Key Highlights:

- Russia’s share of India’s crude oil imports rose from 21.6% in FY23 to over 35% in FY24 and FY25, making Russia India’s largest single supplier.

- US tariffs on Indian goods were raised to a record 50% in August 2025, sharply reducing Indian exports to America and reshaping trade patterns.

- Despite Western pressure, official data shows India’s Russian oil imports remained robust through October 2025, even as refiners seek alternatives and US purchases rise.

Opening Overview: Geopolitics, Energy Security, and India’s Russian Oil Imports

India’s Russian oil imports have soared dramatically since Western sanctions over the Ukraine conflict, propelling Russia to the dominant supplier position and deeply embedding Russian crude in the Indian energy matrix. Official data show that Russia accounted for more than 35% of India’s crude oil imports in the last two financial years, up sharply from 21.6% in FY23. As the US imposed record-high 50% tariffs on most Indian exports in mid-2025, trade dynamics have shifted further, testing India’s pragmatic “economics first” approach against intensifying geopolitical headwinds.

India’s Russian oil imports remain at the center of bilateral negotiations: while President Trump claims India has scaled back Russian oil purchases, official and third-party data illustrate continued high volumes, with government and trade sources emphasizing flexibility and economic necessity. This article examines the intersection of oil flows, tariffs, and bilateral trade, citing official government agencies and verified analytics to clarify India’s real import and export strategies in 2025.

