Key Highlights:

- The CBDT ITR filing deadline for Assessment Year 2025-26 has been extended from October 31 to December 10, 2025, providing 40 additional days for compliance

- Tax audit report submission deadline moved from October 31 to November 10, 2025, ensuring sequential completion of audit and filing requirements

- Extension covers companies, partnership firms, LLPs, and proprietorships requiring mandatory audits, following multiple High Court directives across various states

Last-Minute Relief Announced Before Deadline

The Central Board of Direct Taxes delivered crucial last-minute relief by announcing the CBDT ITR filing deadline extension on October 29, 2025, just two days before the original October 31 deadline. This decision extends the CBDT ITR filing deadline for Assessment Year 2025-26 from October 31 to December 10, 2025, affecting thousands of companies and taxpayers whose accounts require mandatory auditing under the Income Tax Act.

The Central Board of Direct Taxes (CBDT) has decided to extend the due date of furnishing of Return of Income under sub-Section (1) of Section 139 of the Act for the Assessment Year 2025-26, which is 31st October 2025 in the case of assessees referred in clause (a) of Explanation… pic.twitter.com/w7Hl94Y9Ns

— Income Tax India (@IncomeTaxIndia) October 29, 2025

The announcement came following persistent demands from tax professionals, industry associations, and direct orders from multiple High Courts including Gujarat, Punjab & Haryana, and Himachal Pradesh High Courts. The CBDT ITR filing deadline extension addresses genuine operational challenges faced by businesses during the monsoon season, including floods, natural disasters, and disrupted accounting operations across several Indian states.

