Key Highlights:

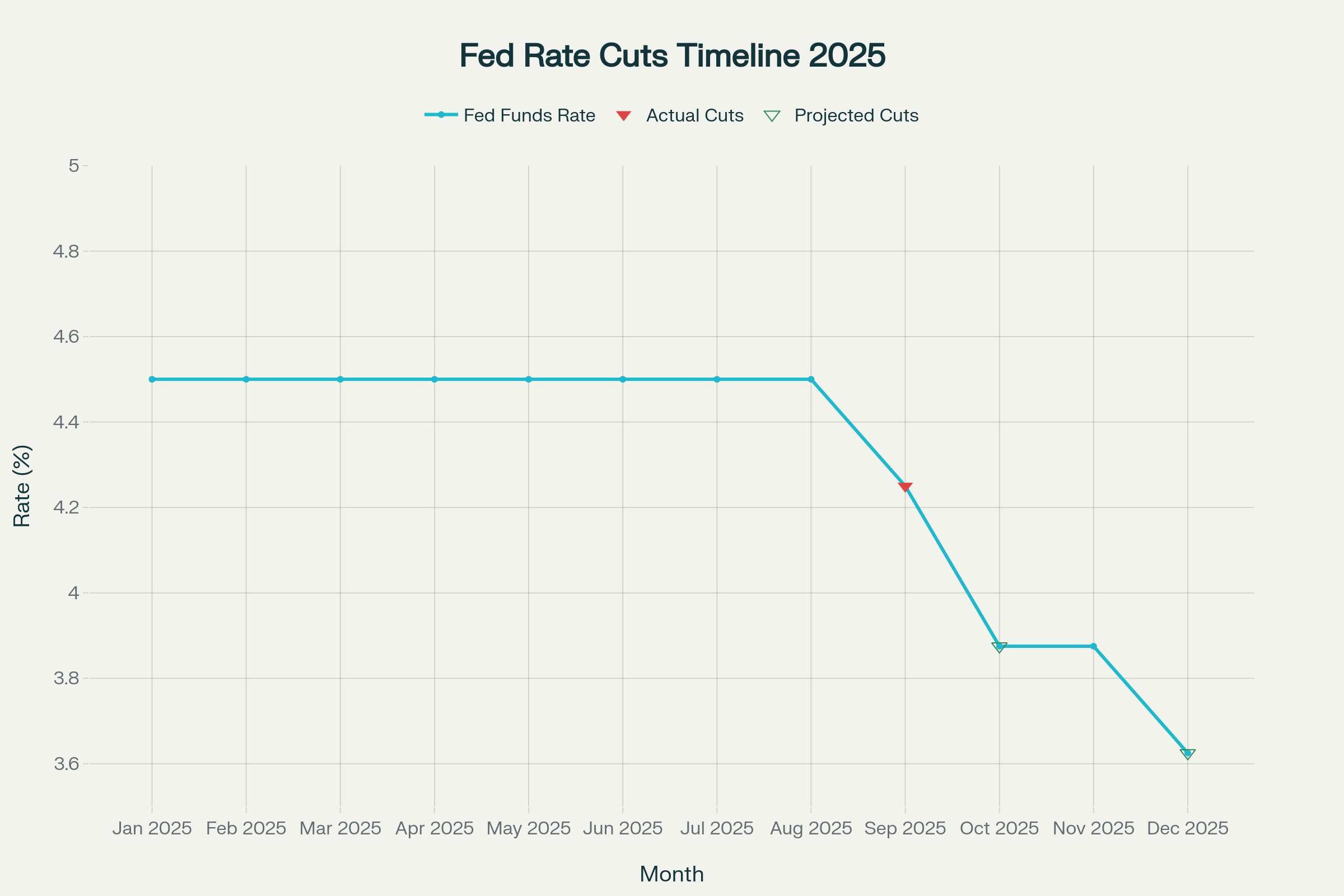

- Federal Reserve rate cuts 2025 began with a quarter-point reduction in September, with Fed projections indicating two additional 25 basis point cuts before year-end

- Rising unemployment among Black Americans reached 7.5% in August 2025, the highest level since early pandemic recovery, driving Fed concerns about labor market fragility

- Economic projections show GDP growth revised upward to 1.6% for 2025, supporting the case for gradual rather than aggressive Federal Reserve rate cuts 2025