Russia’s Dominance in India’s Oil Market

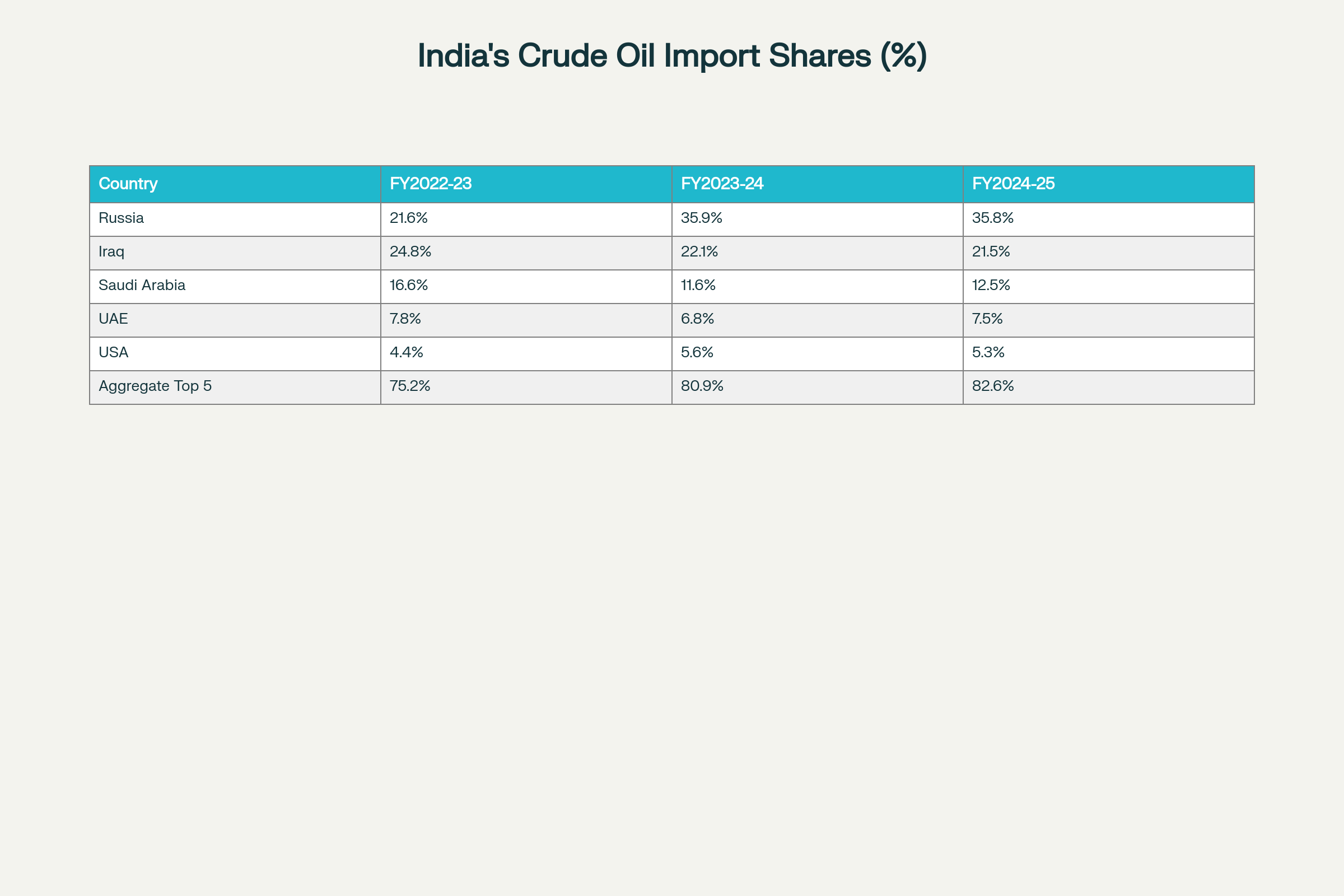

- Russia’s share of India’s crude oil imports surged from 21.6% in FY2022-23 to 35.8% in FY2024-25, marking a structural reorientation of global energy flows.

