Key Highlights

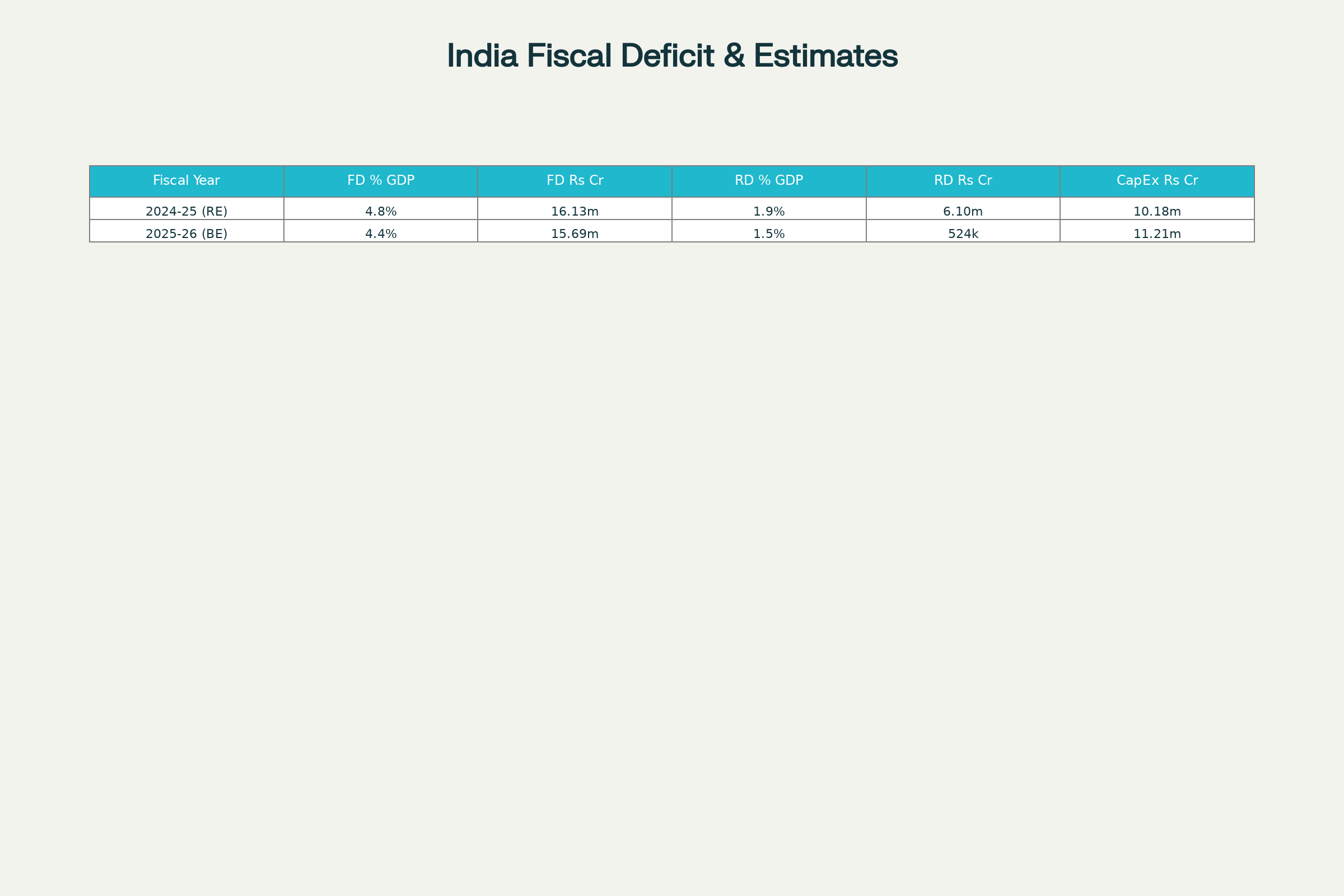

- India targets a fiscal deficit of 4.4% of GDP (Rs 15.69 lakh crore) for 2025-26, down from 4.8% revised estimate for current year

- Finance Minister Nirmala Sitharaman projects revenue buoyancy from increased consumption will offset Rs 48,000 crore GST shortfall

- New GST structure effective September 22 reduces rates on nearly 400 products while maintaining fiscal discipline

Opening Overview: Bold Stance on Revenue Recovery

Finance Minister Nirmala Sitharaman’s latest statement reflects unwavering confidence in India’s ability to achieve its ambitious fiscal deficit target of 4.4% despite implementing one of the most comprehensive tax reforms in recent years. Speaking to PTI, she addressed concerns about the potential Rs 48,000 crore revenue shortfall resulting from the recent GST rate rationalisation, asserting that consumption-driven revenue buoyancy will bridge this gap. The fiscal deficit target represents a significant improvement from the current year’s revised estimate of 4.8%, demonstrating the government’s commitment to fiscal deficit target consolidation amid economic challenges.

The timing of this announcement coincides with the GST Council’s landmark decision to implement a simplified three-tier structure, marking a pivotal moment for India’s tax policy. Sitharaman’s assurance that the government will “stick to the numbers” reinforces her determination to maintain the fiscal deficit target trajectory despite the immediate revenue implications of the reform.

'What we hear from the industry gives me the feeling that, from 22 September, people will go out there to make purchases.

