Key Highlights:

- US-India trade flashpoints center on punishing 50% tariffs affecting $65.5 billion in Indian exports, with half the duties linked to Russian oil purchases creating unprecedented bilateral tensions

- Agricultural commodities worth $38.2 billion annually have become central US-India trade flashpoints as American farmers seek alternatives to lost Chinese markets

- Russian oil imports represent the most contentious US-India trade flashpoints, with Indian refiners now cutting purchases following October 2025 US sanctions on major suppliers

Opening Overview

The escalating US-India trade flashpoints have reached a critical juncture where agricultural commodities, energy policy, and bilateral tariffs are reshaping the foundation of economic relations between the world’s largest democracies. President Donald Trump’s administration has created unprecedented US-India trade flashpoints through steep 50% tariffs on most Indian exports, generating a $40 billion trade deficit challenge that threatens decades of economic cooperation. These US India trade flashpoints, particularly around corn, soybeans and Russian oil purchases, have transformed routine commercial relationships into high-stakes diplomatic negotiations.

The current US-India trade flashpoints extend far beyond immediate economic statistics, as both nations navigate complex geopolitical pressures while protecting domestic agricultural and energy interests. With Indian exports to America plummeting 37.5% over four months following tariff implementation, these US India trade flashpoints demonstrate how trade policy has become a primary tool of international relations. The resolution of these US India trade flashpoints will likely determine whether bilateral relations can evolve beyond transactional frameworks toward comprehensive strategic partnership.

The Tariff Escalation Creating New Trade Flashpoints

The systematic escalation of tariffs has created the most significant US-India trade flashpoints in bilateral history, beginning with a 10% baseline duty and culminating in the current punitive 50% rate. These US India trade flashpoints include a 25% reciprocal tariff announced in April 2025, followed by an additional 25% tariff effective August 27, 2025, specifically targeting India’s energy relationships with Russia.

