Key Highlights

Lakshmi Mittal UK exit underscores shifting fortunes for high-net-worth residents amid the removal of non-dom tax status and expanded inheritance tax rules.

Official data show a drop to 73,700 non-dom taxpayers in 2024, but combined non-dom and deemed-dom tax receipts reached £12.5 billion, highlighting the stakes for the Treasury and wealthy individuals.

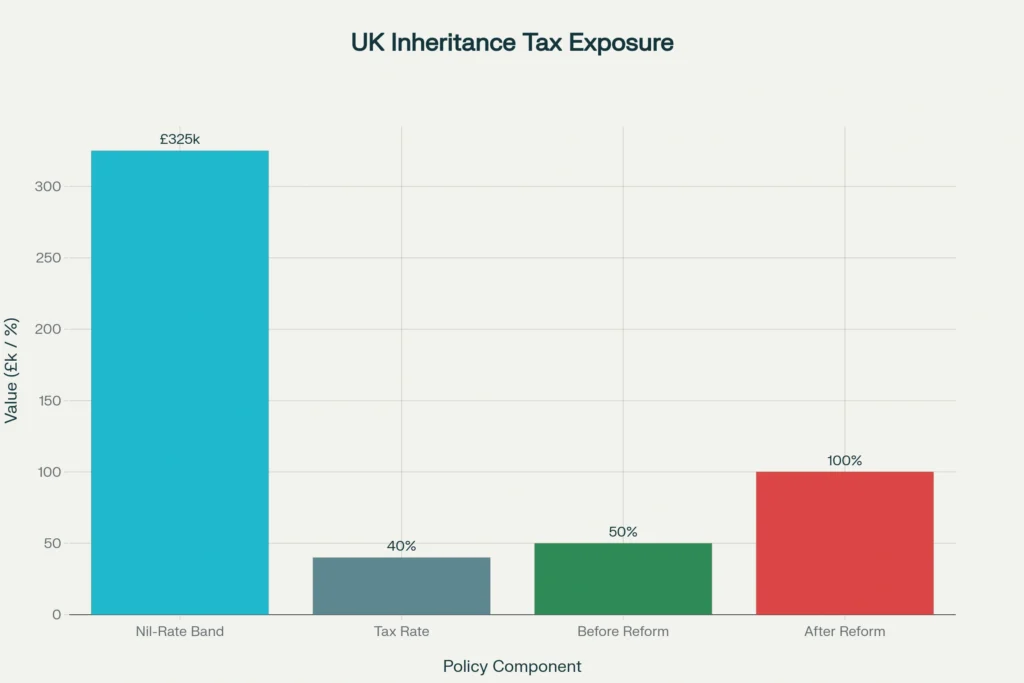

With the current UK inheritance tax threshold at £325,000 and a 40 percent rate on estates above that level, affluent residents face sharply increased estate-tax exposure.

Opening Overview

The move by industrialist Lakshmi Mittal UK to exit the country — often referred to as the “Lakshmi Mittal UK exit” — resonates beyond a personal decision. Amid sweeping fiscal reforms introduced by the government, this exit marks a watershed in how Britain treats global wealth. The abolition of the “non-dom” tax status and the tightening of estate tax rules have transformed the UK from a haven for global-asset holders into a high-tax jurisdiction for the affluent.

As top-tier wealth opts for relocation, the implications for the UK economy, the property market, and future tax revenue are far-reaching. The narrative shifts from London as a magnet for international capital to a nation grappling with the consequences of its own reforms. Lakshmi Mittal UK exit thus becomes a symbol of a broader reordering of incentives for global wealth and residency.

With steady increases in tax receipts from non-domiciled residents prior to reforms, the decision to scrap the non-dom status signals a decisive break in policy. Now, estates and foreign income face scrutiny under new inheritance tax and remittance rules. For individuals like Mittal, change is no longer incremental but existential. This article examines how fiscal policy reshaped the playing field, the data behind the shift, and what it means for high-net-worth individuals, the Treasury, and the United Kingdom’s global positioning.

How Non-Dom Abolition Reshaped Residency Decisions

In the tax year ending April 2024, there were 73,700 individuals claiming non-dom status, down slightly from previous years.

Combined liabilities applying to non-dom and deemed-dom taxpayers reached £12.5 billion in 2023–24.

The non-dom status had long allowed UK residents whose “domicile” was abroad to pay taxes only on UK-sourced income and gains, while foreign income remained outside the UK tax net unless remitted. This regime made the UK a top destination for global elites. However, Lakshmi Mittal UK with the status abolished from April 2025, those with foreign income or global estates now face UK taxation on worldwide income and assets, regardless of whether money is brought into the country.

