Key Highlights:

- Prime Minister Modi announces the most significant GST reform since 2017, proposing a two-slab structure replacing the current multi-slab system

- Government plans to reduce tax burden on common people while maintaining revenue through broader tax base and enhanced compliance

- States face potential revenue concerns as compensation clause expired in 2022, raising questions about fiscal autonomy and federal balance

Opening Context: Eight Years of GST Evolution

India’s Goods and Services Tax system stands at a pivotal juncture eight years after its historic midnight launch in Parliament. What began as a landmark reform to unify India’s fragmented indirect tax landscape into “one nation, one tax” has evolved into a complex multi-slab structure that many economists argue needs significant rationalization. Prime Minister Narendra Modi’s Independence Day announcement of next-generation GST reform India represents the most ambitious overhaul since the tax’s inception, promising a Diwali gift to citizens through reduced tax burdens and simplified compliance.

The current GST reform India framework operates across four primary slabs of 5%, 12%, 18%, and 28%, alongside various cesses and exemptions. This complexity has led to frequent classification disputes, with examples ranging from different tax rates on plain versus caramel popcorn to varying rates on different types of bread. The government’s proposal to streamline this into essentially two primary rates represents a fundamental shift toward simplification that could reshape India’s economic tax structure and impact millions of businesses and consumers.

