Key Highlights:

- The Central Board of Direct Taxes (CBDT) officially extended the Income Tax Audit Deadline from September 30 to October 31, 2025, following High Court directives

- Over 4.02 lakh tax audit reports were successfully uploaded by September 24, with more than 60,000 filed on that day alone

- Multiple High Courts including Rajasthan, Karnataka, and Gujarat have intervened to provide compliance relief for taxpayers and chartered accountants

Critical Relief Arrives for Tax Practitioners

The Income Tax Audit Deadline extension to October 31, 2025 represents a significant development for millions of taxpayers and chartered accountants across India who faced mounting pressure to meet the original September 30 cutoff. This decision by the CBDT follows unprecedented judicial intervention from multiple High Courts and addresses widespread concerns about technical difficulties and natural calamities affecting compliance.

The Income Tax Audit Deadline extension became necessary after professional associations, including chartered accountant bodies, highlighted disruptions caused by floods and natural disasters in various regions. Despite the Income Tax Department’s clarification that the e-filing portal operated smoothly without technical glitches, the Income Tax Audit Deadline extension acknowledges practical challenges faced by taxpayers in completing their statutory obligations.

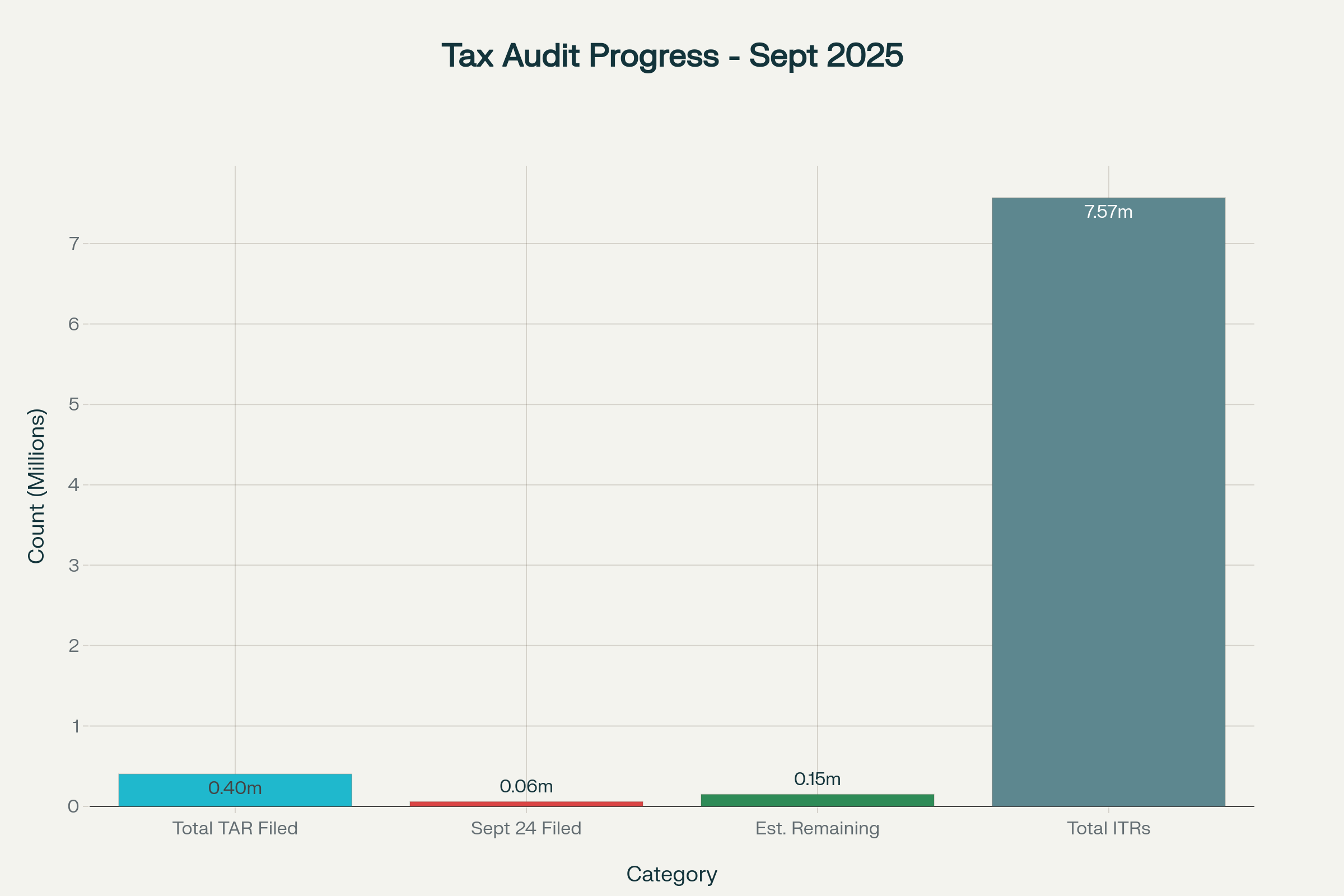

Filing statistics reveal significant compliance momentum before the Income Tax Audit Deadline extension, with over 402,000 tax audit reports successfully uploaded and more than 60,000 submissions recorded on September 24 alone. The Income Tax Audit Deadline extension ensures that remaining taxpayers can complete their obligations without rushing through critical verification processes.

Tax Audit Report filing statistics showing significant progress before the Income Tax Audit Deadline extension

Judicial Intervention Drives Policy Change

Rajasthan High Court Takes Lead

