Key Highlights:

- Air India 10000 crore aid sought from Tata Sons and Singapore Airlines for systems upgrade and engineering capabilities

- The airline faces ₹4,000 crore losses due to Pakistan airspace closure following military tensions

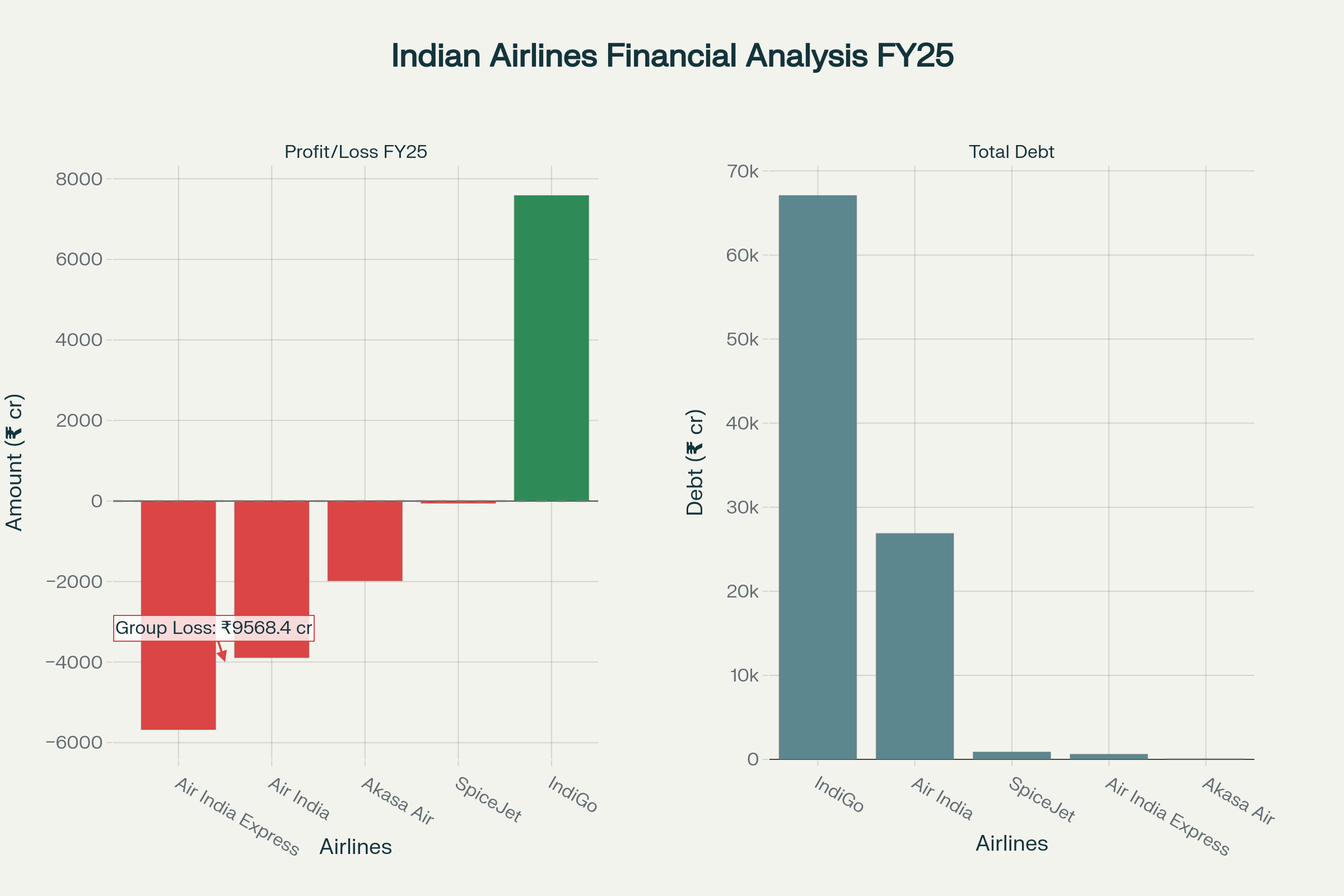

- Combined losses of Air India and Air India Express reached ₹9,568.4 crore in FY25

Crisis-Driven Funding Request Emerges

The Air India 10000 crore aid request emerges from a confluence of challenges that have destabilized the carrier’s operations throughout 2025. The most devastating blow occurred on June 12, 2025, when Air India Flight AI-171, a Boeing 787 Dreamliner bound for London, crashed into a college building shortly after takeoff from Ahmedabad, killing 241 passengers with only one survivor.