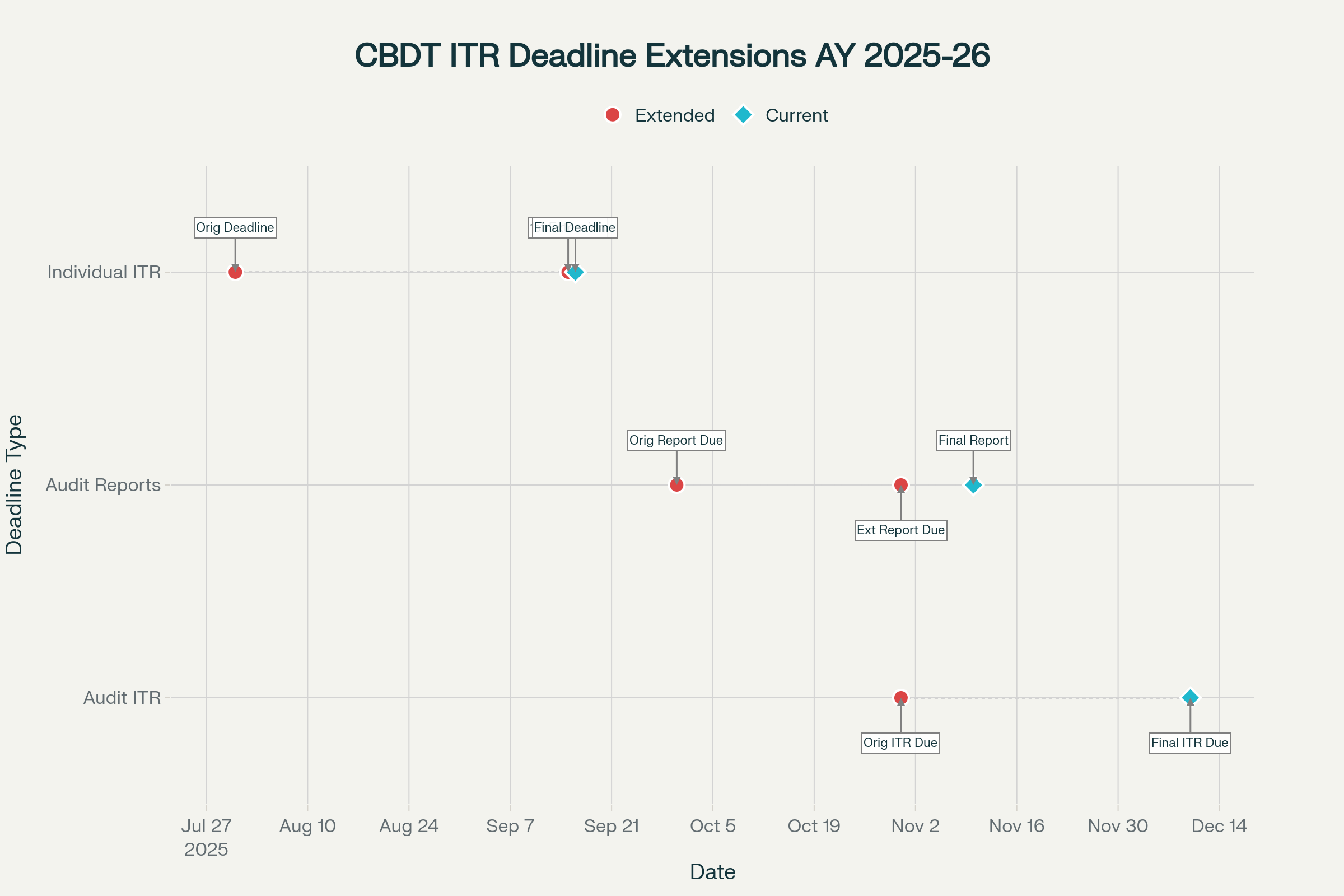

CBDT ITR Filing Deadline Extensions Timeline for Assessment Year 2025-26

High Court Pressure Forces Government Action

Multiple High Courts had criticized the Central Board of Direct Taxes for delaying the CBDT ITR filing deadline extension and issued specific directives to extend compliance deadlines. The Gujarat High Court had earlier directed the CBDT to issue a circular under Section 119 of the Income Tax Act extending the CBDT ITR filing deadline to November 30, 2025, for audit cases. Following suit, the Punjab & Haryana High Court and Himachal Pradesh High Court issued similar orders on October 29, 2025, the same day the Central Board of Direct Taxes announced the extension.

These judicial interventions emphasized that there should be at least a one-month gap between tax audit report filing and the CBDT ITR filing deadline to ensure proper compliance procedures. The courts observed that the compressed timeline between audit completion and return filing was causing undue hardship to taxpayers and their professional advisors.

Comprehensive Deadline Restructuring

The CBDT ITR filing deadline extension encompasses a complete restructuring of audit-related compliance timelines for Assessment Year 2025-26. The specified date for furnishing audit reports under various provisions of the Income Tax Act has been extended from October 31 to November 10, 2025, providing adequate time for audit completion before the CBDT ITR filing deadline. This sequential approach ensures that taxpayers can complete their mandatory audit requirements and subsequently file their income tax returns by the extended CBDT ITR filing deadline of December 10, 2025.

The original audit report deadline was September 30, 2025, which had been previously extended to October 31, 2025, through Circular No. 14/2025 dated September 25, 2025. This latest extension represents the second major revision to audit timelines, demonstrating the government’s acknowledgment of practical compliance challenges during the current assessment year.

