Key Highlights:

- Manufacturers must revise Maximum Retail Prices (MRP) for drugs and medical devices from September 22, 2025, following tax rate cuts under GST 2.0 implementation

- Re-labelling and re-stickering of existing stock released before the GST 2.0 implementation date is voluntary, not mandatory

- Insurance companies lose Input Tax Credit benefits on commissions for individual health and life policies under GST 2.0 implementation exemption reforms

Opening Overview

The Central Government’s comprehensive GST 2.0 implementation, effective from September 22, 2025, has introduced significant changes for pharmaceutical manufacturers and insurance providers while ensuring consumer benefits remain protected. The Ministry of Finance has clarified through its second set of Frequently Asked Questions (FAQs) that drug companies need not undertake expensive re-labelling operations for stocks already in the market, providing much-needed operational flexibility during this transition period. These clarifications address critical concerns following the GST Council‘s landmark 56th meeting held on September 3, 2025, which approved the most significant tax reforms since GST’s inception in 2017.

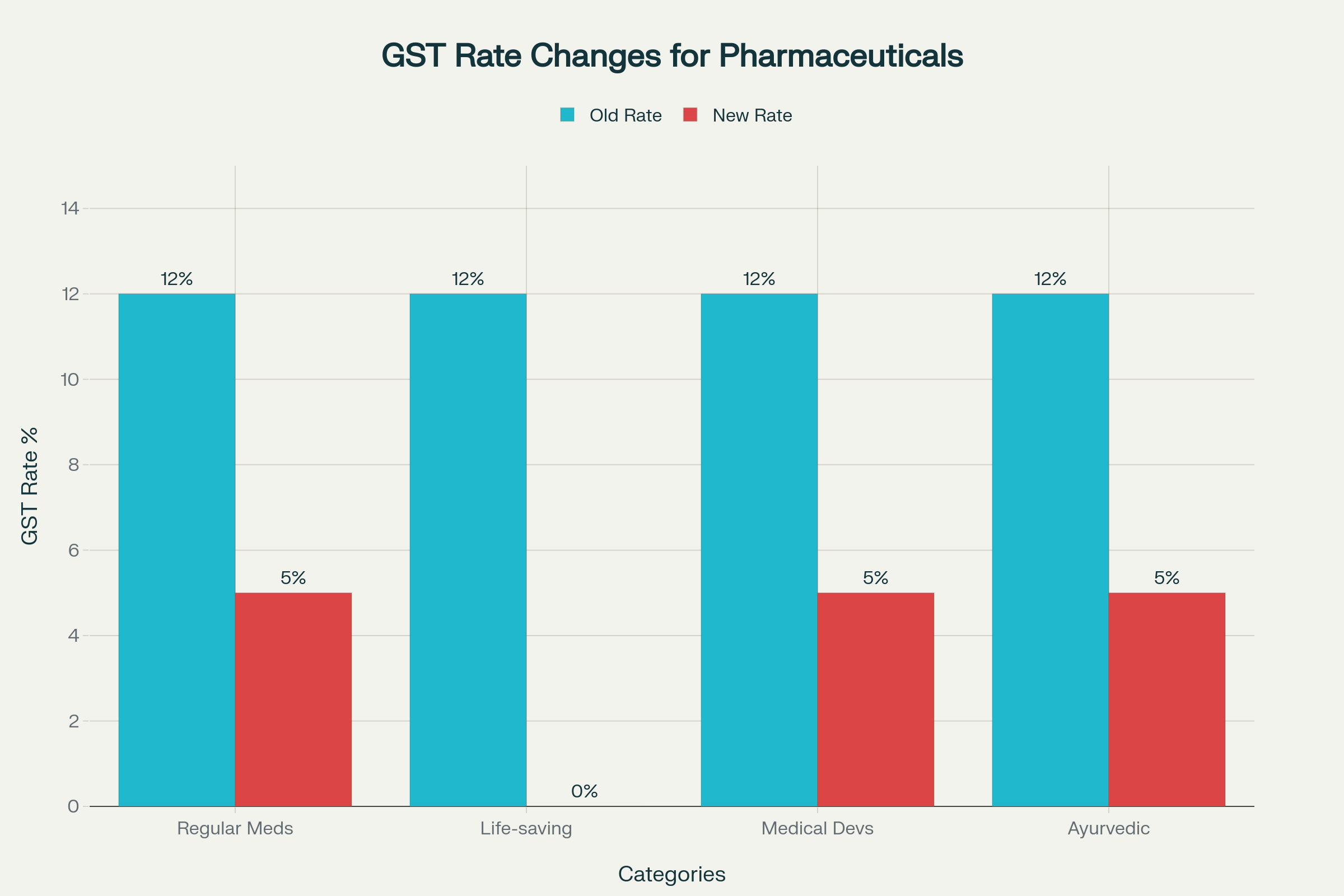

The pharmaceutical sector stands to benefit significantly from reduced rates under GST 2.0 implementation, with most medicines seeing tax cuts from 12% to 5%, while 36 life-saving drugs for conditions including cancer and rare diseases have been completely exempted from GST. However, the framework requires careful coordination between manufacturers, regulators, and retailers to ensure price benefits reach end consumers without supply chain disruptions.

Pharmaceutical Price Revision Framework and Stock Management

- Drug manufacturers and marketing companies must issue revised price lists to dealers and retailers reflecting new rates from September 22, 2025

- Companies are required to sensitize stakeholders through electronic, print, and social media channels about rate reductions

- The National Pharmaceutical Pricing Authority (NPPA) has mandated MRP revisions while permitting voluntary re-labelling of existing stocks under GST 2.0 implementation