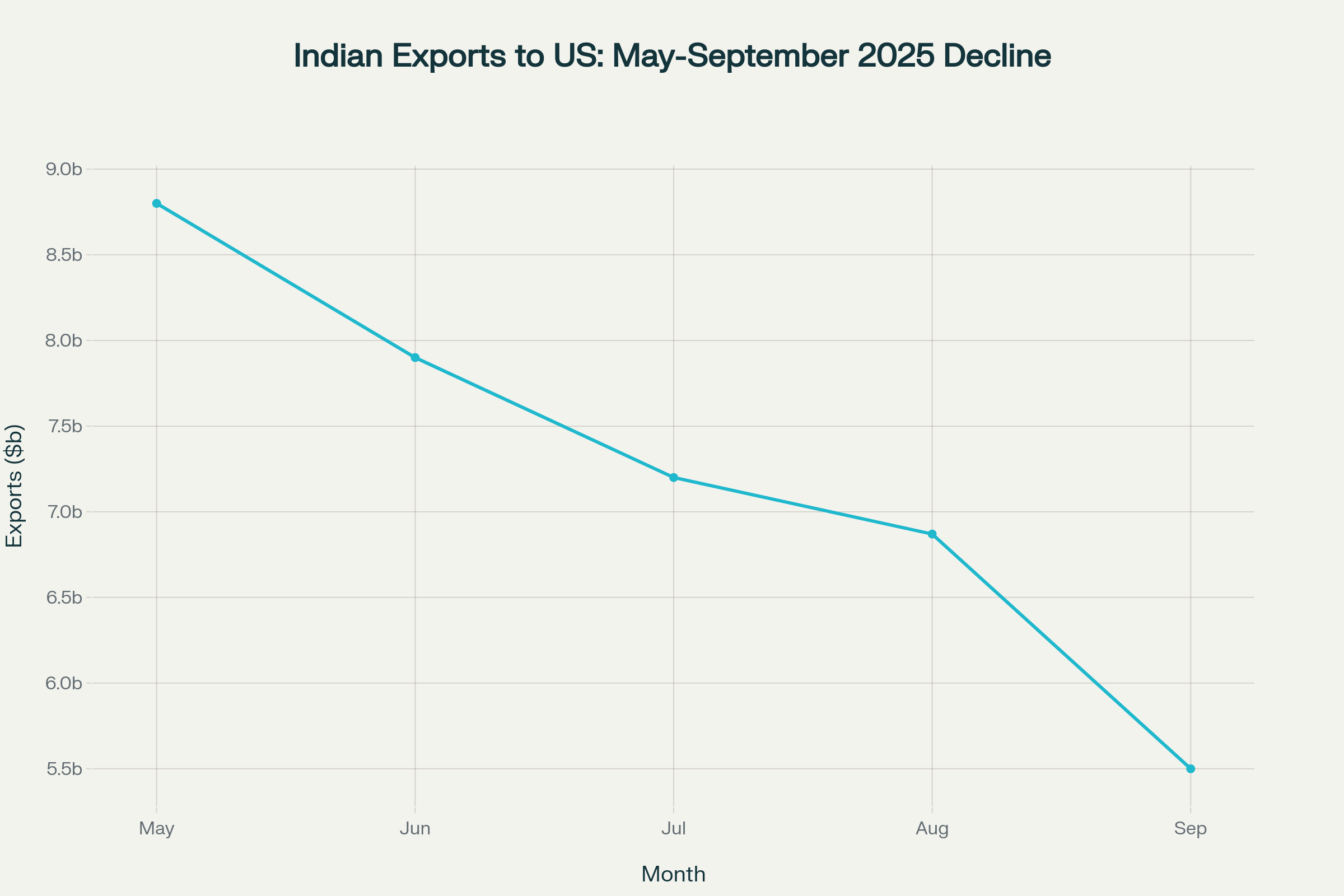

Indian exports to the US have declined sharply following the implementation of 50% tariffs, dropping from $8.8 billion in May to $5.5 billion in September 2025

The impact of these US-India trade flashpoints is evident in monthly export data:

- Indian exports declined from $8.8 billion in May 2025 to $5.5 billion in September 2025

- Textile, gems and jewelry sectors experienced the sharpest declines under new US-India trade flashpoints

- September 2025 marked the steepest monthly export fall, dropping 20.3% as US-India trade flashpoints intensified

Official US Census Bureau data reveals the magnitude of these US-India trade flashpoints, with US imports from India totaling $65.5 billion through July 2025 compared to just $25.5 billion in US exports to India. This $40 billion deficit represents the core of current US India trade flashpoints and highlights the urgency for negotiated solutions.

The tariff burden from these US-India trade flashpoints disproportionately affects key sectors including textiles, engineering goods, gems and jewelry, seafood, and leather products that collectively employ millions of workers. Strategic sectors remain partially exempt from the highest US-India trade flashpoints, notably pharmaceuticals where India supplies nearly 50% of the US generic drug market.

Agricultural Commodities Driving US-India Trade Flashpoints

The United States has strategically positioned agricultural exports at the center of US-India trade flashpoints, with corn and soybeans representing $38.17 billion in annual export value becoming primary negotiating tools. These agricultural US-India trade flashpoints reflect America’s need to find alternative markets after losing Chinese buyers to broader trade tensions.