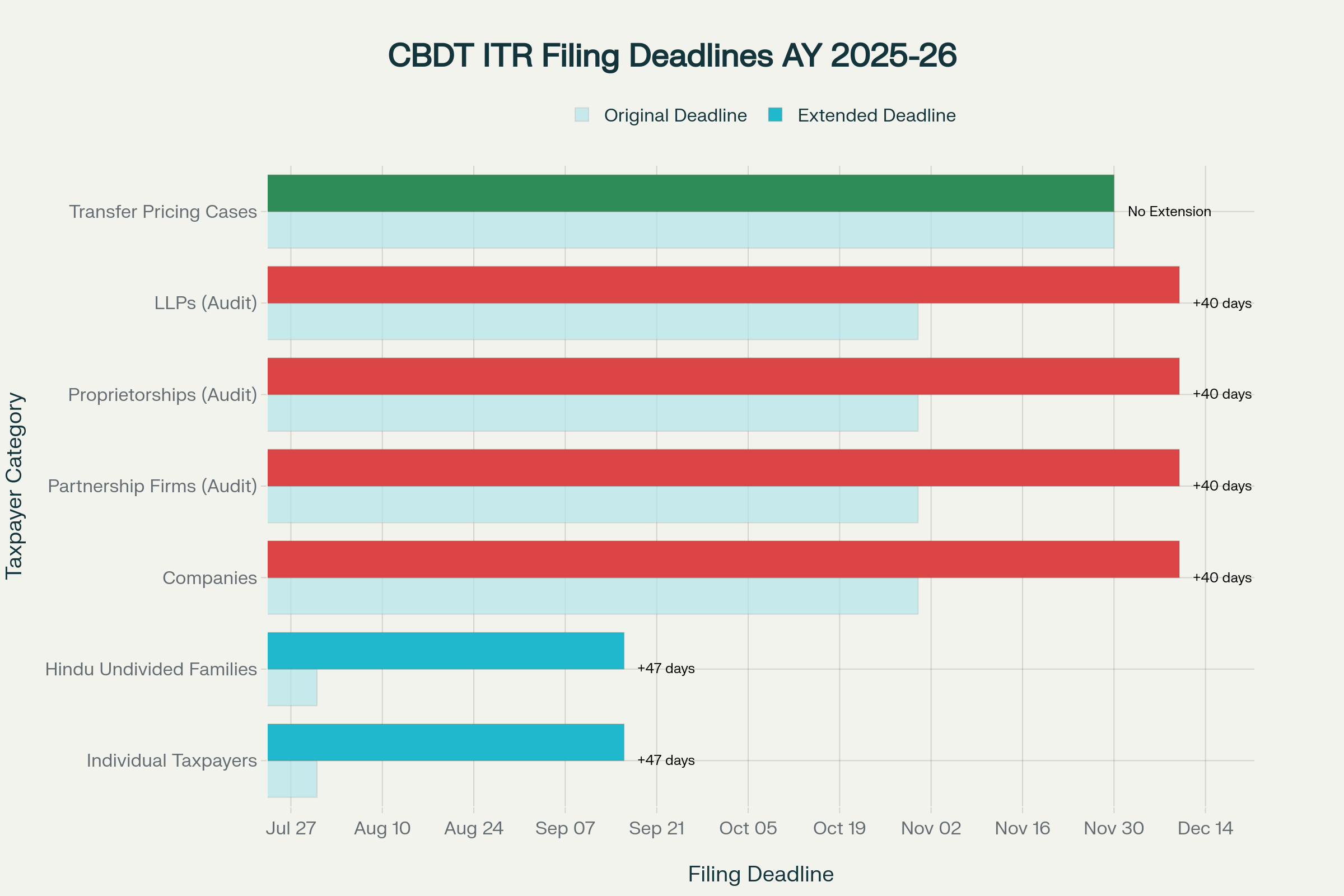

CBDT ITR Filing Deadline by Taxpayer Category – AY 2025-26

Targeted Coverage and Beneficiaries

The CBDT ITR filing deadline extension specifically applies to assessees covered under clause (a) of Explanation 2 to sub-section (1) of Section 139 of the Income Tax Act, 1961. Companies, partnership firms, limited liability partnerships, and proprietorships whose accounts are mandatorily subject to audit under the Income Tax Act or any other applicable law benefit from this CBDT ITR filing deadline extension. Tax experts have noted that the official notification appears to have missed granting relief to taxpayers covered under transfer pricing provisions, who typically face a November 30 deadline for ITR filing.

Individual taxpayers and Hindu Undivided Families had their CBDT ITR filing deadline extended earlier from July 31 to September 15, and subsequently to September 16, 2025, ensuring comprehensive relief across all taxpayer categories. The current extension ensures that audit cases, which face more complex compliance requirements, receive appropriate time allocation without compromising on the quality of financial reporting and tax compliance.

