Summary

- Karnataka’s small traders suspend tea, coffee, and milk sales in protest.

- Vendors reject UPI payments, citing GST notices based on digital data.

- CM Siddaramaiah calls a meeting with small trader representatives.

Brewing Discontent: Karnataka Bakeries’ Small Traders vs GST Crackdown

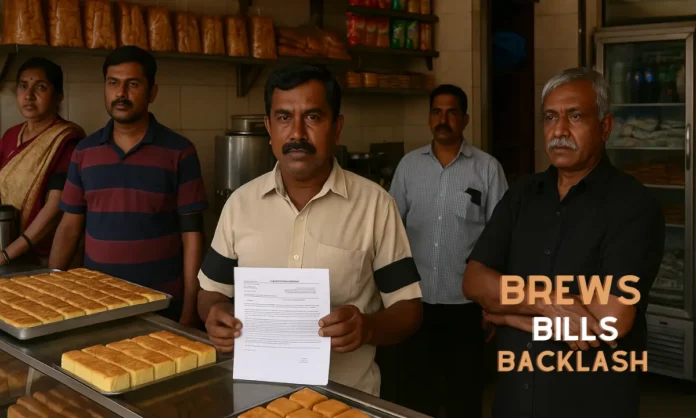

Karnataka woke up to an unusual silence on Wednesday morning. The clinking of cups and the aroma of fresh filter coffee were missing from local Karnataka Bakeries and tea stalls. In a statewide show of defiance, small traders suspended the sale of tea, coffee, and milk to protest against the Goods and Services Tax (GST) notices issued by the Commercial Tax Department. Wearing black badges and armbands, the traders accused the authorities of unfairly targeting small-scale businesses using data sourced from digital payment platforms like UPI.

The Karnataka Bakeries protest reflects a growing tension between the government’s push for digital transactions and the ground realities faced by small traders. For many vendors including Karnataka Bakeries, UPI was initially seen as a tool of convenience and transparency, but the recent notices—based solely on digital receipts crossing the GST thresholds—have turned convenience into a nightmare.

Chief Minister Siddaramaiah, sensing the mounting unrest, has called an emergency meeting with small trader associations at his residence which included Karnataka Bakeries. The meeting with Karnataka Bakeries, scheduled for the afternoon, aims to address their grievances and prevent the situation from spiraling into a full-scale confrontation. Trader groups have already warned of a statewide bandh on July 25, 2025, if the tax notices are not withdrawn.

GST Notices Trigger Panic

- Notices issued using UPI and digital transaction data.

- Thresholds of Rs 20 lakh for services and Rs 40 lakh for goods crossed digitally.

- Traders shocked over large retrospective tax demands.

The Commercial Tax Department’s sweeping enforcement drive has sparked widespread anxiety. Officials examined UPI and other digital transaction data from FY 2021–22 to FY 2024–25 and issued notices to traders and Karnataka Bakeries whose digital receipts crossed GST thresholds. Many vendors, especially those dealing in exempt goods, were taken aback.

Take the case of Shankargouda Hadimani, a vegetable seller from Haveri. Shankargouda was stunned to receive a GST notice demanding Rs 29 lakh after officials tallied his UPI transactions over four years at Rs 1.63 crore. Vegetables are GST-exempt, and Shankargouda has been filing regular returns. “I don’t even know how I can arrange such a huge sum. I sell fresh vegetables, not luxury goods,” he lamented. His story has become a symbol of the traders’ anger against what they perceive as arbitrary tax enforcement.

Officials have clarified that GST liability is determined by total turnover, not just digital payments. However, this technical explanation has failed to ease fears among traders, many of whom now see digital payments as a liability. Across cities like Bengaluru, Hubballi, and Mysuru, signs reading “No UPI, Cash Only” have appeared in bakeries and tea stalls.

Vendors Fight Back

- Black badge protests held across Karnataka.

- Tea, coffee, and milk sales suspended to highlight the issue.

- Bandh threat if notices are not withdrawn.

The protest of Karnataka Bakeries was highly symbolic yet impactful. Tea and coffee are integral to Karnataka’s culture, and their absence sent a strong message to the government. Labour activist Ravi Shetty, who coordinated the protests in parts of Bengaluru, said, “Today we are wearing black bands on our arms. No Karnataka Bakeries is selling milk. Only black tea will be available as a mark of protest.”

While other commercial activities continued, the protest disrupted morning routines for thousands of people. Many customers expressed solidarity, while some were frustrated at the lack of their daily coffee fix from Karnataka Bakeries. A Karnataka Bakeries owner in Basavanagudi noted that despite losing sales, participating in the protest was necessary. “This is about survival. We are not refusing to pay fair taxes, but these arbitrary notices will destroy small businesses,” he said.

Trader associations including Karnataka Bakeries are now preparing for a more aggressive stance if their demands go unheard. The July 25 bandh could see shops and small businesses across Karnataka shut their doors in unison, marking one of the largest protests against tax enforcement in recent years.

Government Under Pressure

- CM Siddaramaiah to meet small trader groups.

- Need for balance between tax enforcement and small business survival.

- Digital payments face backlash due to perceived misuse of data.

Chief Minister Siddaramaiah’s quick response indicates the seriousness of the issue. He is expected to meet representatives of small trader associations, including members of bakery and street vendor unions. The government is under increasing pressure to strike a balance between tax enforcement and protecting the livelihoods of small entrepreneurs.

Traders including Karnataka Bakeries argue that while large corporations find ways to manage tax liabilities, small vendors are being unfairly penalized for adopting digital payment systems that the government itself has promoted. “We switched to UPI because we were told it’s the future of payments. Now, the same data is being used against us,” said Rajiv Gowda, a bakery owner from Mysuru.

The controversy also raises questions about the effectiveness of India’s digital financial policies. While UPI has been celebrated for its role in increasing transparency and reducing cash dependency, cases like these risk pushing small traders back into cash-only operations, undermining the very goal of a digital economy.

What Lies Ahead?

- July 25 bandh could disrupt commerce statewide.

- Potential policy review on GST enforcement methods.

- Traders demand withdrawal of unfair notices.

If the government fails to reach a compromise, the protests are likely to intensify. A bandh would not only affect bakeries and tea stalls but also small retail shops, markets, and roadside vendors across the state. Such a move could disrupt daily life and send strong political signals, particularly ahead of local body elections.

For now, all eyes are on Siddaramaiah’s meeting. A rollback of the notices or a clear policy clarification could calm tensions. However, if traders perceive the outcome as inadequate, the July 25 bandh could mark the beginning of a larger, prolonged standoff between small businesses and tax authorities.

A Brewing Storm

The Karnataka GST protest is more than just a dispute over tax notices—it reflects a larger clash between policy enforcement and the realities of small business operations. As the state increasingly moves toward digital financial systems, small traders are struggling to adapt without feeling penalized for their compliance. The suspension of tea, coffee, and milk sales was a symbolic but powerful act, highlighting the frustrations of a sector often ignored in policy debates.

If a resolution is not reached soon, the situation could escalate into a broader challenge for both the state government and its digital payment policies. The coming days, particularly the outcome of Siddaramaiah’s meeting and the planned July 25 bandh, will determine whether this storm subsides or intensifies into a larger movement. For now, Karnataka’s tea cups remain empty, and its traders are determined to make their voices heard.