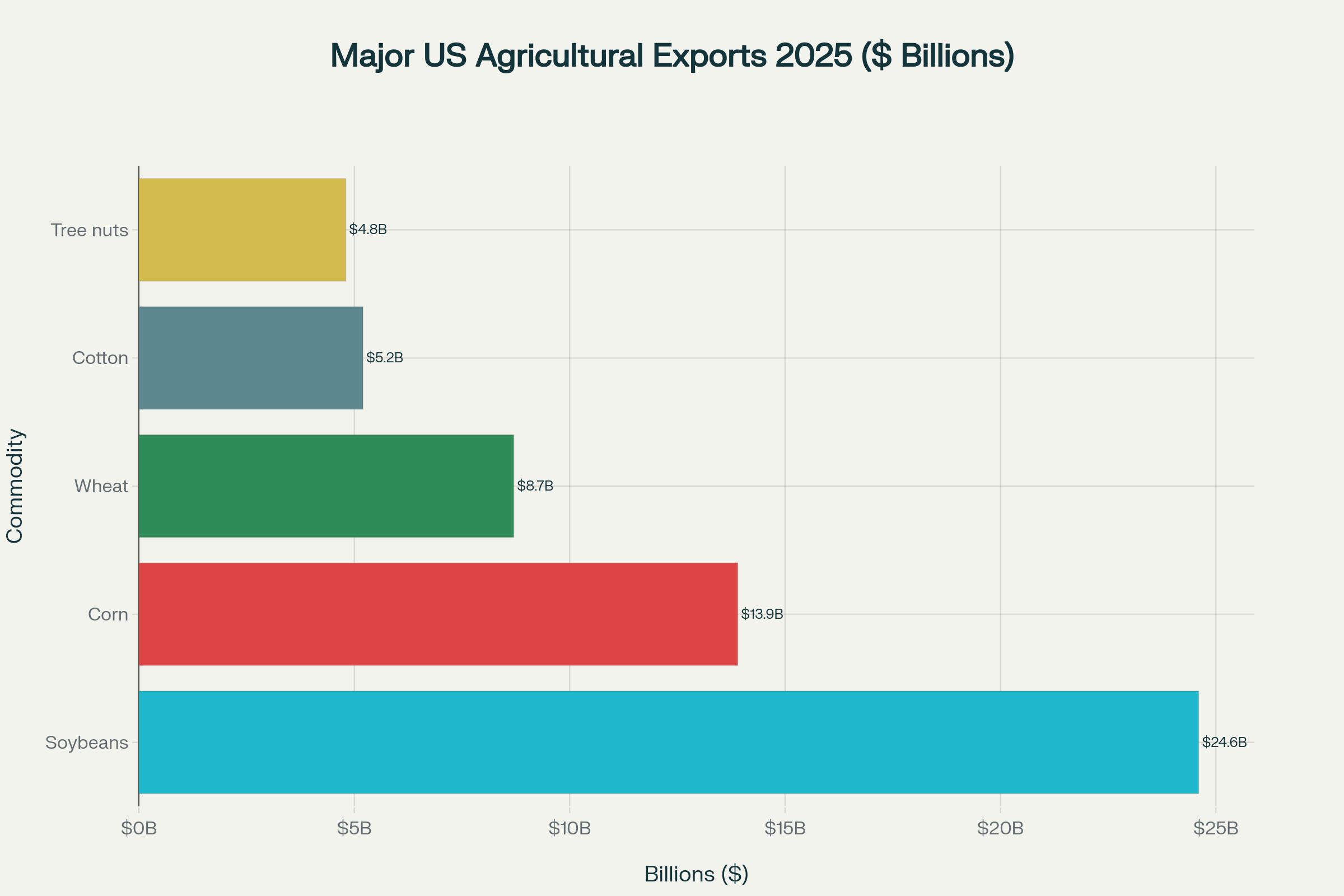

US agricultural exports are led by soybeans at $24.6 billion and corn at $13.9 billion, making these commodities central to trade negotiations with India

Key agricultural statistics driving US-India trade flashpoints include:

- American soybeans constitute 14% of total US agricultural exports at $24.6 billion annually

- US corn accounts for 7.9% at $13.9 billion, creating pressure for new market access

- China’s reduced soybean imports from $17.9 billion in 2022 to $12.8 billion in 2024 intensified US-India trade flashpoints

The agricultural dimensions of US-India trade flashpoints reflect broader geopolitical realignments, as trade tensions between Washington and Beijing have made US agricultural products too expensive for Chinese buyers. US soybean farmers facing surplus stocks and reduced market access view India’s vast agricultural market as essential for resolving these US India trade flashpoints.

