Key Highlights:

- Kerala High Court terms Centre’s stance on Wayanad landslide victims loan waiver as “stepmotherly attitude” and constitutional failure

- Judicial bench stays all banking recovery actions against disaster survivors until PIL disposal on October 29

- Court challenges Centre’s differential treatment citing Rs 707 crore approval for Gujarat-Assam while denying relief to affected families

Constitutional Challenge Over Relief Denial

The Kerala High Court delivered unprecedented criticism of the Union government’s refusal to grant Wayanad landslide victims loan waiver, with Justice A K Jayasankaran Nambiar and Justice Jobin Sebastian declaring that the Centre has “virtually failed” the disaster survivors. The judicial bench explicitly rejected the government’s constitutional defense, emphasizing that Article 73 grants vast executive powers that should be exercised for humanitarian crises involving affected families.

The Central Government’s refusal to waive the loans of those affected by the devastating Wayanad landslides of 2024 is shocking. Especially while the loans of certain large business houses are waived without hesitation. These loans represent the lives of people who have endured…

— Priyanka Gandhi Vadra (@priyankagandhi) October 8, 2025

The court’s suo motu PIL addressing disaster management became the battleground for this constitutional confrontation, with judges terming the Centre’s position as “unfortunate” and “exasperating” regarding relief for affected families. The bench questioned the government’s willingness rather than capability, asking “Who are you trying to fool?” when confronted with bureaucratic explanations for denying the Wayanad landslide victims loan waiver. This judicial intervention establishes significant precedent for disaster-related financial relief policies, particularly concerning affected families as a constitutional expectation.

Banking Recovery Moratorium Imposed

The Kerala High Court issued comprehensive stay orders halting all recovery proceedings against affected families, impleading 12 major banking institutions including State Bank of India, Canara Bank, Central Bank of India, Punjab National Bank, and Bank of Baroda as parties to the case. The judicial directive specifically prohibits banks from employing “Shylockian methods” to recover loans from disaster survivors whose agricultural properties and livelihoods were completely destroyed.

- Banks directed to file counter-affidavits indicating willingness for complete or partial relief for affected families

- All recovery actions suspended until final case disposal scheduled for October 29, 2025

- Financial institutions must justify refusal to grant relief with reference to constitutional fairness

The bench emphasized that asking disaster survivors to repay agricultural loans when their collateral security has “ceased to exist” constitutes “an affront to their dignity” in the context of relief for affected families. This judicial protection provides immediate relief to approximately 3,500 affected families while establishing legal framework for future disaster-related policies involving the Wayanad landslide victims loan waiver. The court’s reference to fundamental rights demonstrates intersection between banking regulations and constitutional obligations during humanitarian crises requiring relief for affected families.

Discriminatory Treatment Allegations

The court highlighted stark disparities in the Centre’s disaster response approach, noting that while the Union government approved Rs 707 crore for flood and landslide-affected Gujarat and Assam during 2024, it refused relief despite similar catastrophic circumstances affecting families in Kerala. This comparison became central to judicial arguments about differential treatment violating federal constitutional principles regarding disaster relief policies.