Labor Market Deterioration Drives Policy Pivot

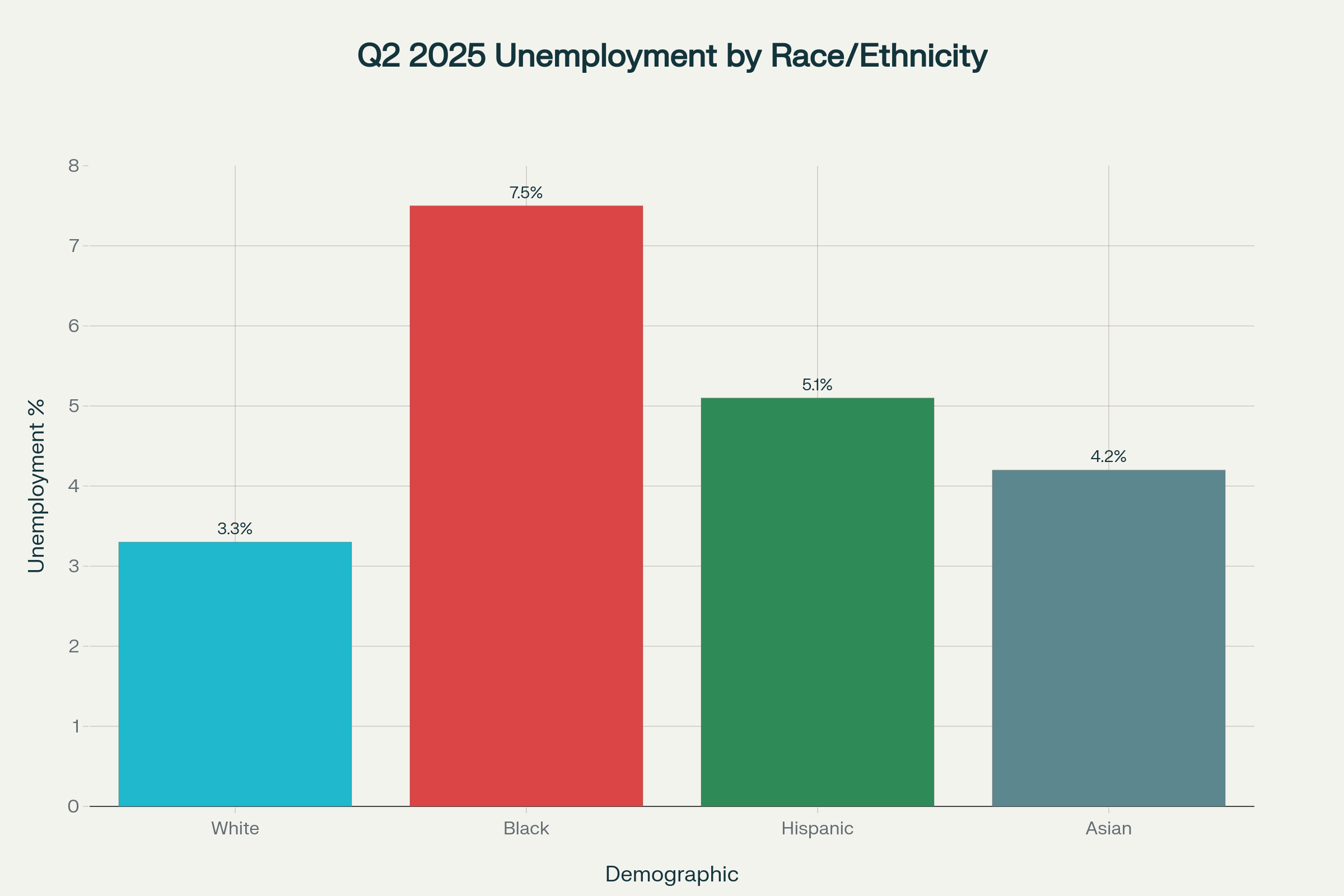

The Federal Reserve’s decision to initiate Federal Reserve rate cuts 2025 reflects mounting evidence of labor market weakness, particularly among vulnerable populations. Black unemployment has surged to 7.5% as of August 2025, representing a dramatic increase from 6.0% in May and marking the highest level since the pandemic recovery period. This deterioration underscores the disproportionate impact of economic cooling on minority communities, a key factor influencing Federal Reserve rate cuts 2025 timing.

Fed officials acknowledge that current job creation is running below the pace needed to maintain stable unemployment, creating vulnerability to any increase in layoffs. Powell emphasized that minority unemployment patterns are flashing warning signals, with Hispanic unemployment at 5.1% and overall unemployment ratios showing persistent disparities. These trends provide strong justification for Federal Reserve rate cuts 2025 despite inflation remaining above target levels.

Youth unemployment has also deteriorated significantly, with Black youth unemployment reaching alarming levels compared to white counterparts. The Fed’s focus on maximum employment under its dual mandate has increasingly prioritized these demographic disparities, viewing Federal Reserve rate cuts 2025 as necessary to prevent further labor market deterioration. Current employment data reveals troubling trends beyond headline figures, with the broader U-6 unemployment measure capturing underemployment concerns.

The central bank’s September projections maintain unemployment forecasts at 4.5% for year-end 2025, but officials acknowledge growing downside risks that could necessitate more aggressive Federal Reserve rate cuts 2025 if conditions worsen.

Unemployment disparities by race and ethnicity in Q2 2025, highlighting Federal Reserve rate cuts 2025 motivation

Fed Projections Signal Continued Easing Path

Federal Reserve officials have significantly revised their Federal Reserve rate cuts 2025 outlook, with the median projection now showing the federal funds rate declining to 3.6% by year-end, compared to the previous 3.9% forecast from June. This revision indicates broad committee support for continued monetary easing, with Federal Reserve rate cuts 2025 expected to total 75 basis points from September levels.finance.