India’s regulatory framework creates significant obstacles within these US-India trade flashpoints. Current Indian rules prohibiting ethanol production from imported grains and banning genetically modified food crops directly conflict with US agricultural objectives in resolving US India trade flashpoints. The Trump administration argues that addressing these US India trade flashpoints requires India to allow imported corn exclusively for ethanol blending, not direct agricultural use.

| Commodity | US Export Value (2025) | India Import Potential | Current Barriers |

|---|---|---|---|

| Soybeans | $24.6 billion | High demand for animal feed | Domestic producer opposition |

| Corn | $13.9 billion | Growing ethanol program needs | GM crop restrictions |

| Soymeal | $8.2 billion | World’s largest cattle herd | Surplus domestic stocks |

| Dairy Products | $7.8 billion | Large consumer market | Religious and cultural sensitivities |

Russian Oil: The Geopolitical Core of Trade Flashpoints

Russian energy relationships have become the most contentious element within US-India trade flashpoints. Since 2022, India’s emergence as a major buyer of discounted Russian crude oil has created persistent US India trade flashpoints while Western nations imposed comprehensive sanctions on Moscow.

Critical elements of these energy-related US-India trade flashpoints include:

- India imported Russian oil worth billions at discounted rates, citing energy security for 1.4 billion citizens

- US sanctions on Russian oil giants Rosneft and Lukoil, announced October 2025, supply over 60% of India’s crude imports

- Indian refiners are now reviewing Russian contracts, potentially resolving key US-India trade flashpoints

President Trump has repeatedly claimed that Prime Minister Modi assured him of reducing Russian oil purchases to address US-India trade flashpoints. However, India’s Ministry of External Affairs maintains that energy procurement decisions are based on national interests and market conditions, without explicitly confirming commitments that would resolve these US India trade flashpoints.

The October 2025 US sanctions on major Russian oil producers have created practical imperatives for Indian refiners within these US-India trade flashpoints. Major Indian companies, including Reliance Industries, have begun purchasing millions of barrels from Middle Eastern and US suppliers, potentially removing significant obstacles from US India trade flashpoints. This shift could eliminate half of the current 50% tariff burden explicitly linked to punishing Russian oil purchases within US India trade flashpoints.

Negotiating Solutions to Trade Flashpoints

Trade and industry sources suggest that resolving current US-India trade flashpoints could reduce tariffs on Indian exports from 50% to 15-16% through a comprehensive agreement. The framework for addressing these US India trade flashpoints centers on energy diversification and agricultural market access, with both sides making strategic concessions.

Key negotiating positions within US-India trade flashpoints include:

- US negotiators pressing for immediate market access for American corn, soybeans, and soymeal to resolve agricultural US-India trade flashpoints

- India considering limited imports while maintaining small farmer protections within US-India trade flashpoints

- Agreement success hinges on India’s willingness to modify ethanol regulations addressing US-India trade flashpoints

Indian agricultural stakeholders have expressed strong opposition to unrestricted US imports, citing potential disruption to domestic producers within these US-India trade flashpoints. Political sensitivity around US India trade flashpoints is heightened by upcoming Bihar assembly elections, where farmer sentiment could influence electoral outcomes in this major corn-producing state.

The negotiation dynamics within US-India trade flashpoints reflect broader strategic calculations beyond immediate trade benefits. For America, resolving agricultural US India trade flashpoints addresses domestic political pressures while advancing geopolitical goals of reducing India’s Russian energy dependence. For India, resolving US India trade flashpoints could restore export competitiveness while maintaining energy procurement flexibility.

Final Perspective

The convergence of agricultural economics, energy geopolitics, and trade policy has transformed US-India trade flashpoints into defining challenges for bilateral relations that extend far beyond traditional commercial frameworks. Current US India trade flashpoints, while economically disruptive, have forced comprehensive reassessment of bilateral priorities that could establish more strategic partnerships.

Successful resolution of these US-India trade flashpoints around corn, soybeans and Russian oil will likely determine whether bilateral relations can transcend current tensions toward deeper economic cooperation. These US India trade flashpoints serve as a crucial test of both nations’ ability to balance domestic political pressures with long-term strategic interests in an increasingly complex global environment. The coming months will demonstrate whether US India trade flashpoints become catalysts for strengthened partnership or further deterioration between two crucial democratic powers.