This tragic incident has fundamentally altered Air India’s operational landscape, with the airline now seeking the Air India 10000 crore aid to fund comprehensive safety system upgrades, modernize maintenance facilities, and strengthen engineering oversight. The requested funding specifically targets upgrading operational systems, services, and establishing robust in-house engineering and maintenance departments rather than relying heavily on third-party contractors.

Pakistan’s closure of its airspace to Indian carriers following the Pahalgam terror attack in April has forced Air India to reroute international flights to Europe and North America, resulting in additional operational costs of ₹4,000 crore. These longer routes have increased flight durations by 60-90 minutes on average, significantly impacting fuel consumption, crew costs, and overall profitability. The Air India 10000 crore aid becomes essential to offset these massive losses and maintain operational viability.

Aviation industry projections indicate that Indian airlines will face collective losses of ₹95-105 billion in FY2026, compared to ₹55 billion in FY2025, primarily due to slower traffic growth and rising operational costs. The Air India 10000 crore aid request must be viewed within this broader industry context of financial stress.

Financial Performance and Ownership Structure

Air India‘s financial performance in FY25 reflects the magnitude of challenges facing the carrier, with the airline reporting standalone losses of ₹3,890.2 crore while its subsidiary Air India Express posted even larger losses of ₹5,678.2 crore. The combined pre-tax losses of both entities reached ₹9,568.4 crore, according to official data presented in Parliament by the Ministry of Civil Aviation. This deteriorating financial position necessitates the Air India 10000 crore aid to stabilize operations and continue transformation efforts.

Air India Financial Performance and Industry Comparison (FY25)

The current ownership structure places Tata Group as the majority stakeholder with a 74.9% stake, while Singapore Airlines holds the remaining 25.1% following the November 2024 merger of Vistara into Air India. This partnership arrangement means any Air India 10000 crore aid provided will be proportional to ownership stakes, with decisions pending on whether funding will take the form of interest-free loans or equity infusion.

Despite the current Air India 10000 crore aid request, both parent companies have already demonstrated substantial financial commitment to the airline’s transformation. In FY25 alone, Tata Sons and Singapore Airlines jointly invested ₹9,558 crore in the airline, with Tata Sons contributing ₹3,224.82 crore and Singapore Airlines investing ₹6,333.18 crore through preferential share allotments. Additionally, a significant ₹4,306 crore infusion occurred in March 2025, highlighting the ongoing capital requirements of the airline’s ambitious transformation program.

Air India’s debt burden currently stands at ₹26,879.6 crore, representing a substantial financial obligation that impacts the carrier’s operational flexibility and strategic planning. This debt level, while significant, remains lower than industry leader IndiGo’s debt of ₹67,088.4 crore, though IndiGo reported substantial profits of ₹7,587.5 crore in FY25. The Air India 10000 crore aid will help address this debt burden and improve the airline’s financial position.

Transformation Progress and Strategic Initiatives

Air India has achieved significant milestones in its transformation program despite financial challenges, completing the retrofit of 27 legacy A320neo aircraft with modern three-class cabin configurations in October 2025. This retrofit program, launched in September 2024 and completed within 13 months, represents part of the broader $400 million fleet modernization initiative. The Air India 10000 crore aid will accelerate similar transformation initiatives across the airline’s operations.

The airline now operates over 104 A320 Family aircraft featuring new or upgraded interiors, servicing 3,024 weekly flights across 82 domestic and short-haul international routes. All flights on busiest domestic routes including Delhi-Mumbai, Delhi-Hyderabad, Delhi-Bengaluru, and Mumbai-Chennai now feature upgraded aircraft, demonstrating tangible progress in service enhancement.

