Key Highlights

- Union Minister Piyush Goyal announces strict monitoring mechanisms to ensure full GST benefits transfer to consumers

- Government plans close surveillance with state cooperation to track price reductions post-September 22 implementation

- Industry provides assurances of complete tax reduction pass-through to retail prices

Opening Context Sets National Reform Agenda

The Modi government has implemented comprehensive surveillance mechanisms to guarantee that the benefits of major GST rationalisation reforms reach consumers in full, Union Commerce and Industry Minister Piyush Goyal announced during a media briefing at the BJP headquarters on Friday. The gst rationalisation benefits to consumers initiative represents the most significant tax reform since India’s independence, transitioning from the current four-slab structure to a simplified two-rate framework. GST rationalisation benefits to consumers will be actively monitored through coordinated federal and state oversight to prevent corporate retention of tax savings. The minister emphasised that gst rationalisation benefits to all consumers monitoring would extend beyond implementation through sustained vigilance mechanisms.

PM @NarendraModi ji's historic Diwali gift for all!

— Piyush Goyal (@PiyushGoyal) September 3, 2025

Heartiest congratulations to PM Modi ji and FM @NSitharaman ji on the introduction of the #NextGenGST reforms, duly supported by the @GST_Council in line with the Union Government’s proposals on GST rate cuts and reforms.… pic.twitter.com/C5ZGogC1UR

Government Monitoring Framework Ensures Price Transfer Mechanisms

The Centre has established comprehensive oversight protocols to track gst rationalisation benefits to consumers implementation across all affected sectors. Goyal confirmed that industry leaders have provided written assurances that “the entire fall in taxes on various items will be reflected in their prices,” establishing accountability frameworks for gst rationalisation benefits to consumers delivery.

- Federal monitoring through dedicated surveillance teams tracking retail price movements