The National Pharmaceutical Pricing Authority (NPPA) issued comprehensive guidelines on September 12, 2025, directing all pharmaceutical manufacturers to revise Maximum Retail Prices in accordance with the reduced rates. The directive emphasizes that while MRP revision is mandatory to ensure consumer benefits from GST 2.0 implementation, the physical recall and re-labelling of stocks released before September 22 remains optional, addressing industry concerns about supply chain disruptions.

GST 2.0 Implementation: Pharmaceutical Sector Rate Changes from September 22, 2025

Manufacturers must submit revised price lists in Form V/VI to dealers, retailers, State Drug Controllers, and government authorities, ensuring transparency in the price revision process. The Central Drugs Standard Control Organisation (CDSCO) has permitted companies choosing voluntary re-labelling to affix stickers under Rule 104A of the Drugs and Cosmetics Rules, 1945, with a mandatory declaration to licensing authorities within three months.

The pharmaceutical industry associations have been encouraged to release advertisements in national and vernacular newspapers to communicate the rate reductions effectively. This coordinated approach aims to prevent price arbitrage and ensure that the 18% cost reduction benefit reaches patients without creating market confusion or supply shortages.

Companies opting for phased re-labelling must ensure no drug shortages occur during the transition period, with the NPPA emphasizing patient welfare over operational convenience. The Finance Ministry’s monitoring mechanism requires CGST field offices to submit monthly reports on pre- and post-September 22 MRP changes for six months, ensuring compliance oversight.

Insurance Sector Transformations and Input Tax Credit Implications

- Individual health and life insurance policies are completely exempt from 18% GST effective September 22, 2025

- Insurance companies must reverse Input Tax Credit on commissions and brokerages for individual policies under GST 2.0 implementation

- Reinsurance services receive full GST exemption, providing operational cost relief to insurers