The Rajasthan High Court’s Jodhpur bench issued a crucial interim order on September 24, directing the CBDT to extend the Income Tax Audit Deadline to October 31, 2025. This directive emerged from merged petitions filed by the Bhilwara and Jodhpur Tax Bar Associations, highlighting common challenges faced by taxpayers across the state.

We are pleased to inform you that the *Hon’ble Rajasthan High Court has extended due date for filing of Tax Audit Reports from 30th September to 31st October.*

— Tax Bar Association (@JodhpurTba) September 24, 2025

Ably represented Sr. Adv. Vikas Balia and Adv. Prateek Gattani.

TAX BAR ASSOCIATION JODHPUR v/s UOI [CW 18593/2025]

Chartered Accountant Amit Ji Sheth, President of the Tax Bar Association, Bhilwara, expressed relief stating that the Rajasthan High Court’s order provided significant respite before the Income Tax Audit Deadline, allowing practitioners to hope for swift government implementation. The Income Tax Audit Deadline extension addresses delays in utility forms and technical glitches that have plagued the filing process.

Karnataka High Court Follows Suit

Karnataka High Court acted decisively on a petition filed by the Karnataka State Chartered Accountants Association (KSCAA), directly extending the Income Tax Audit Deadline to October 31, 2025. The Income Tax Audit Deadline extension in Karnataka demonstrates the widespread nature of compliance challenges facing tax professionals nationwide.

Chartered Accountant Shivaprakash Viraktamath, President of KSCAA, confirmed that the Karnataka High Court ruled favorably, extending the Income Tax Audit Deadline to provide adequate time for accurate report preparation. This Income Tax Audit Deadline extension ensures that taxpayers can maintain compliance standards without compromising accuracy.

Understanding Tax Audit Requirements Under Section 44AB

Mandatory Audit Thresholds

The Income Tax Audit Deadline extension particularly benefits businesses with turnover exceeding Rs 1 crore and professionals with gross receipts above Rs 50 lakh, who must comply with Section 44AB requirements. However, businesses maintaining cash transactions at or below 5% of total transactions enjoy higher thresholds, with audit requirements triggered only at Rs 10 crore turnover.

