SUMMARY

- The Centre has committed the entire $10 billion outlay under the India Semiconductor Mission, including funding for upcoming projects

- Ten semiconductor projects have been approved across six states since 2021, representing collective investments of approximately $18.5 billion

The India Semiconductor Mission has emerged as the primary catalyst for domestic India semiconductor industry ecosystem development, serving as the nodal agency under the Ministry of Electronics and Information Technology for investment screening and implementation oversight. The mission’s success is evidenced by the approval of ten projects ranging from massive fabrication investments to specialized assembly and testing facilities across multiple states including Gujarat, Assam, Uttar Pradesh, Odisha, Andhra Pradesh, and Punjab.

S Krishnan, Secretary of the Ministry of Electronics and IT, announced that the government has developed a comprehensive blueprint for the second phase of the India Semiconductor Mission, with expansion plans focusing on ecosystem support for equipment manufacturers, gas vendors, and testing firms. This expanded approach reflects the recognition that India semiconductor industry manufacturing requires a sophisticated network of supporting industries and specialized services to achieve competitive scale and efficiency.

The Design-Linked Incentive scheme represents another critical component of India semiconductor industry strategy, offering financial incentives and infrastructure support across various development stages. The scheme targets domestic companies, startups, and MSMEs involved in semiconductor design, with the objective of nurturing at least 20 domestic companies to achieve combined turnover exceeding $1.8 billion within five years. Through three distinct components including chip design infrastructure support, product design incentives, and deployment-linked benefits, the DLI scheme addresses the entire semiconductor development lifecycle.

Recent approvals include advanced manufacturing facilities in Sanand, Gujarat, Dholera, Gujarat, and expansion projects in existing facilities, demonstrating the geographic distribution of India semiconductor industry investments across India. These projects incorporate cutting-edge technologies including Silicon Carbide fabrication and advanced packaging capabilities, positioning India to compete with established global semiconductor manufacturing centers.

A defining chapter in India's semiconductor journey is unfolding, with innovation and investment driving a new wave of growth. Addressing Semicon India 2025 in Delhi. https://t.co/5jurEGuYnI

— Narendra Modi (@narendramodi) September 2, 2025

Global Competitiveness and Technological Capabilities

- India aims to achieve 25% local value addition in electronics manufacturing by FY25 and increase to 40% by 2030

- The India semiconductor industry ecosystem expansion includes focus areas such as artificial intelligence, IoT, and cloud computing technologies

India semiconductor industry competitiveness strategy leverages existing strengths in materials science, research and development, and technical talent while addressing infrastructure gaps and manufacturing capabilities. The country’s positioning as a trusted global partner emphasizes contributions across the equipment, materials, and services supply chain pillars, moving beyond traditional outsourcing models toward comprehensive manufacturing and design capabilities.

The technological focus encompasses advanced semiconductor applications including System on Chips, Integrated Circuits, and IP cores development. These high-value segments require sophisticated design capabilities and advanced manufacturing processes, areas where India semiconductor industry seeks to establish competitive advantages through targeted investments and skill development programs. The emphasis on indigenous content and import substitution reflects broader economic objectives of reducing trade dependencies while building export capabilities.

International collaboration plays a crucial role in technology transfer and capability building, with partnerships involving companies from Taiwan, South Korea, and the United States bringing advanced manufacturing processes and technical expertise to Indian facilities. These collaborations facilitate knowledge transfer while ensuring access to global markets and supply chains essential for India semiconductor industry business success.

Quality standards and certification requirements represent critical factors in global semiconductor competitiveness, with Indian facilities implementing international best practices and obtaining necessary certifications for automotive, aerospace, and defense applications. The focus on high-reliability applications demonstrates India semiconductor industry ambition to serve demanding market segments rather than limiting operations to commodity semiconductor products.

Innovation Infrastructure and Future Development Roadmap

- The Centre for Development of Advanced Computing operates the India Chip Centre providing state-of-the-art design infrastructure including EDA tools and IP cores

- Research and development priorities include smartphones, consumer durables, and networking equipment with emphasis on high-priority product segments

Innovation infrastructure development represents a fundamental pillar of India semiconductor industry strategy, with specialized facilities providing access to expensive design tools and fabrication services typically beyond the reach of startups and small companies. The India Chip Centre offers comprehensive support including Electronic Design Automation tools, Intellectual Property cores, and Multi Project Wafer fabrication services, enabling domestic companies to develop competitive semiconductor products without prohibitive upfront investments.

The government’s approach to innovation extends beyond traditional manufacturing toward emerging technologies including artificial intelligence accelerators, 5G communication chips, and electric vehicle semiconductor components. These high-growth segments offer opportunities for India semiconductor industry to establish early leadership positions in next-generation technologies rather than competing in mature market segments dominated by established players.

Workforce development initiatives address the critical need for specialized technical skills in semiconductor design, manufacturing, and testing. The India semiconductor industry requires expertise spanning materials science, process engineering, electronic design, and quality assurance, necessitating comprehensive educational programs and industry-academia partnerships. Government initiatives include specialized training programs, research fellowships, and international exchange opportunities designed to build world-class technical capabilities.