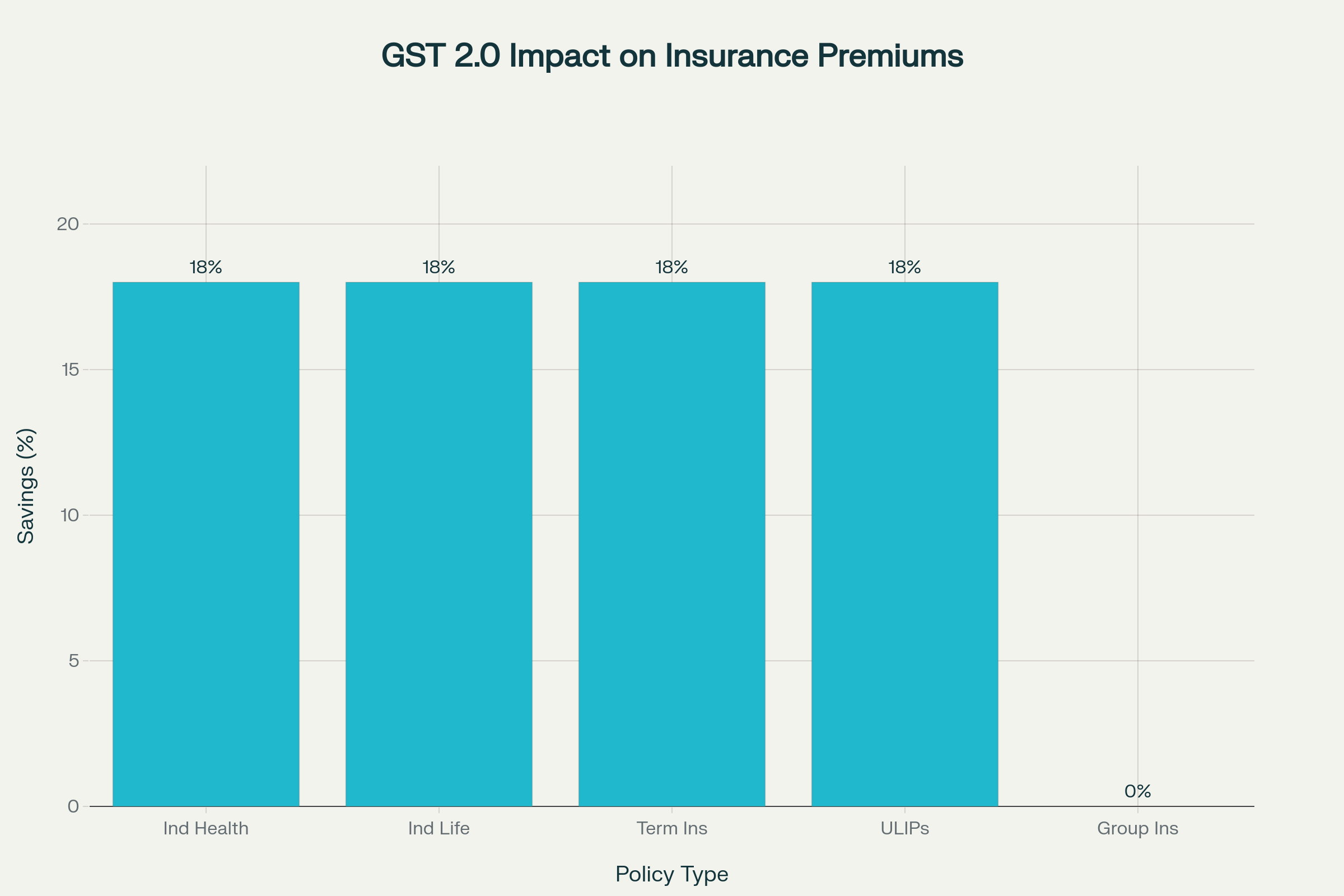

The insurance sector experiences a fundamental shift under GST 2.0 implementation, with individual health and life insurance policies receiving complete GST exemption, making them approximately 18% more affordable for consumers. This historic reform aligns with India’s “Insurance for All by 2047” vision and is expected to boost insurance penetration among first-time buyers and underserved populations.

GST 2.0 Implementation: Insurance Sector Premium Savings from September 22, 2025

However, insurance companies face operational challenges as they lose the ability to claim Input Tax Credit on GST paid for commissions and brokerages related to individual policies. The Finance Ministry clarifies that while reinsurance services will be exempted, other input services such as commissions must have their ITC reversed, potentially reducing the effective premium reduction to 10-15% in some cases.

Group insurance policies remain outside the exemption scope, with the Central Board of Indirect Taxes and Customs (CBIC) expected to provide further clarification on specific coverage criteria. Insurance companies must restructure their pricing models to account for the loss of input credits while ensuring competitive premium offerings in the newly exempted individual policy segment.

The exemption covers comprehensive policy types including term insurance, Unit Linked Insurance Plans (ULIPs), endowment plans, family floater policies, and senior citizen health insurance. This broad coverage ensures maximum consumer benefit while requiring insurers to absorb higher operational costs through improved efficiency rather than passing them to policyholders.

