards for prosecution and extradition

PNB Fraud Case: Scale and Financial Impact Analysis

The Punjab National Bank fraud case underlying the Mehul Choksi extradition represents one of India’s most significant banking scandals, involving fraudulent Letters of Undertaking worth Rs 13,000 crore orchestrated between 2017-2018. Investigation revealed that PNB’s Brady House branch officials issued 165 LoUs and 58 Foreign Letters of Credit to the accused’s firms without proper authorization, cash margins, or entries in the bank’s central monitoring system.

These fraudulent instruments enabled the fugitive and his nephew Nirav Modi to secure credit from international banks including SBI Mauritius, Allahabad Bank Hong Kong, Axis Bank Hong Kong, Bank of India Antwerp, Canara Bank Manama, and SBI Frankfurt. When the scheme collapsed, PNB faced liability of Rs 6,344.97 crore specifically attributable to the operations, while the total fraud amount reached Rs 13,500 crore including Modi’s portion.

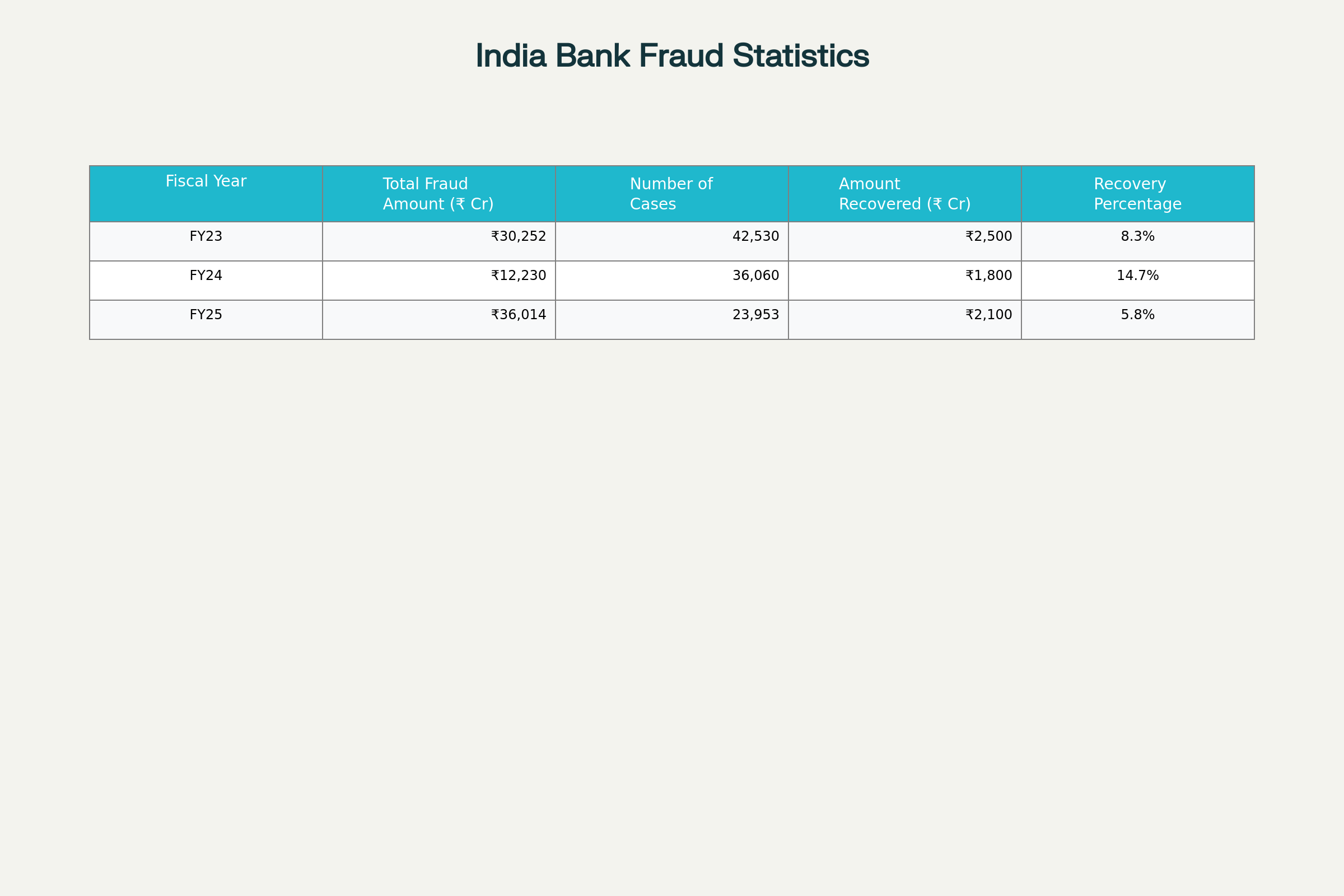

Asset recovery efforts by the Enforcement Directorate initially identified diamonds and properties worth Rs 5,000 crore, but laboratory analysis revealed most diamonds were counterfeit, reducing actual recoverable assets to approximately Rs 2,500 crore. The Mehul Choksi extradition success offers hope for enhanced asset recovery through direct legal proceedings in Indian courts.

India’s Bank Fraud Statistics: Three-Year Comparative Analysis (FY23-FY25)

International Pursuit and Custody Details

The fugitive’s international flight began in January 2018 when he departed India for the United States before ultimately settling in Antigua and Barbuda, where he had obtained citizenship in November 2017. The pursuit leading to the eventual Mehul Choksi extradition approval involved tracking his later relocation to Belgium in 2023, citing medical reasons and leveraging his wife’s Belgian nationality to establish residency. The CBI’s Global Operations Centre successfully tracked the fugitive to Antwerp in July 2024, leading to a formal request for Mehul Choksi extradition submitted in August 2024. Belgian authorities arrested him on April 11, 2025, and he has remained in custody for six months despite multiple unsuccessful bail applications preceding the Mehul Choksi extradition approval.

The Belgian judicial system consistently denied bail requests based on flight risk assessments, supported by evidence of previous attempts to evade legal proceedings across multiple jurisdictions. India provided detailed assurances regarding detention conditions to facilitate Mehul Choksi extradition, guaranteeing housing in Mumbai’s Arthur Road Jail Barrack No. 12 with facilities meeting European standards, including clean water, adequate food, medical access, newspapers, television, and recreational activities.