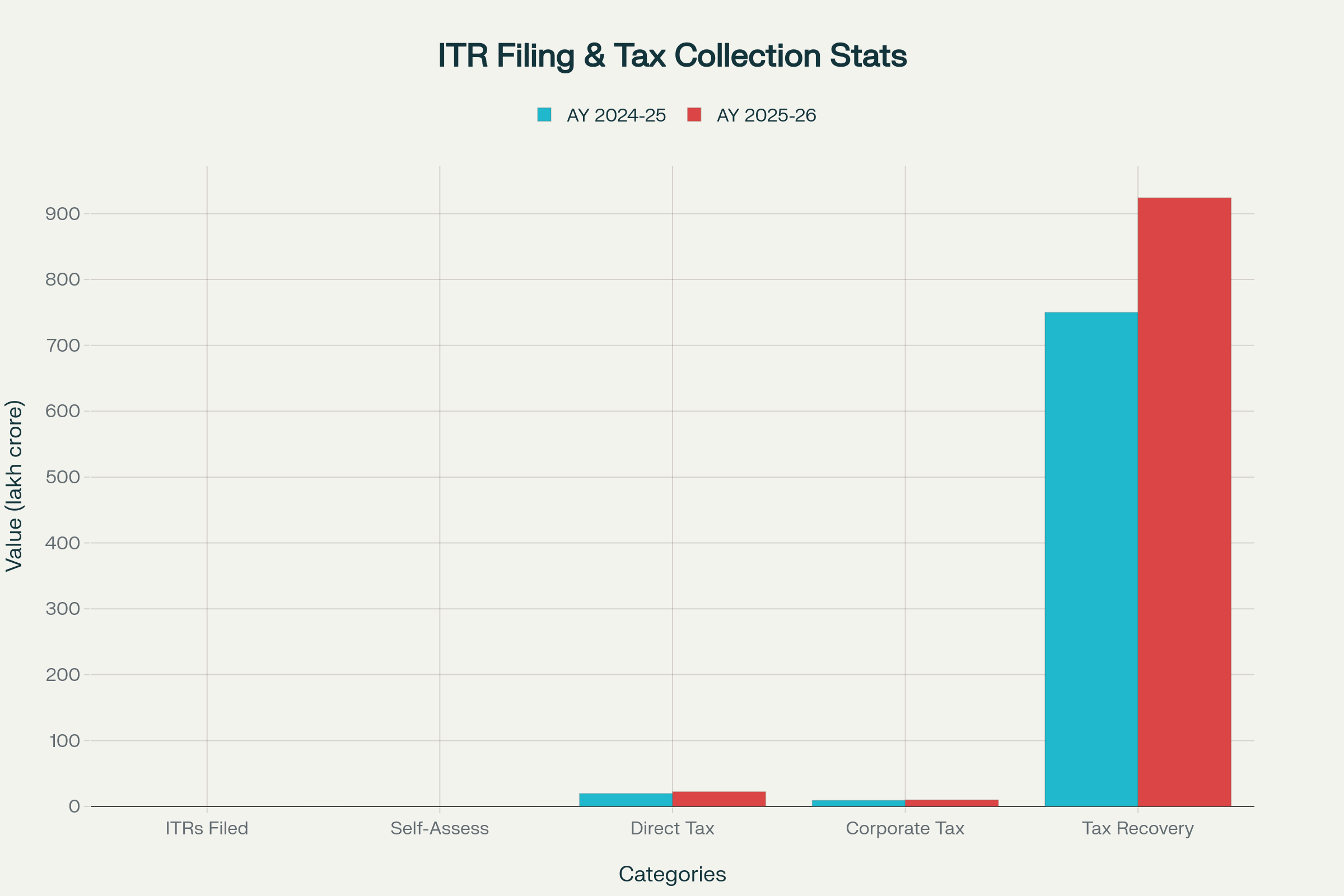

Strong Compliance Performance Despite Extensions

The multiple CBDT ITR filing deadline extensions have not negatively impacted overall tax compliance, with robust filing statistics demonstrating taxpayer responsiveness across categories. By September 16, 2025, over 7.54 crore Income Tax Returns had been filed for Assessment Year 2025-26, with 1.28 crore taxpayers paying self-assessment tax, indicating healthy voluntary compliance. This represents a positive trend compared to Assessment Year 2024-25 when 7.28 crore returns were filed by the original July 31 deadline. The CBDT ITR filing deadline extension for audit cases is expected to further boost these compliance numbers as companies and audited taxpayers complete their filings by December 10, 2025.

Direct tax collections have shown remarkable growth, with net collections reaching ₹22.26 lakh crore for FY 2024-25 compared to ₹19.60 lakh crore in the previous year, reflecting a 13.57% increase despite deadline extensions. The Central Board of Direct Taxes has also demonstrated efficiency in tax recovery operations, collecting ₹92,400 crore in outstanding tax dues for FY 2024-25, representing a 23.2% increase from the previous fiscal year.

ITR Filing and Tax Collection Statistics: AY 2024-25 vs AY 2025-26

Final Assessment

The CBDT ITR filing deadline extension to December 10, 2025, represents a pragmatic balance between maintaining tax compliance standards and acknowledging genuine operational challenges faced by businesses. This decision, combined with the November 10 audit report deadline, provides a logical sequence for completing statutory obligations while ensuring adequate time for quality compliance work. The extension demonstrates the government’s responsiveness to judicial directives and industry concerns while maintaining robust tax collection performance, as evidenced by record-breaking direct tax collections and strong voluntary compliance rates during Assessment Year 2025-26.