Summary

- Iran’s possible Strait of Hormuz closure threatens global oil flow; India braces for fallout.

- Union Minister Hardeep Singh Puri assures fuel stability, citing diversified energy routes.

- Experts warn even a week-long disruption could trigger $105+ crude and economic ripples.

A Chokepoint Crisis: India Watches Hormuz With Measured Alarm

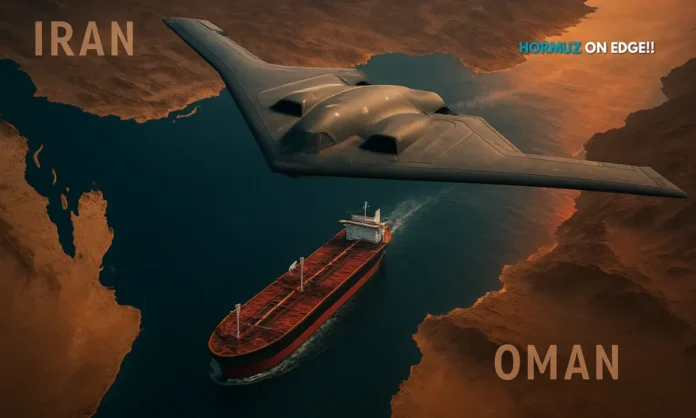

The Strait of Hormuz, a narrow stretch of water between Iran and Oman, may soon become the epicentre of the most volatile oil shock since the Gulf War. In the aftermath of the B-2 Spirit Iran strike, Tehran is reportedly weighing the closure of the Strait, a channel that moves nearly 20% of global oil and gas. The final decision, expected from Iran’s Supreme National Security Council, could test not just global supply chains but India’s decades-long energy calculus.

For India, the question is no longer academic. Union Minister for Petroleum and Natural Gas, Hardeep Singh Puri, responded swiftly. In a post on X, he assured citizens that “oil marketing companies have supplies of several weeks,” and that thanks to diversified sourcing under Prime Minister Modi’s leadership, India is “not overly dependent” on the Hormuz route anymore. But experts argue otherwise: in the global oil game, geography still rules. And if the Strait is sealed for more than a few days, India—despite stockpiles—will feel the burn.

The keyword now isn’t blockade or war—it’s duration. Because if Iran holds the Strait for over a week, the ripple effects could turn into economic shockwaves across Asia.

🚨 BREAKING: Iran votes to CLOSE the Strait of Hormuz — a chokepoint for 20% of the world’s oil.

— Harsh Goenka (@hvgoenka) June 22, 2025

If this happens, here’s what it could mean for India and the world:

🇮🇳 India:

– Crude import bill may explode📈

– Rupee under pressure 💸

– Fuel prices could soar ⛽

– Inflation… pic.twitter.com/emBVvTKRdg

Strategic Preparedness or Optimism Bias?

- Minister Puri claims India’s oil sourcing has diversified significantly in recent years.

- Key routes now include Russia, UAE, West Africa, and domestic reserves.

- Oil marketing companies (OMCs) reportedly hold several weeks’ worth of supply buffers.

- Assurance given that fuel supply stability for citizens will be maintained.

- Critics question the true resilience of non-Hormuz routes under sustained stress.

India’s energy diplomacy over the past decade has been focused on one central goal: diversification. From strengthening Russian oil imports under discounted terms to courting Gulf states and even reviving old investments in African energy corridors, the country has attempted to reduce its vulnerability to West Asian bottlenecks. Minister Puri’s statement reiterated this approach, underlining that “a large volume of our supplies do not come through the Strait of Hormuz now.”

Yet analysts remain cautious. The geography of oil flow isn’t just about volume—it’s about velocity, storage, and chokepoints. The Strait of Hormuz still accounts for substantial LNG and crude volumes to India’s western ports. Even if direct dependence has reduced, a prolonged disruption at Hormuz would increase pressure on alternative supply lines, raise insurance premiums, and disrupt port timings. These secondary effects could compound into real shortages or price spikes.

The fuel buffer with OMCs may cover several weeks, but beyond that, the test becomes one of logistics, not intent. Can India scale alternative deliveries at the speed required?

Global Oil Shock: One Week Away?

- If the Strait remains closed beyond seven days, global crude could breach $105/barrel.

- Sensitive sectors like aviation, manufacturing, and agriculture could face input price hikes.

- India’s retail inflation is vulnerable to global energy cost surges.

- Russian imports help, but discounts are fading and delivery times remain high.

- Excise duty cuts may be reviewed if prices breach critical thresholds, sources warn.

Sources familiar with energy trends have already issued quiet warnings to policymakers. According to NDTV Profit, experts believe a sustained closure—beyond one week—would “jolt the global economy.” Oil prices are acutely responsive to even speculative disruptions at Hormuz. Add a confirmed closure, and we could witness crude shooting past $105/barrel within days.

India’s economic model, which relies on relatively affordable energy to maintain growth, could falter under such cost burdens. Sensitive sectors like transport, aviation, fertilizers, and heavy industry are directly exposed. Meanwhile, the government may be forced to intervene through fiscal tools—possibly reviewing excise duties on petrol and diesel to cushion consumer prices.

But such decisions carry consequences. Lower duties mean reduced government revenue at a time when India is trying to increase public capital expenditure. It becomes a tradeoff between protecting citizens from inflation and safeguarding macroeconomic stability.

Beyond the Strait: What India’s Oil Map Reveals

- India’s recent focus on Russian oil may not be sustainable without deep discounts.

- African routes (Nigeria, Angola) remain underdeveloped and vulnerable to shipping delays.

- LNG imports still depend on Hormuz, especially from Qatar and Iran.

- India’s domestic refining capacity is world-class but feedstock insecurity persists.

- Strategic petroleum reserves (SPR) offer only partial insulation for 30–45 days.

On paper, India has made progress. Russian oil now constitutes a significant portion of imports, and crude continues to arrive via western and northern corridors. Yet the logistics of these routes are far more complex than those flowing through Hormuz. Russian barrels take longer to arrive, insurance concerns persist due to sanctions, and pricing volatility has increased due to changing payment mechanisms.

Africa offers promise, but infrastructure remains a bottleneck. Ports in Nigeria and Angola lack the scale and turnaround time of Middle Eastern terminals. LNG imports from Qatar—vital for India’s urban power and industrial sectors—still pass through Hormuz.

India’s Strategic Petroleum Reserves (SPR) do provide some insulation, but they are not a panacea. With capacity for about 30–45 days of net imports, SPRs buy time—not permanence. In the event of a prolonged conflict or continued closure of Hormuz, India will be forced to draw down these reserves—triggering future vulnerability once again.

In other words, diversification has helped—but dependence hasn’t disappeared.

The Barrel Gamble Ahead

The Strait of Hormuz is a narrow chokepoint, but its closure would create wide consequences. India’s ability to weather the storm depends on how long the disruption lasts—and how fast global oil markets rebalance. Hardeep Singh Puri’s assurance of stability reflects strong planning, but the situation remains fragile.

In an interconnected oil economy, no country is truly insulated. India’s partial independence from Hormuz may delay the burn—but not indefinitely. The B-2 Spirit strike that ignited this geopolitical firestorm may have succeeded in neutralising Iran’s nuclear capability—but it may have also reignited a global energy war.

What comes next is not just a test of fuel reserves—but of foresight, flexibility, and how long a government can keep the pumps running while the sea lanes remain blocked.