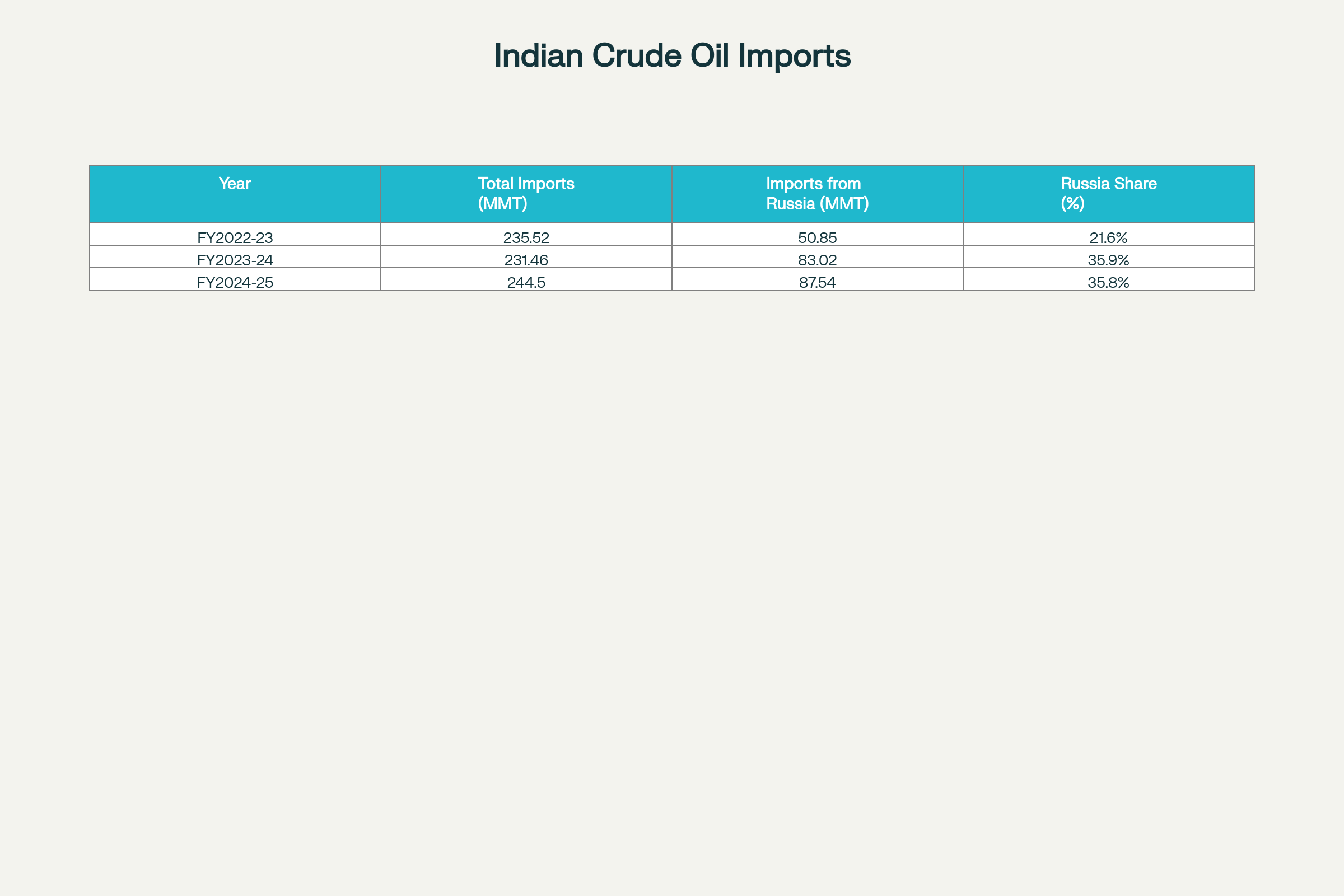

- India imported 87.54 million metric tonnes (MMT) of Russian crude in FY2024-25, nearly doubling from 50.85 MMT two years prior, according to DGCI&S data.

India’s Russian oil imports—virtually negligible before the 2022 Ukraine invasion—have become strategically central after sanctions disrupted traditional supply chains. Official statistics from India’s Directorate General of Commercial Intelligence & Statistics (DGCI&S) and the Ministry of Petroleum confirm this sharp structural transformation. Over three fiscal years, total crude imports hovered between 231-245 MMT, but purchases from Russia rose significantly, reaching 35-36% of total supply for two consecutive years.

Trends in India’s Russian oil imports demonstrate the dramatic reorientation of global energy supply chains since 2022, driven primarily by steep price discounts offered by Russian sellers, sometimes exceeding $19–20 per barrel in 2023 before narrowing to $3.5–5 per barrel by late 2024. The resulting savings were substantial, with Indian refiners realizing upwards of $16.7 billion in cumulative discount benefits since mid-2022.

Table: Country-wise Share of India’s Crude Oil Imports (FY2022-23 to FY2024-25)