The integration of startups and MSMEs into the India semiconductor industry ecosystem represents a strategic priority, with dedicated support programs providing access to infrastructure, mentoring, and market opportunities. This approach recognizes that innovation often emerges from smaller companies with specialized expertise, requiring targeted support to scale operations and compete effectively in global markets.

Closing Assessment

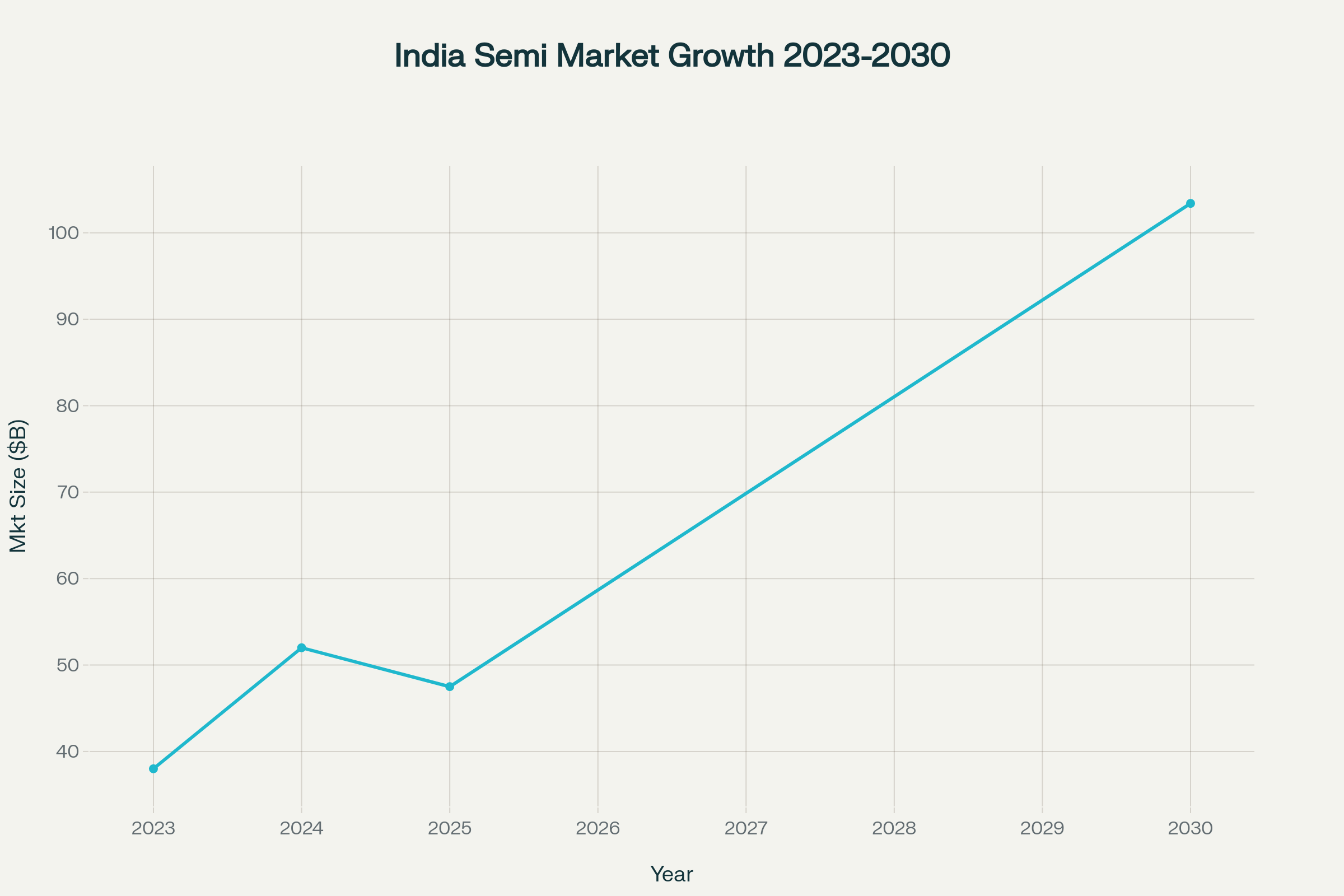

Prime Minister Modi’s characterization of semiconductor chips as “digital diamonds” encapsulates India’s transformation from a technology consumer to a manufacturing and innovation hub in one of the world’s most strategic industries. The comprehensive approach encompassing manufacturing, design, and ecosystem development positions India semiconductor industry to capture significant value creation opportunities while reducing strategic dependencies on foreign suppliers. With market projections indicating growth from $52 billion in 2024 to $103.4 billion by 2030, India semiconductor industry represents both immediate economic opportunities and long-term technological sovereignty.

The success of the India Semiconductor Mission’s first phase, with $10 billion committed and ten projects approved, provides a strong foundation for the expanded second phase focusing on ecosystem players and advanced technologies. As global supply chains continue evolving and demand for semiconductors accelerates across automotive, telecommunications, and industrial applications, India semiconductor industry strategic investments in manufacturing capabilities, innovation infrastructure, and human capital development create a compelling value proposition for both domestic and international stakeholders seeking resilient and competitive semiconductor solutions.