Summary

- Lok Sabha passes the Income Tax No 2 Bill 2025, replacing the Income Tax Act, 1961 with a simplified and streamlined tax code.

- The S.I.M.P.L.E framework reduces sections, chapters, and word count to make compliance easier for individuals and businesses.

- Awaiting Presidential assent before enforcement, with official guidance resources already available on the Income Tax India portal.

Legislative Turning Point

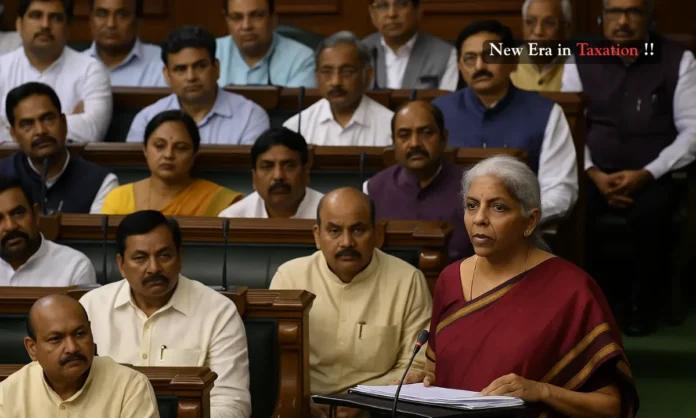

The passage of the Income Tax No 2 Bill 2025 in the Lok Sabha represents one of the most comprehensive overhauls of India’s tax system in over six decades. Designed to replace the long-standing Income Tax Act, 1961, the bill aims to create a cleaner, more concise legal framework for taxpayers and administrators alike.

Marketed under the acronym S.I.M.P.L.E, the legislation emphasizes removing outdated provisions, simplifying definitions, and streamlining processes for filing returns, claiming deductions, and receiving refunds. The bill was shaped through an extensive review process by the Parliamentary Select Committee, which successfully pushed for the inclusion of nearly all its 285 recommendations.

With the country’s tax-to-GDP ratio currently around 11.7% according to Finance Ministry data, the Income Tax No 2 Bill 2025 is positioned as a strategic step toward enhancing compliance efficiency while avoiding unnecessary complexity. This bill’s adoption signals a legislative turning point that could influence tax reforms for decades.

Structural Shifts in the Bill

- Old Income Tax Act replaced after 63 years of service.

- Word count reduced by nearly half to make the law more accessible.

The Income Tax No 2 Bill 2025 replaces the cumbersome structure of the 1961 Act, which had 819 sections and 47 chapters spanning over 512,000 words. The new law trims this to 536 sections and 23 chapters, reducing the total word count to about 260,000.

Finance Minister Nirmala Sitharaman highlighted in Parliament that simplification does not mean losing substance, but instead focuses on making provisions understandable for all taxpayers. For smaller businesses and individuals, this could mean lower compliance costs and fewer procedural hurdles.

The S.I.M.P.L.E approach, “Simplified Income Measurement and Procedural Law Enhancement,” centers on:

- Phasing out irrelevant provisions.

- Offering clearer guidelines on deductions and exemptions.

- Expanding the use of digital filing and refund systems.

The bill also introduces a standardized structure for Tax Deducted at Source (TDS), reducing disputes and accelerating refunds.

Provisions Worth Highlighting

- Incorporates recommendations from broad-based consultations.

- Launch of official guidance tools to support transition.

A notable feature of the Income Tax No 2 Bill 2025 is the scale of stakeholder engagement during its drafting. The Select Committee led by MP Baijayant Panda consulted with industry leaders, tax experts, and trade bodies to refine the bill, incorporating almost all of the 285 suggested changes.

To help taxpayers prepare, the Central Board of Direct Taxes (CBDT) has launched the “Income-tax Bill 2025 Navigator” along with detailed FAQs on the Income Tax India website.

The bill also proposes a ‘nil’ Tax Collection at Source (TCS) on education-related remittances under the Liberalised Remittance Scheme (LRS), making it easier for families to send funds abroad for higher studies. This specific provision under the Income Tax No 2 Bill 2025 is expected to ease the financial planning process for thousands of households.

Insights from Stakeholders

- Experts welcome simplification but warn of transitional challenges.

- Industry may face short-term disruptions during adaptation.

While the Income Tax No 2 Bill 2025 has been praised for clarity and simplification, tax professionals caution that condensed laws can sometimes introduce interpretative challenges. The restructuring of sections could require professionals and businesses to adjust compliance manuals, retrain staff, and upgrade accounting software.

For multinational companies, aligning operations with the new framework might involve significant recalibration of ERP systems and documentation processes. Stakeholders believe that the Income Tax No 2 Bill 2025 will deliver long-term benefits but acknowledge that the initial shift could demand substantial adjustment efforts.

Critics also argue that the bill does little to address India’s narrow tax base. Data from the Comptroller and Auditor General (CAG) shows that less than 6% of the population currently files income tax returns, indicating that simplification must be coupled with stronger enforcement and outreach.

Implementation Roadmap

- Law awaits Presidential assent before coming into force.

- Possible phased rollout to ensure smooth transition.

With approval from both the Lok Sabha and the Rajya Sabha, the Income Tax No 2 Bill 2025 now awaits Presidential assent. Government sources indicate that a phased implementation from April 1, 2026, is under consideration to give taxpayers and businesses time to adapt.

In the months ahead, the CBDT is expected to issue detailed rules on the transition process, legacy cases under the old Act, and the law’s integration with the Goods and Services Tax (GST) ecosystem.

Economists suggest that a well-executed rollout could enhance India’s standing in the World Bank’s Ease of Doing Business index, especially in the “Paying Taxes” category.

Closing Reflection

The Income Tax No 2 Bill 2025 is more than a policy update, it is a legislative reset aimed at making India’s tax laws fit for the modern economy. By reducing the law’s size, simplifying its language, and aligning it with digital compliance systems, the government hopes to create a more transparent and efficient tax environment.

Stakeholders agree that the Income Tax No 2 Bill 2025 will test the capacity of both taxpayers and administrators during its initial years. If the transition is handled with clear communication and consistent interpretation, this reform could stand out as one of India’s most significant fiscal achievements in recent history.