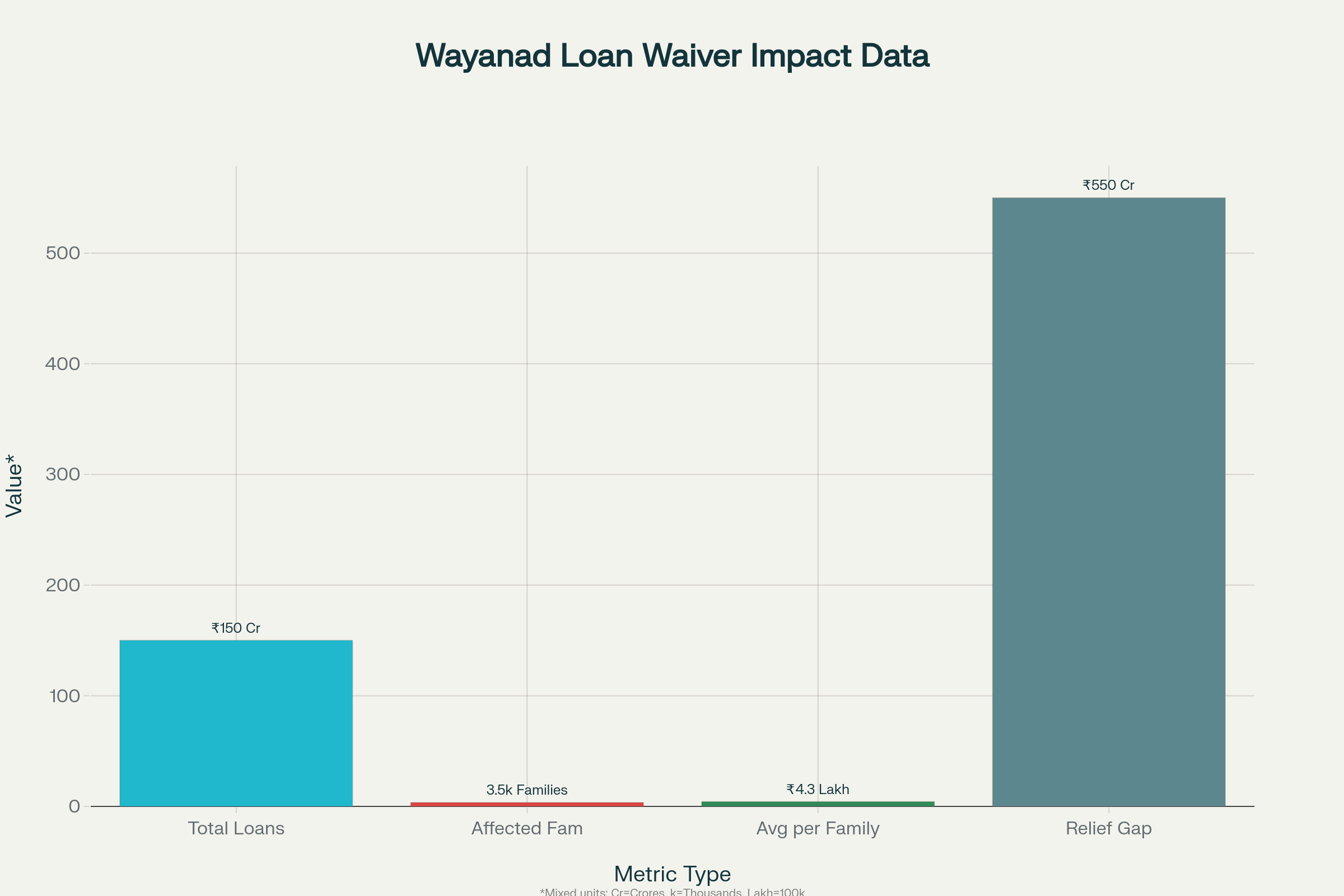

MP Priyanka Gandhi reinforced these allegations, stating that the Centre readily waives loans for big businesses while denying relief to affected families, highlighting selective application of financial assistance policies. According to official data, the disaster affected approximately 3,500 families with outstanding agricultural loans totaling around Rs 150 crore requiring consideration for the Wayanad landslide victims loan waiver. The average burden per affected family stands at Rs 4.3 lakh, representing substantial financial stress for survivors seeking relief through the Wayanad landslide victims loan waiver.

Wayanad landslide victims loan waiver requirements compared to available relief funding shows significant financial burden on disaster survivors

Official Position And Regulatory Framework

The Centre’s Ministry of Home Affairs affidavit claimed no provision exists for granting relief in natural disaster cases, with the Ministry of Finance asserting limited powers to intervene in banking transactions regulated by the Reserve Bank of India. The RBI separately communicated that it cannot mandate banks to provide relief for affected families, suggesting only moratorium or restructuring options as feasible alternatives.

However, the Kerala High Court rejected these jurisdictional arguments regarding the Wayanad landslide victims loan waiver, emphasizing that constitutional authority under Article 73 provides sufficient executive power for humanitarian intervention. The judicial bench criticized bureaucratic responses as inadequate for addressing the constitutional implications of denying relief during severe natural disasters affecting thousands of families. Official casualty statistics reveal 298 confirmed deaths with 32 missing persons declared deceased, while 359 individuals were reported as dead or missing in the disaster that necessitates consideration of the Wayanad landslide victims loan waiver.

Legal Precedent And Future Implications

The Kerala High Court’s intervention in this controversy establishes watershed judicial precedent for India’s disaster response jurisprudence, creating binding oversight of executive humanitarian obligations during natural calamities affecting vulnerable families. The court’s stay on banking recovery actions provides immediate constitutional protection for thousands of families while challenging federal-state boundaries in disaster management regarding relief policies.

The judicial observation that “party politics cannot negate constitutional guarantees of fundamental rights protection” underscores broader implications of this case for disaster victims across India seeking similar relief measures. With the matter scheduled for final hearing on October 29, 2025, the Centre faces mounting constitutional pressure to reconsider its position on the Wayanad landslide victims loan waiver, particularly given judicial emphasis on dignity and fairness in state action. This legal precedent may establish relief for disaster-affected families as constitutional expectation rather than discretionary government charity, influencing future disaster response policies nationwide regarding the Wayanad landslide victims loan waiver.