Digital transaction benefits further extend compliance relief, as businesses conducting 95% or more transactions digitally face audit requirements only after crossing Rs 15 crore turnover. Professional services including legal, medical, engineering, architectural, and technical consultancy fall under mandatory audit requirements when gross receipts exceed Rs 75 lakh under current provisions.

Presumptive Taxation Impact

The Income Tax Audit Deadline extension significantly affects taxpayers under presumptive taxation schemes, particularly those operating under Section 44AD who declare income below prescribed rates. Businesses opting for presumptive taxation under 44AD enjoy increased audit thresholds up to Rs 2 crore, provided they maintain the prescribed income declaration rates.

Professionals under Section 44ADA presumptive schemes must undergo audits if they declare profits below 50% of gross receipts while their total income exceeds basic exemption limits. The Income Tax Audit Deadline extension provides crucial additional time for these taxpayers to complete their compliance obligations accurately.

Compliance Framework and Penalty Structure

Audit Report Submission Process

Tax audit reports must be submitted through Forms 3CA, 3CB, or 3CD depending on the taxpayer’s specific circumstances and existing audit obligations under other laws. Form 3CA applies to taxpayers already required to undergo audits under legislation such as the Companies Act, while Form 3CB serves those not subject to other statutory audit requirements.

The Income Tax Audit Deadline extension ensures that chartered accountants have adequate time to complete comprehensive financial reviews, verify compliance with tax laws, and prepare accurate reports without rushing through critical verification processes. All audit reports must be prepared exclusively by qualified chartered accountants authorized under the Chartered Accountants Act, 1949.