Monthly Fluctuations and Policy Impact

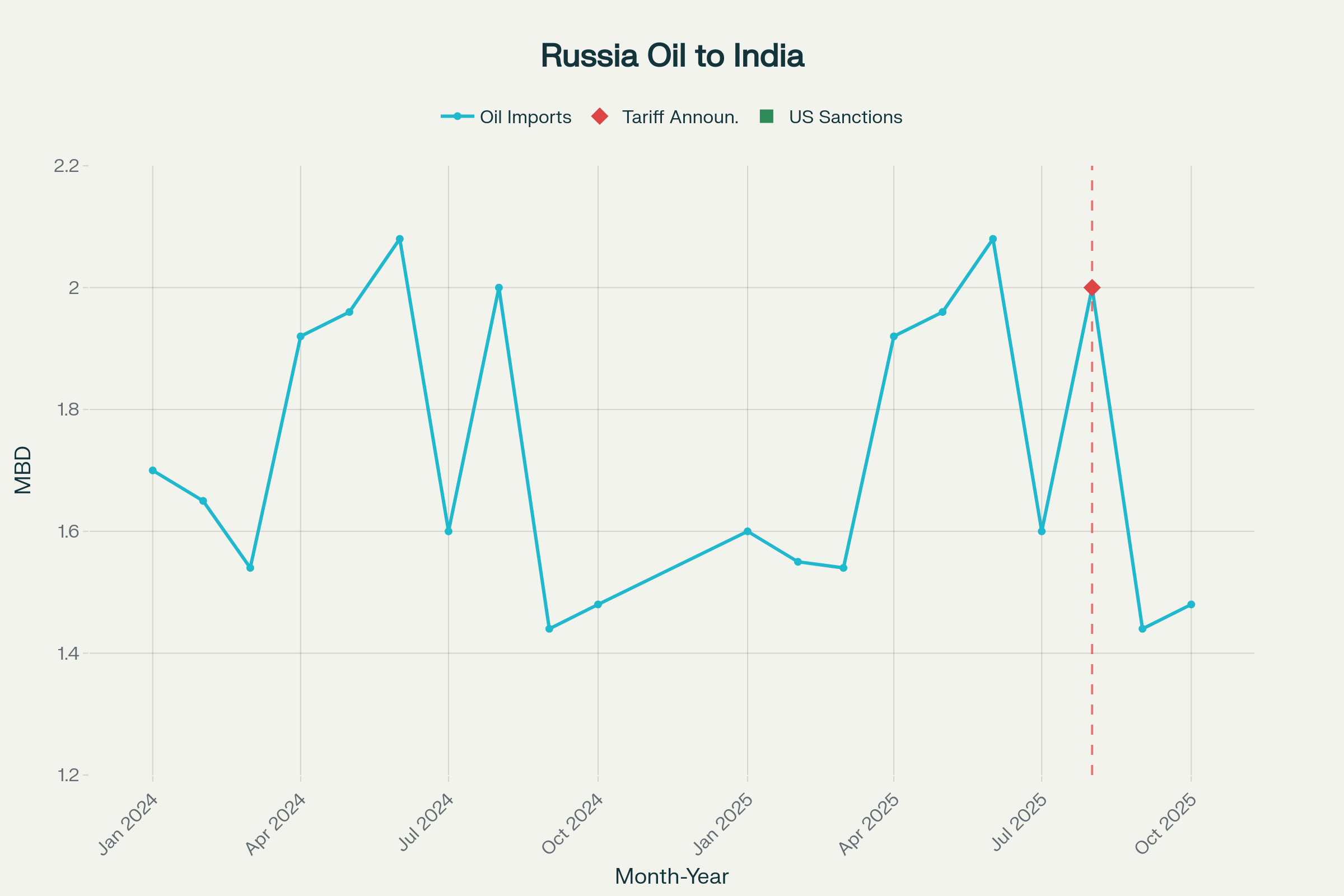

- Indian monthly imports of Russian crude ranged from 1.44 to 2.08 million barrels per day (bpd) in 2025, with periodic dips reflecting US sanctions and inventory management cycles.

- Despite US pressure and new treasury sanctions starting November 2025, Russian barrels continued flowing robustly in October 2025, with no formal directive from New Delhi halting purchases.

Both DGCI&S and commercial tracking data from Kpler & OilX corroborate these import patterns: after a summer peak in June 2025 (above 2 million bpd), Russian supplies dipped to around 1.44–1.48 million bpd in September-October but remained far above pre-war levels. India’s Russian oil imports continue to be driven by economics rather than politics, according to official ministry statements and third-party analytics firms.

Indian refiners pursued “economics first” procurement policies, seeking flexible sourcing amid changing global prices and Western political actions. Market dynamics reward flexibility: when discounts widened in East–West trade corridors, Indian volumes rebounded correspondingly. Understanding the monthly volatility of India’s Russian oil imports requires examining both market incentives and diplomatic pressure, which have moved in opposite directions throughout 2025.

Line Chart: Monthly Russian Oil Imports to India (MBD, Jan 2024–Oct 2025)

US Tariffs and Strategic Linkage to Energy Policy

- In August 2025, the United States raised tariffs on most Indian exports to a historic 50%, the steepest rate against any major US trading partner at that time.

- Affected product sectors include textiles, gems, leather, auto parts, chemicals, and pharmaceuticals, with tariff relief explicitly linked to reduction in India’s Russian oil imports.

The tariff measures—enacted by Executive Order and tracked by US Customs & Border Protection—compounded previous baseline and reciprocal tariffs, pushing effective rates from single digits to 50% for most sectors. For comparative context, this rate significantly exceeds the 30% on Chinese goods or 20% on exports from Vietnam, Thailand, and the Philippines. Official Indian government data show these tariffs caused Indian exports to the US to decline 37.5% over four months (May to September 2025), triggering exporters to rapidly diversify toward non-US markets and labor-intensive sectors.

The US strategy explicitly links tariff relief to India’s willingness to moderate India’s Russian oil imports, adding significant pressure to New Delhi’s energy security calculus. Washington has made clear that any bilateral trade deal hinges on tangible reductions in India’s Russian oil imports, creating a direct nexus between energy procurement and market access.