Air India’s five-year transformation plan, known as Vihaan.AI, includes ambitious fleet expansion targets with plans to add more than 90 aircraft by 2025, including 56 planes from mega-orders with Airbus and Boeing. The airline has placed orders for 470 aircraft including 250 Airbus planes and 220 Boeing aircraft, representing one of the largest procurement programs in Indian aviation history. The Air India 10000 crore aid will support this ambitious fleet expansion and modernization strategy.

From early 2027, Air India plans to retrofit 13 legacy Boeing 777 aircraft, aiming for program completion by October 2028. The comprehensive transformation focuses on dramatically growing network and fleet, developing revamped customer propositions, improving reliability and on-time performance while taking leadership positions in technology, sustainability, and innovation.

Industry Comparison and Market Position

The Air India 10000 crore aid request occurs within a challenging industry landscape where financial performance varies dramatically between carriers. While Air India and Air India Express reported combined losses exceeding ₹9,500 crore, IndiGo’s strong profitability of ₹7,587.5 crore demonstrates that operational success remains achievable in the Indian market.

Recent financial analysis reveals IndiGo’s remarkable recovery, transitioning from substantial losses to profitability with operating margins improving from -0.09% to 22.34%. By contrast, SpiceJet consistently reported negative margins, indicating persistent challenges similar to Air India’s current situation. The Air India 10000 crore aid represents a crucial investment to achieve similar turnaround success.

| Financial Performance Comparison (FY25) | Air India Group | IndiGo | Other Airlines |

|---|---|---|---|

| Net Loss/Profit (₹ Crore) | -9,568.4 | +7,587.5 | Mixed Results |

| Debt Burden (₹ Crore) | 27,497.1 | 67,088.4 | Varying Levels |

| Transformation Investment | ₹9,558 | Organic Growth | Limited |

| Market Position | Recovery Phase | Market Leader | Struggling |

Singapore Airlines has publicly reaffirmed its commitment to supporting Air India’s transformation program, stating it will continue providing expertise and operational support as a significant minority shareholder. This declaration came specifically in response to reports about the Air India 10000 crore aid request, indicating Singapore Airlines’ recognition of the airline’s strategic importance despite current challenges.

Strategic Implications and Future Outlook

The Air India 10000 crore aid represents more than emergency funding, it constitutes a strategic investment in India’s aviation future and the airline’s positioning within the rapidly growing domestic market. The funding will specifically support development of in-house engineering capabilities, reducing dependence on external service providers and potentially improving operational efficiency and cost management.

Industry projections indicate continued challenges, with domestic air passenger traffic declining 1.4% in September 2025 compared to the previous year, dropping to 128.5 lakh passengers. Rising aviation turbine fuel costs, which account for 30-40% of operational expenses, continue pressuring airline profitability, with prices averaging ₹95,181 per kilolitre in FY2025. The Air India 10000 crore aid becomes crucial to weather these industry-wide headwinds.

The airline’s transformation efforts face additional complexity from supply chain disruptions affecting aircraft deliveries, potentially impacting fleet modernization plans by 15-25% in 2025. These delays, combined with rupee depreciation and ongoing airspace restrictions, create a challenging operating environment that extends timelines for achieving profitability targets. The Air India 10000 crore aid provides essential buffer against these uncertainties.

Closing Assessment

The Air India 10000 crore aid request from Tata Sons and Singapore Airlines represents a pivotal moment in India’s aviation history, underscoring the substantial financial commitment required to transform the national carrier into a competitive international airline. The combination of tragic safety incidents, geopolitical disruptions, and operational challenges has created an unprecedented crisis demanding comprehensive system overhauls and strategic investments.

The airline’s current financial metrics, including ₹26,879.6 crore in debt and ₹9,568.4 crore in combined losses for FY25, highlight the transformation challenge’s magnitude. However, the demonstrated commitment of both parent companies, evidenced by their ₹9,558 crore investment in FY25 and successful completion of fleet modernization programs, suggests confidence in Air India’s strategic importance and long-term viability.

Success in securing the Air India 10000 crore aid will likely determine the airline’s ability to accelerate transformation timelines, establish operational capabilities necessary for effective competition in India’s dynamic aviation market, and achieve sustainable profitability targets. The outcome of these funding discussions will significantly influence Air India’s trajectory toward operational excellence, safety leadership, and financial sustainability in the challenging years ahead.