— Nirmala Sitharaman Office (@nsitharamanoffc) September 6, 2025

Absolutely, there’s likely to be a surge and we will meet fiscal deficit targets as estimated.

No need for any change in expenditure plans.'

– Smt… pic.twitter.com/T2Opp0cLZt

Strategic GST Reform Framework Supporting Economic Growth

- Comprehensive rate restructuring covers nearly 400 products from daily essentials to automobiles

- Three-tier GST structure establishes slabs at 5%, 18%, and 40% with zero tax on basic necessities

The fiscal deficit target strategy hinges on the government’s calculated approach to GST reform, which becomes effective from September 22. This restructuring represents more than a simple rate adjustment; it constitutes a fundamental shift in India’s indirect tax philosophy. Under the new framework, essential items including milk, bread, and paneer will remain tax-free, while most daily necessities fall under the 5% GST slab. Electric vehicles and small cars will benefit from the reduced 5% rate, while other consumer goods will be taxed at 18%.

Sitharaman emphasised that this reform touches the lives of all 140 crore Indians, describing it as a “people’s reform” that directly benefits every household. The fiscal deficit target calculations incorporate this broad-based impact, with the Finance Minister projecting that increased purchasing power will translate into higher consumption volumes. Individual health and life insurance premiums receiving complete GST exemption represents another significant relief measure that supports the government’s consumption-boosting strategy while maintaining the fiscal deficit target.

The government’s confidence in achieving the fiscal deficit target despite these rate cuts stems from dynamic revenue modelling rather than static calculations. Sitharaman noted that the Rs 48,000 crore figure represents a baseline estimate that will change as consumption patterns respond to the lower tax burden.

Revenue Buoyancy Mechanisms and Consumption Dynamics

- Consumption surge expected from September 22 implementation date

- Revenue generation through increased transaction volumes rather than higher rates

- Economic multiplier effects anticipated across sectors

The fiscal deficit target strategy relies on sophisticated revenue buoyancy mechanisms that account for India’s consumption elasticity. Sitharaman’s projection that the Rs 48,000 crore shortfall can be recovered “this year itself” demonstrates the government’s confidence in these multiplier effects. The consumption spurt anticipated from September 22 will likely generate additional economic activity across multiple sectors, creating a cascading effect on overall tax collections.

This approach to maintaining the fiscal deficit target represents a departure from traditional fiscal conservatism, embracing dynamic scoring methodologies that account for behavioural changes. Lower GST rates on consumer goods are expected to increase demand, leading to higher production volumes, increased employment, and expanded economic activity. The resulting increase in direct tax collections, corporate tax revenues, and other indirect taxes should help offset the immediate GST revenue reduction.

The fiscal deficit target framework also benefits from India’s strong economic fundamentals, with first-quarter GDP growth of 7.8% exceeding expectations. This robust performance provides additional fiscal space for the government to implement reforms while maintaining deficit discipline. Sitharaman indicated that the combination of GST reform and strong economic performance could push GDP growth beyond the projected 6.3-6.8% range for FY26.

Fiscal Consolidation Path and Debt Management Strategy

- Debt-to-GDP ratio targeted at 50% by March 2031, down from current 57.1%

- Central government outstanding liabilities projected at 56.1% of GDP in 2025-26

- Capital expenditure maintained at Rs 11.21 lakh crore, representing 10% increase over previous year

The fiscal deficit target of 4.4% represents a crucial milestone in India’s medium-term fiscal consolidation roadmap. According to official budget documents, this target forms part of a six-year plan outlined in the FRBM statement, designed to ensure central government debt remains on a declining path as a percentage of GDP. The government’s commitment to this fiscal deficit target reflects broader macroeconomic stability objectives that extend beyond immediate revenue considerations.

Capital expenditure allocation of Rs 11.21 lakh crore for 2025-26 demonstrates that achieving the fiscal deficit target will not compromise growth-supporting investments. This represents a 10% increase over the revised estimate of Rs 10.18 lakh crore for the current year, indicating that fiscal discipline and development spending can coexist within the fiscal deficit target framework.

The transition to using debt-to-GDP as the primary fiscal policy benchmark starting in 2026-27 marks a significant evolution in India’s fiscal management approach. The fiscal deficit target strategy supports this transition by ensuring that debt accumulation remains sustainable while providing adequate fiscal space for essential government functions and counter-cyclical spending when required.

Closing Assessment: Balanced Growth and Fiscal Responsibility

Finance Minister Sitharaman’s confidence in meeting the fiscal deficit target despite implementing significant tax reforms reflects a sophisticated understanding of India’s economic dynamics. The projection that consumption-driven revenue buoyancy will offset GST rate cuts represents a calculated risk based on robust economic fundamentals and historical consumption patterns. This approach to the fiscal deficit target demonstrates that responsible fiscal management need not constrain pro-growth policy measures.

The success of this strategy will ultimately depend on the materialisation of projected consumption increases and the government’s ability to maintain expenditure discipline. Sitharaman’s assertion that there will be “no impact on fiscal deficit or fiscal management” while implementing one of India’s most comprehensive tax reforms represents a bold commitment to both economic stimulus and fiscal responsibility. The fiscal deficit target of 4.4% thus becomes not merely a numerical objective but a symbol of India’s evolving approach to economic governance, where growth promotion and fiscal prudence converge in a unified policy framework.