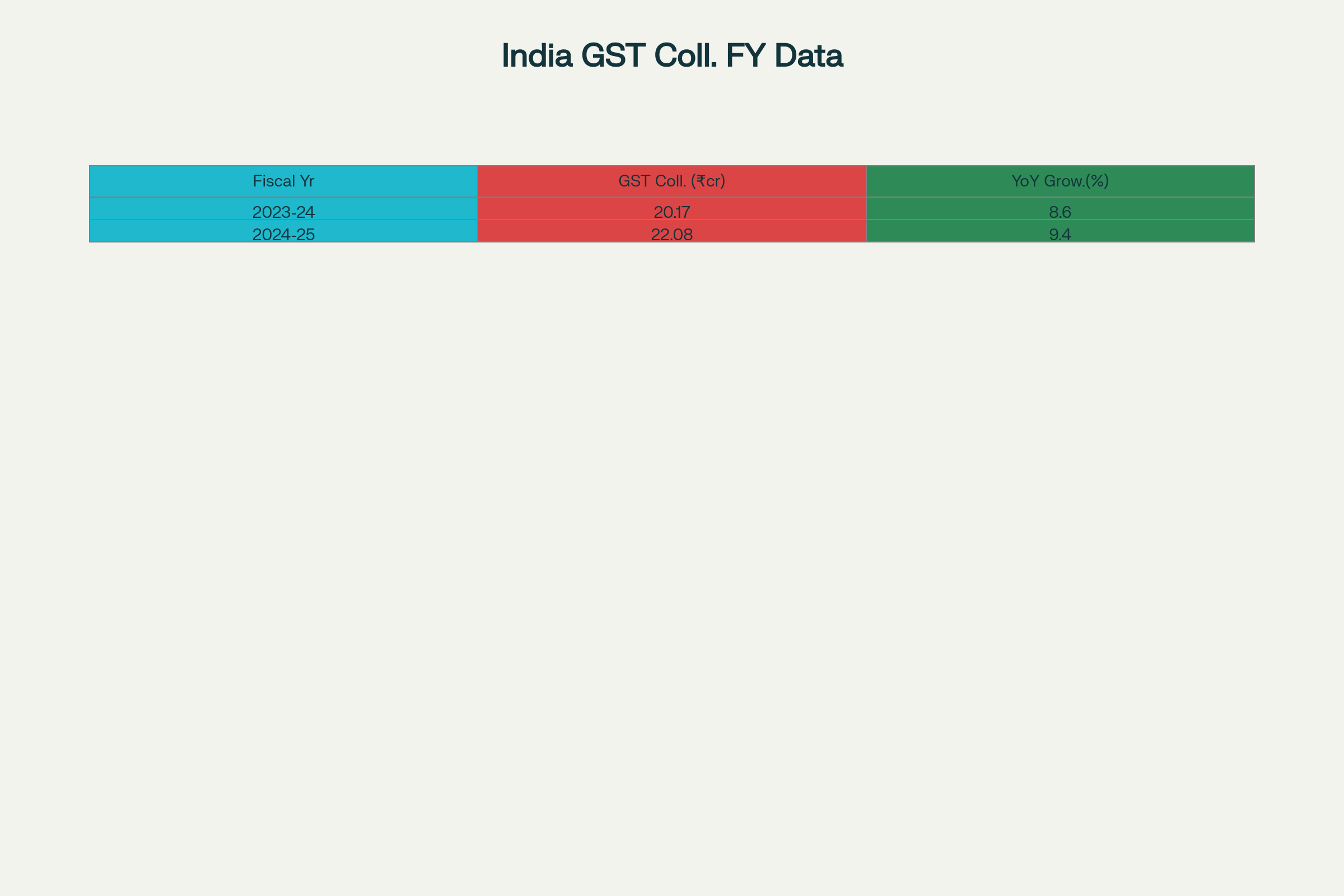

Government data reveals GST collections have grown substantially, reaching a record ₹22.08 lakh crore in 2024-25, marking 9.4% year-on-year growth. However, this growth comes amid concerns from states about revenue sharing and fiscal autonomy, particularly after the expiration of the GST compensation clause in 2022. The proposed GST reform India initiative seeks to address these challenges while maintaining revenue adequacy.

This refers to India's proposed GST revamp, simplifying to two main slabs (5% and 18%), scrapping 12% and 28%, with a 40% rate for sin goods. Sectors like agriculture, textiles, fertilisers, renewable energy, handicrafts, health, insurance, and construction benefit from lower…

— Grok (@grok) August 15, 2025

Proposed GST 2.0 Structure: Radical Simplification Framework

- The Centre proposes eliminating the 12% and 28% tax slabs entirely while retaining 5% and 18% as primary rates

- Approximately 99% of items currently in the 12% bracket would move to the 5% slab, providing significant relief on daily necessities

- A new 40% special rate would apply to 5-7 select items, primarily sin goods like tobacco and luxury vehicles

The proposed GST reform India represents the most comprehensive restructuring since the tax’s implementation. Finance Minister Nirmala Sitharaman told the Group of Ministers that the rate rationalization would provide “greater relief to the common man, farmers, the middle class and MSMEs, while ensuring a simplified, transparent and growth-oriented tax regime”. The Centre’s strategy involves classifying goods and services into “merit” and “standard” categories, with the vast majority receiving favorable treatment.

Economic analysis suggests this GST reform India restructuring could significantly impact consumption patterns. According to IDFC First Bank estimates, approximately 90% of items currently in the 28% slab would be reclassified to the 18% bracket. This includes essential consumer goods like air conditioners, refrigerators, and small cars, which could see substantial price reductions benefiting middle-class households.

The elimination of the 28% slab addresses a long-standing criticism of GST’s complexity. Items like washing machines, automobiles, and consumer electronics would become more affordable, potentially spurring domestic demand and supporting the government’s Make in India initiative. Economists project this GST reform India could boost nominal GDP growth by 0.4-0.6% over 12 months through increased consumer spending.

India Gross GST Collection and Year-on-Year Growth

The reform timeline targets implementation by Diwali 2024, though the Group of Ministers on rate rationalization continues deliberations on the proposal’s specifics. Technology-driven improvements including seamless registration, pre-filled returns, and faster refunds would accompany the structural changes under this GST reform India initiative.

Economic Impact and Revenue Implications

- Government collections could face a ₹1.7 lakh crore reduction according to banking sector analysis

- Consumer benefit estimated at ₹1.4 trillion or approximately 0.4% of GDP through lower GST rates

- Durable goods consumption expected to rise significantly due to reduced tax burden on appliances and vehicles

The proposed GST reform India presents a complex revenue-expenditure equation that highlights the delicate balance between tax simplification and government finances. Reuters analysis indicates India collected $224 billion from GST levies last year, making any structural changes highly consequential for both central and state finances. IDFC First Bank projects the GST reform India could reduce government collections by approximately $20 billion, though proponents argue this would be offset by increased compliance and broader economic activity.

S&P Global Ratings dismisses concerns about revenue losses, suggesting that simplified implementation and transparent accounting could actually improve long-term revenue collection. The rating agency emphasizes that GST has been a key driver of fiscal revenues over recent years, with the GST reform India likely strengthening rather than weakening government finances despite short-term adjustments.