- Belgian courts rejected multiple bail applications citing substantial flight risk evidence before approving Mehul Choksi extradition

- CBI coordination with Interpol and European law enforcement agencies facilitated successful tracking leading to the arrest

- India’s diplomatic assurances address European human rights standards for prisoner treatment to ensure smooth extradition process

Appeal Process and Future Implications

The Belgian court’s Mehul Choksi extradition approval initiates a 15-day appeal window during which the defense team can challenge the decision before Belgium’s Supreme Court. Legal experts anticipate that while appeals are standard procedure in cases involving Mehul Choksi extradition, the comprehensive evidence presented by Indian authorities and the court’s detailed reasoning strengthen the likelihood of upholding the original ruling.

This case establishes important precedent as the first successful application of the modernized India-Belgium treaty for Mehul Choksi extradition, potentially streamlining future requests involving financial crimes. The ruling demonstrates increasing international cooperation in combating cross-border economic offenses, particularly as Belgium’s decision reinforces the principle that dual criminality requirements can be satisfied in complex financial fraud cases necessitating Mehul Choksi extradition.

If appeals fail or are not filed, the actual Mehul Choksi extradition will proceed under strict diplomatic protocols, with continued monitoring by both Belgian and Indian authorities throughout the process. The successful completion of Mehul Choksi extradition would enable Indian courts to proceed with criminal proceedings that have been pending since 2018, while also providing closure to thousands of investors affected by the PNB fraud case.

Closing Assessment

The Belgian court’s decision to approve Mehul Choksi extradition represents a watershed moment in India’s fight against economic fugitives and demonstrates the effectiveness of international legal cooperation in pursuing financial criminals across borders. This landmark ruling for Mehul Choksi extradition not only brings India closer to securing justice in the Rs 13,000 crore PNB fraud case but also establishes crucial precedent for future requests involving complex financial crimes.

The comprehensive legal framework supporting this decision for Mehul Choksi extradition, combined with Belgium’s recognition of dual criminality principles, strengthens India’s position in similar cases involving other economic offenders who have fled abroad. While the fugitive retains appeal rights, the thorough documentation and evidence presentation by Indian authorities, coupled with consistent judicial recognition of flight risk factors, suggest strong prospects for ultimate success in securing the Mehul Choksi extradition and his return to face trial.