The Fed’s “dot plot” projections reveal one official supporting much more aggressive Federal Reserve rate cuts 2025, with forecasts suggesting the federal funds rate could drop below 3.0% by year-end. This outlier position, attributed to newly appointed Governor Stephen Miran, reflects the ongoing debate within the committee about appropriate policy responses to economic conditions. Miran dissented in favor of a 50 basis point cut rather than the 25 basis point reduction implemented.

Economic growth projections provide optimism for the Federal Reserve rate cuts 2025 trajectory, with GDP forecasts revised upward to 1.6% for 2025 from the previous 1.4% estimate. Officials also raised growth projections for 2026 to 1.8% and 2027 to 1.9%, suggesting confidence that Federal Reserve rate cuts 2025 can support economic activity without triggering excessive stimulus.

Inflation projections complicate the Federal Reserve rate cuts 2025 outlook, with PCE inflation expected to reach 3.0% by year-end, well above the Fed’s 2% target. Core PCE inflation projections remain at 3.1% for 2025, indicating persistent price pressures that could constrain future easing. However, officials view labor market risks as currently outweighing inflation concerns, supporting continued Federal Reserve rate cuts 2025.

Federal Reserve rate cuts 2025: Timeline showing actual September cut and projected additional reductions through year-end

Political Pressures Test Fed Independence

The implementation of Federal Reserve rate cuts 2025 has occurred amid unprecedented political pressure from President Trump, who has consistently demanded more aggressive monetary easing. Trump’s appointment of Stephen Miran to the Fed Board immediately before the September meeting, followed by Miran’s dissent for larger cuts, highlights ongoing tensions over Federal Reserve rate cuts 2025 policy.

Powell addressed independence concerns directly, emphasizing the Fed’s commitment to data-driven decision-making regardless of political influence. The broad committee support for the 25 basis point cut, including from other Trump appointees Michelle Bowman and Christopher Waller, demonstrates institutional resilience in conducting Federal Reserve rate cuts 2025 based on economic conditions rather than political pressure.

Market reactions to Federal Reserve rate cuts 2025 announcements were mixed initially, with Treasury yields rising before settling lower. The dollar strengthened modestly against major trading partners, while equity markets showed volatility as investors processed implications of gradual rather than aggressive easing. Rate futures markets now price in more than 90% probability of additional Federal Reserve rates cuts 2025 at the October meeting.

The political dynamics surrounding Fed appointments continue evolving, with Trump’s unsuccessful attempt to dismiss Governor Lisa Cook highlighting governance tensions. Cook participated in the September meeting despite legal challenges, demonstrating the Fed’s commitment to operational continuity during Federal Reserve rates cuts 2025 implementation.

Economic Implications and Market Response

Financial markets are adjusting expectations for Federal Reserve rate cuts 2025, with significant implications for borrowing costs and investment decisions. Lower interest rates should provide relief for consumers and businesses facing elevated borrowing costs, particularly in housing markets where mortgage rates may decline. Corporate investment could increase as financing becomes more accessible through Federal Reserve rate cuts 2025.

The Fed’s longer-term projections suggest the federal funds rate could decline to approximately 3.0% over time, representing substantial easing from current levels. This outlook supports continued Federal Reserve rates cuts 2025 and beyond, though officials maintain flexibility to adjust based on evolving economic conditions.

However, persistent inflation above the Fed’s target creates risks for Federal Reserve rate cuts 2025 sustainability. Should price pressures intensify due to external factors like tariffs or supply chain disruptions, the central bank may need to pause or reverse course. This uncertainty complicates long-term planning for businesses and investors anticipating Federal Reserve rate cuts 2025 benefits.

Powell emphasized that Federal Reserve rate cuts 2025 success will depend not just on individual rate changes but on the broader trajectory toward neutral monetary policy. The committee maintains a “meeting-by-meeting” approach to Federal Reserve rate cuts 2025, preserving flexibility to respond to changing economic conditions while supporting maximum employment objectives.

Closing Assessment

The Federal Reserve’s initiation of Federal Reserve rates cuts 2025 represents a critical policy inflection point, driven primarily by deteriorating labor market conditions despite persistent inflation above target levels. Chair Powell’s strong indication that additional Federal Reserve rates cuts 2025 are probable demonstrates the central bank’s commitment to supporting employment even at potential costs to price stability progress.

Rising unemployment among minority groups and weakening job creation have become paramount concerns, outweighing previous hesitations about Federal Reserve rate cuts 2025 while inflation remains elevated. The central bank’s projections suggest Federal Reserve rate cuts 2025 could total 75 basis points by year-end, bringing meaningful support to economic activity and vulnerable communities.

Political pressures and questions about Fed independence add complexity to Federal Reserve rate cuts 2025 decisions, but broad committee support suggests institutional resilience. Market expectations now align with Fed projections for continued easing, though the ultimate scope of Federal Reserve rate cuts 2025 will depend on evolving labor market conditions and the delicate balance between employment and inflation objectives.