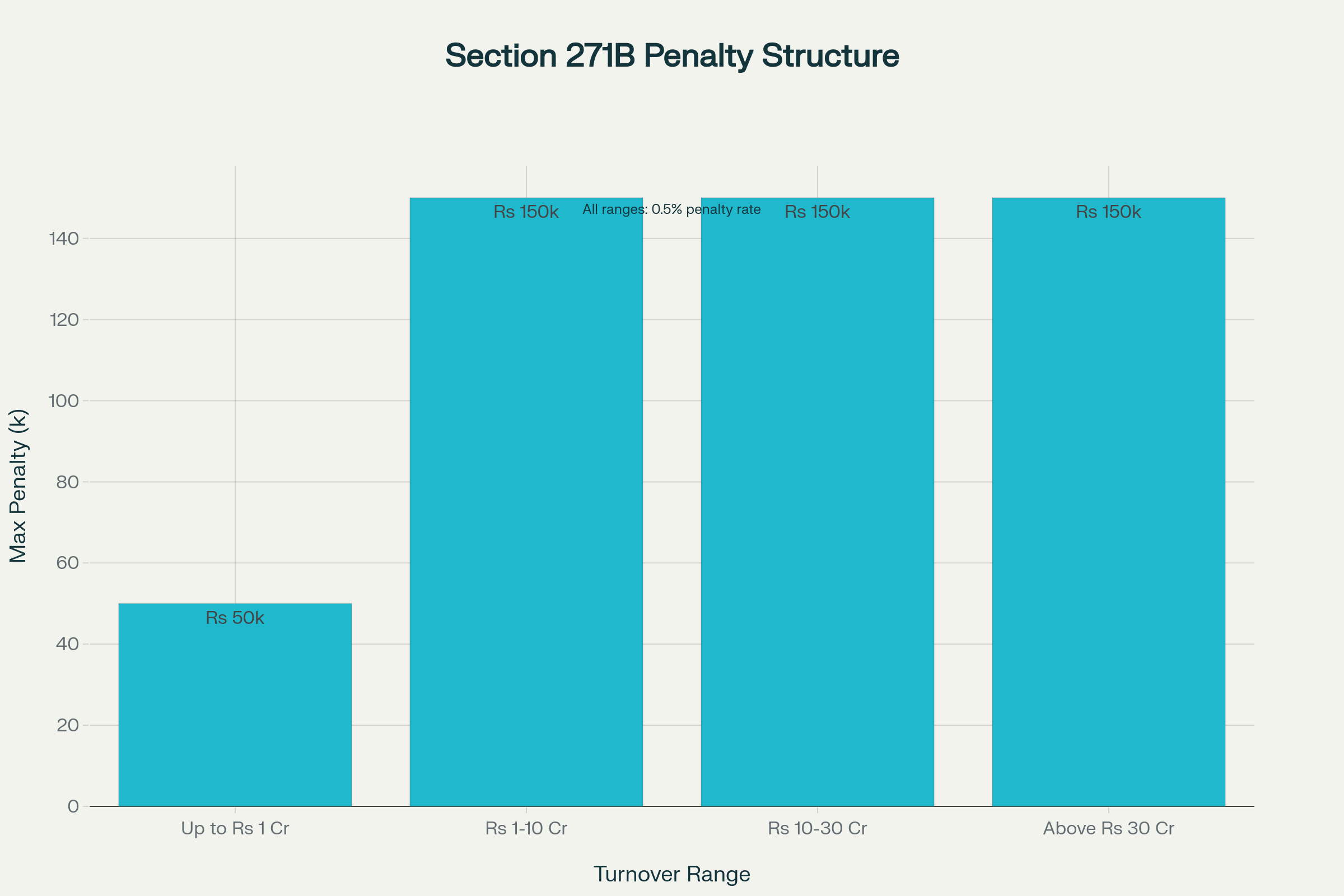

Penalty Implications Under Section 271B

Failure to meet the Income Tax Audit Deadline, even after the extension, triggers penalties under Section 271B calculated as 0.5% of total sales, turnover, or gross receipts, capped at Rs 1.5 lakh. The Income Tax Audit Deadline extension helps taxpayers avoid these substantial penalties while maintaining accuracy in their financial reporting.

The penalty structure under Section 271B applies regardless of whether the delay spans one day or several months, making the Income Tax Audit Deadline extension particularly valuable for taxpayers struggling with complex compliance requirements. Taxpayers unable to provide reasonable explanations for non-compliance face automatic penalty imposition under this section.

Penalty structure for non-compliance with Income Tax Audit Deadline requirements under Section 271B

Strategic Implications for October Compliance

The Income Tax Audit Deadline extension to October 31, 2025 creates a compressed timeline for both audit report submissions and subsequent ITR filings, as most audit cases require return filing by the same date. Gujarat High Court has already directed CBDT to extend ITR filing deadlines for audit cases to November 30, 2025, recognizing this timing challenge.

Tax practitioners anticipate significant workload concentration in October, particularly considering festival season holidays that reduce available working days for compliance activities. The Income Tax Audit Deadline extension, while providing relief, necessitates careful planning by chartered accountants and taxpayers to manage the October compliance rush effectively.

Professional associations continue monitoring the situation, with similar petitions pending in other High Courts across the country, suggesting potential for additional extensions or modifications to compliance timelines. The Income Tax Audit Deadline extension demonstrates the tax administration’s responsiveness to practical challenges while maintaining essential compliance standards.

Closing Assessment

The Income Tax Audit Deadline extension to October 31, 2025 represents a balanced approach between maintaining tax compliance integrity and acknowledging practical challenges faced by taxpayers and professionals. This extension affects millions of businesses and professionals across India, providing crucial breathing room for accurate report preparation while avoiding substantial penalties.

The coordinated response from multiple High Courts and the CBDT’s swift implementation demonstrates the importance of practical compliance considerations in tax administration. As taxpayers navigate the extended Income Tax Audit Deadline, the focus must remain on maintaining accuracy and completeness in financial reporting while utilizing the additional time effectively.

The Income Tax Audit Deadline extension ultimately serves the broader goal of tax compliance by ensuring that audit reports maintain their intended quality and accuracy standards rather than being rushed to meet unrealistic deadlines. This approach supports both taxpayer interests and the government’s revenue collection objectives through improved compliance quality.