Table: Recent US Tariffs on Indian Products (August 2025)

| Product Sector | Pre-August Tariff | Post-August Tariff |

|---|---|---|

| Textiles & Apparel | 10–15% | 50% |

| Gems & Jewelry | 2–10% | 50% |

| Chemicals | 10–15% | 50% |

| Marine Products | 25% | 58.2% |

| Automobiles/Parts | 25% | 50% |

Source: CBP, DGCI&S, Cleartax, USITC

Official Data vs Political Rhetoric

- Indian officials confirm no formal directive has been issued to refiners to curtail Russian oil; actual import volumes remain substantial, though gradually moderating post-sanctions.

- The US has leveraged tariffs explicitly, linking future trade relief to reduction in India’s Russian oil imports, while Indian negotiators seek procurement flexibility.

India’s Ministry of External Affairs and Ministry of Petroleum consistently argue that supply-side constraints, domestic affordability, and inventory optimization—rather than geopolitical inducements—drive oil import policy decisions. Official sources confirm that Russia’s share in India’s oil basket remains above 35% through October 2025, with gradual but non-systemic decline as refiners test alternate supply from the US, Middle East, and Africa. Seasonal demand, monsoon slowdowns, and fluctuating discounts all influence monthly variations—a dynamic visible in both Kpler/OilX data and official Commerce Ministry releases.

Table: India’s Total Crude Oil Imports & Russian Volumes (FY2022-25)

Domestic refiners, including Indian Oil Corporation and Reliance Industries, indicate that purchasing decisions regarding India’s Russian oil imports are dictated primarily by pricing competitiveness and technical compatibility with existing refinery configurations. While White House statements, including those by President Trump, claim India has pledged to curtail Russian oil purchases, Indian government agencies have neither confirmed nor publicly announced any such major policy adjustment. Ministry officials instead emphasize pragmatic energy management and the challenge of abruptly shifting decades-long supply relationships. The gap between political claims and the reality of India’s Russian oil imports remains substantial, as verified by multiple official data sources.

Trade Negotiations and Future Trajectory

- Trade talks between the US and India remain active, with both sides expressing optimism about potential tariff reduction agreements by end-2025, conditional on documented moderation in India’s Russian oil imports.

- Indian officials articulate an “energy security first” doctrine, positioning procurement flexibility as vital to serving 1.4 billion consumers and maintaining stable domestic economic growth.

The intersection of record US tariffs and sustained high levels of India’s Russian oil imports places India at a delicate decision point, balancing trade benefits against energy competitiveness and domestic inflation control. The US, seeking to curtail Russian government revenues, has imposed both treasury sanctions and trade penalties but remains open to reducing tariffs if New Delhi demonstrates tangible import diversification.

The Indian Commerce Ministry underscores the adverse impact of 50% tariffs on national GDP and export volumes, and pursues diversification of goods, destinations, and sourcing to offset losses inflicted by US policy measures. Negotiations regarding India’s Russian oil imports will likely dominate bilateral discussions through 2026, with both nations seeking to reconcile economic interests and strategic objectives. Energy analysts predict that India’s Russian oil imports will remain above 30% of total crude intake through at least mid-2026, given existing contracts, refinery configurations, and price advantages.

Closing Assessment: The Enduring Reality of India’s Russian Oil Imports

In sum, India’s Russian oil imports remain significant and robust through October 2025, according to every official source and verified third-party tracker, and have definitively not been “largely stopped” as political rhetoric might suggest. The narrative of India’s energetic decoupling from Russia is not supported by either high-frequency monthly import data or official annual statistical summaries from government agencies. Tariff escalation by the United States marks a significant turning point in trade policy but remains tightly linked to US leverage over India’s Russian oil imports volumes.

For 2026 and beyond, India’s energy strategy will hinge on continued flexibility, competitive pricing dynamics, and the capacity to diversify sourcing—not wholesale ideological alignment with either Western or Eastern suppliers. Official data will remain the critical benchmark for evaluating both the reality and political rhetoric surrounding India’s Russian oil imports and its standing in global energy markets and trade relationships. The ultimate trajectory of India’s Russian oil imports will depend on both evolving market conditions and diplomatic resolution of current trade tensions between Washington and New Delhi.