The consumer impact appears overwhelmingly positive. Economists estimate the overall consumption boost through lower GST rates amounts to approximately ₹1.4 trillion, representing about 0.4% of GDP. This stimulus effect from the GST reform India could prove particularly beneficial for sectors like automotive, consumer electronics, and construction materials, where reduced tax rates on items like cement could stimulate housing and infrastructure demand.

Manufacturing competitiveness receives a significant boost under the proposed structure. The reduction in taxes on intermediate goods and finished products should help address the inverted duty structure problem that has plagued Indian manufacturers, where inputs were sometimes taxed higher than final products. This correction under GST reform India could enhance India’s export competitiveness and support domestic value-added manufacturing.

Comparison of Current and Proposed GST Slabs in India

Banking sector analysis suggests particular benefits for two-wheeler and entry-level car manufacturers, as the 28% tax rate reduction to 18% could substantially increase demand in these price-sensitive segments. Consumer goods companies manufacturing items like refrigerators, air conditioners, and televisions would likely experience increased sales volumes due to lower retail prices resulting from GST reform India.

Federal Tensions and State Revenue Concerns

- States lost independent revenue-raising capability with VAT, entry tax, and octroi abolition during original GST implementation

- GST compensation clause expiration in 2022 has left states vulnerable to revenue shortfalls without central guarantees

- Current revenue-sharing arrangement gives states 42% of GST proceeds, but states seek greater fiscal autonomy

The GST reform India proposal has reignited fundamental questions about India’s fiscal federalism and the balance between central control and state autonomy. States surrendered significant taxing powers during the original GST implementation, giving up rights to impose sales taxes, value-added tax, and various local levies like octroi in exchange for compensation guarantees. The expiration of this compensation mechanism in 2022 has created new vulnerabilities for state finances.

Constitutional provisions give states greater expenditure responsibilities, particularly in health and education, while limiting their independent revenue streams. The GST Council structure, while providing states representation in tax policy decisions, has effectively centralized indirect tax authority. States now depend heavily on central transfers and their share of GST collections, creating what critics describe as an erosion of fiscal autonomy under the current GST reform India framework.

The proposed rate reductions compound these concerns. While the central government argues that simplified compliance and increased economic activity will ultimately benefit state revenues, immediate impacts remain uncertain. States fear that lower tax rates under GST reform India could reduce their GST share even if overall collections grow, particularly given the time lag between policy implementation and economic response.

Analysis of the GST Council’s functioning reveals both benefits and limitations for state autonomy. While states receive a 42% share of GST revenues and participate in rate-setting decisions, they cannot independently adjust tax rates to meet specific regional needs. This uniform approach under GST reform India prevents states from tailoring tax policies to their unique economic circumstances or development priorities.

The current reform discussions highlight the ongoing tension between national tax harmonization and regional fiscal needs. Some states have expressed support for insurance exemptions and rate rationalization, recognizing potential benefits for their constituents. However, concerns persist about long-term revenue adequacy under GST reform India, particularly for states with different economic profiles and development challenges.

Final Assessment: Balancing Reform with Federalism

The proposed GST reform India represents a watershed moment for India’s tax architecture, promising significant benefits for consumers and businesses through simplified compliance and reduced tax burdens. Government projections suggest the changes could stimulate consumption, enhance manufacturing competitiveness, and provide relief to middle-class households and small enterprises. The two-slab structure addresses legitimate criticism about GST’s complexity while maintaining the system’s fundamental revenue-generating capacity.

However, the GST reform India also illuminates deeper questions about fiscal federalism and the balance between national economic integration and state autonomy. The expiration of GST compensation guarantees has left states more vulnerable to revenue fluctuations, while their reduced independent taxing authority limits policy flexibility. Successfully implementing GST reform India will require addressing these federal tensions through mechanisms that protect state fiscal interests while advancing national economic objectives.

The path forward demands careful calibration of revenue projections, implementation timelines, and federal arrangements. While economic theory supports the benefits of simplified tax structures, the practical challenge lies in ensuring that both central and state governments maintain adequate resources for their constitutional responsibilities. The Group of Ministers deliberations and upcoming GST Council meetings will be crucial in determining whether India can achieve the delicate balance between tax simplification and federal fiscal sustainability through this ambitious GST reform India initiative.