The data underscores the scale that non-doms once represented, with tens of thousands of taxpayers and billions in annual liability. The drop to 73,700 in 2024 suggests a stabilising but smaller pool under the old rules. For many, the calculus changed abruptly. With the end of the non-dom regime, avoiding UK tax now demands either severing UK residence or restructuring assets. For a high-net-worth individual with global capital such as Mittal, relocation becomes financially rational.

In that context, Lakshmi Mittal UK exit is not about one person — it reflects a broader pattern where fiscal policy intersects residency, wealth distribution, and global mobility.

Inheritance Tax: The New Frontier of Estate Exposure

The tax-free “nil-rate band” remains at £325,000 per individual.

Estates above that threshold are generally taxed at 40 percent, though a reduced rate applies if part of the estate is directed toward charitable causes.

For UK residents with global properties and overseas assets, the removal of non-dom status means these assets now fall under UK estate tax rules. This is a major shift for wealth holders with cross-border portfolios.

Prior to reforms, many wealthy UK residents could shelter overseas assets from inheritance tax by claiming non-dom status and structuring holdings offshore. The abolition of that status removes that shield. Now, global estates — including overseas property, investments, and trusts — may be taxed as part of UK inheritance tax exposure.

For someone like Lakshmi Mittal UK — with mansion-sized homes in London, assets worldwide, and known property elsewhere — this represents a seismic change. Under current inheritance tax rules, unless estate planning and domicile shifting occur, substantial portions of global estate could be subject to a 40 percent levy above £325,000.

The policy shift places the burden squarely on high-net-worth individuals: restructure and possibly relocate, or stay but face heavy estate-tax exposure. For many, like Lakshmi Mittal UK as recent exits suggest, leaving becomes the more fiscally sound option.

Broader Impact: Capital Flight, Wealth Migration, and the UK Economy

The non-dom taxpayer base has been in decline, and experts warn that further shrinkage could intensify if wealthy residents continue to leave.

While the government expects increased revenue from broader tax coverage, the long-term loss of capital, foreign investment, and high-spending residents may offset these gains.

The UK’s strategy appears driven by a desire to broaden the tax base, ensure fairness, and capture global wealth, but it comes with trade-offs. Wealth migration is not new; when tax regimes shift, capital flows follow. Individuals with the means to relocate — international businessmen, global entrepreneurs, and mobile asset holders — may take their investments, spending power, and tax contributions to alternative jurisdictions.

For property markets in cities like London, a wave of exits could mean declining demand for ultra-luxury real estate, potentially softening prices or slowing growth. High-end service sectors such as luxury retail, concierge services, private schooling, and exclusive clubs could feel the strain as wealthy clients depart.

On the other hand, the Treasury may initially benefit from expanded taxable bases. Yet sustaining such gains depends on whether wealthy individuals remain UK residents. If exits accelerate, the long-term outlook becomes uncertain.

Lakshmi Mittal UK exit may be the first of many, especially among individuals whose wealth is globally diversified and whose domicile decisions are responsive to tax policy changes.

What This Means for High-Net-Worth Individuals and Global Mobility

For global elites, domicile and residency decisions now carry far greater fiscal weight. The era when non-dom status offered a reliable tax shelter is over.

Countries offering stable low-tax regimes, tax-free estates, or favourable residency rules become more attractive alternatives.

If individuals hold multi-jurisdictional assets, the UK’s new regime forces a comprehensive reevaluation. Estate planning becomes more complex, and offshore structures no longer provide the same protection against UK tax exposure. For many, full relocation becomes the most effective — and sometimes only — way to shield wealth from UK tax.

Other nations may capitalise on this shift by intensifying efforts to attract mobile wealth. Real estate markets, tax advisers, and global finance hubs could see increased demand. Financial domicile may now be as significant as citizenship itself.

For decision-makers, businesses, and high-net-worth individuals, the message is clear: tied wealth is more fragile than before. Lakshmi Mittal UK exit demonstrates that reality vividly.

Closing Assessment

The decision by Lakshmi Mittal UK to leave the United Kingdom transcends personal preference. As the “Lakshmi Mittal UK exit,” it marks a definitive turning point in how the world’s richest individuals view Britain — not merely as a financial centre but as a jurisdiction where tax policy directly governs global mobility. By abolishing non-dom status and extending estate tax exposure, the UK government has signalled that the wealthiest residents must now reckon with full global taxation.

Although recent figures indicate robust tax receipts from non-dom taxpayers, the long-term consequences of capital flight, wealth migration, and diminished investment remain uncertain. There is a growing paradox: expanded tax coverage may come at the cost of fewer wealthy taxpayers contributing to the system.

For global wealth holders, the rules have changed. For the UK government, the coming years will reveal whether the trade-off between revenue and competitiveness has been balanced effectively. Lakshmi Mittal UK exit stands not only as a symbol of personal repositioning but as a cautionary lesson for any nation attempting to tax globally mobile capital.