Service Sector Rate Rationalization and Compliance Requirements

- Beauty and physical well-being services face mandatory 5% GST rate without Input Tax Credit options

- Hotel accommodation services under Rs 7,500 per unit per day cannot opt for higher rates with ITC benefits

- Local delivery services through e-commerce platforms attract 18% GST with liability determined by registration status under GST 2.0 implementation

The service sector experiences significant restructuring, with beauty and physical well-being services including health clubs, salons, fitness centers, and yoga studios mandatorily taxed at 5% without Input Tax Credit. Service providers cannot choose the alternative 18% rate with full ITC, ensuring maximum consumer benefits while requiring businesses to absorb input costs.

Hotel accommodation services valued at Rs 7,500 or less per unit per day face similar restrictions, with the 5% rate being mandatory and no option for 18% with ITC benefits. This measure targets affordable accommodation segments while ensuring hotels cannot manipulate rate structures to claim input credits at consumer expense.

Local delivery services provided through e-commerce operators such as Zomato, Swiggy, Blinkit, and Zepto will attract 18% GST on delivery charges from September 22, 2025. The tax liability falls on the e-commerce operator when delivery personnel are not registered under Section 22(1), but on the registered service provider when they are liable for registration.

Multimodal transportation services receive dual-rate options, with 5% GST applicable when no air transport is involved, while services including air transportation attract 18% with full ITC. This structure maintains cost-effectiveness for ground-based logistics while ensuring appropriate taxation for premium air-inclusive services.

The Government’s rationale for mandatory lower rates on specific services reflects its commitment to ensuring maximum consumer benefits rather than allowing businesses to choose higher rates for ITC advantages. This approach prioritizes end-user affordability over industry input credit optimization.

Timeline and Monitoring Mechanisms

- All changes take effect from September 22, 2025, coinciding with Navratri festivities following GST 2.0 implementation

- CBIC issued comprehensive notifications on September 17, 2025, providing legal framework for reforms

- Monthly monitoring reports required from field offices for six months to track MRP compliance

The Central Board of Indirect Taxes and Customs (CBIC) issued critical notifications on September 17, 2025, providing the legal framework following GST Council’s 56th meeting recommendations. Notification No. 09/2025-Central Tax (Rate) prescribes revised GST rate schedules, while complementary customs notifications align duties with GST Council decisions.

The September 22, 2025 date was strategically chosen to coincide with Navratri, symbolizing auspicious beginnings for India’s tax reform journey. This timing allows businesses adequate preparation while ensuring consumer benefits commence during the festival season when purchasing activity typically increases.

The Finance Ministry has established robust monitoring mechanisms requiring CGST field offices to submit detailed monthly reports on MRP changes by the 20th of each month for six months following GST 2.0 implementation. These reports will track pre- and post-September 22 pricing data, ensuring pharmaceutical companies comply with mandatory price reduction requirements.

Industry stakeholders receive comprehensive guidance through official FAQs, with the government emphasizing reliance on authenticated sources rather than social media misinformation. The CBIC has actively countered false claims about additional transition benefits, maintaining clarity on actual reform provisions.

State drug controllers and licensing authorities play crucial roles in monitoring compliance, with manufacturers required to submit revised MRP declarations within three months of voluntary re-labelling activities. This multi-layered oversight ensures consumer protection while providing operational flexibility to businesses during the transition period.

Closing Assessment

The GST 2.0 implementation represents India’s most comprehensive tax reform since 2017, balancing consumer benefits with industry operational realities through carefully crafted flexibility mechanisms. The pharmaceutical sector’s relief from mandatory re-labelling requirements demonstrates pragmatic policymaking that prioritizes supply chain stability while ensuring price benefits reach patients effectively.

The insurance sector’s transformation through individual policy exemptions marks a significant step toward universal health coverage, despite operational challenges from Input Tax Credit reversals that companies must navigate strategically. Service sector rate rationalization reflects the government’s commitment to consumer-centric policies, even when it limits business flexibility in rate selection.

The success of these reforms will largely depend on effective industry coordination and government monitoring mechanisms established through the September 22 framework. As businesses adapt to the new tax structure under GST 2.0 implementation, the coming months will determine whether this reform achieves its dual objectives of simplification and affordability for India’s economy.