- State government coordination for ground-level implementation oversight

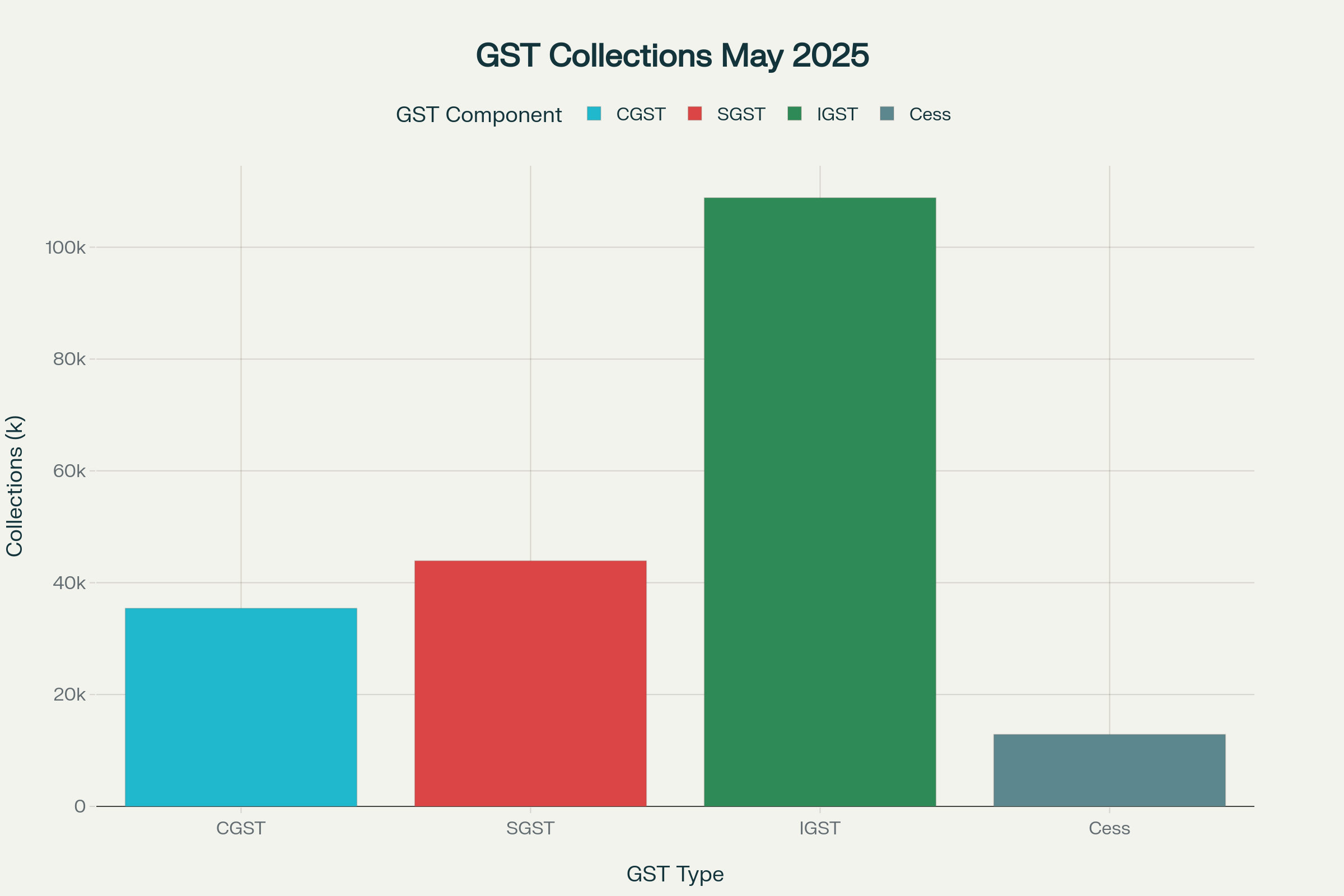

Official data from the Press Information Bureau indicates that the GST Council’s 56th meeting approved sweeping reforms affecting approximately 453 goods categories, with 413 items receiving rate reductions. The gst rationalisation benefits to all consumers package includes moving 295 essential items from 12% to 5% or NIL rates, directly impacting household budgets. Finance Ministry statistics show that gst rationalisation benefits to all consumers could reduce inflation by 65-75 basis points in FY26, according to State Bank of India research projections.

The government’s commitment to ensuring gst rationalisation benefits to all consumers reach households involves multi-tier verification processes including parliamentary member involvement at constituency levels. Union Finance Minister Nirmala Sitharaman confirmed that gst rationalisation benefits to all consumers monitoring represents a “big vigilance exercise” with confidence that benefits will reach common citizens.

US Tariff Independence Establishes Reform Credibility

Minister Goyal firmly dismissed suggestions that recent US tariff impositions influenced the timing of GST reforms, clarifying that gst rationalisation benefits to consumers emerged from sustained year-long consultations. The decision-making process involved extensive deliberations among central and state finance ministers alongside senior administrative officials, establishing the autonomous nature of gst rationalisation benefits to consumers initiatives.

- Year-long consultation process involving federal and state stakeholders

- Independent policy formulation unrelated to external trade pressures

- Consensus-based approach ensuring gst rationalisation benefits to consumers sustainability

“This decision has no link whatsoever with any decision of any country. Such a big change cannot happen overnight,” Goyal stated, emphasising that gst rationalisation benefits to consumers represented strategic domestic policy rather than reactive measures. The minister highlighted that US tariff decisions occurred only last month, while gst rationalisation benefits to consumers planning began nearly twelve months earlier.

The Commerce Ministry’s official statement confirms that gst rationalisation benefits to all consumers reforms address structural tax system improvements rather than external trade pressures. These gst rationalisation benefits to all consumers measures focus on creating sustainable domestic demand growth through reduced tax burdens on essential commodities.

Economic Impact Analysis Projects Substantial Consumer Relief

Research projections indicate that gst rationalisation benefits to consumers could deliver significant inflation moderation and increased purchasing power. Citi Research estimates suggest households will experience spending power increases equivalent to 0.7-0.8% of GDP for fiscal year 2026, amplifying gst rationalisation benefits to consumers across economic segments.

- Inflation reduction potential of 1.1 percentage points with complete pass-through implementation

- Consumer electronics sector transitions from 28% to 18% GST rates

- Essential goods categories moving to 5% or zero tax brackets

SBI Research analysis confirms that gst rationalisation benefits to all consumers will moderate consumer price index inflation by 25-30 basis points in essential goods categories during 2026. The gst rationalisation benefits to consumers framework affects approximately 8.5% of the Consumer Price Index basket, creating substantial downward pressure on retail prices.

Manufacturing sectors including textiles, automobiles, electronics, and construction materials will experience significant cost reductions, enabling enhanced gst rationalisation benefits to consumers through improved supply chain economics. The elimination of inverted duty structures particularly benefits MSME manufacturers, facilitating better gst rationalisation benefits to consumers transmission.

Political Response Framework Addresses Opposition Criticism

The minister strongly countered Congress party criticism regarding delayed GST implementation, asserting that gst rationalisation benefits to consumers criticism exposes opposition shortcomings. Goyal highlighted that Congress governments failed to implement GST during their 2004-2014 tenure, choosing to focus on corruption instead of gst rationalisation benefits to consumers development.

- Congress-led state governments attempted GST Council obstruction

- Opposition criticism reflects internal party limitations

- Consensual decision-making ensures gst rationalisation benefits to consumers sustainability

The minister specifically targeted Rahul Gandhi, comparing him to “a rocket which could not take off despite numerous launch attempts,” suggesting that gst rationalisation benefits to consumers criticism lacks credible foundation. Goyal emphasised that Gandhi’s inconsistent positions demonstrate disconnect from gst rationalisation benefits to consumers realities affecting ordinary citizens.

Electoral considerations do not drive government decisions, with Goyal recalling Prime Minister Modi’s instruction to delay investment announcements in poll-bound states, demonstrating commitment to gst rationalisation benefits to consumers over political advantages. This approach ensures that gst rationalisation benefits to consumers maintain integrity regardless of political cycles.

Closing Assessment Confirms Systematic Implementation Strategy

The comprehensive gst rationalisation benefits to consumers framework represents transformative tax policy delivering immediate relief while establishing long-term economic growth foundations. Through coordinated federal-state monitoring, industry accountability mechanisms, and inflation reduction projections, gst rationalisation benefits to consumers ensure that September 22 implementation translates into tangible household savings. The government’s proactive surveillance approach demonstrates unprecedented commitment to gst rationalisation benefits to consumers verification, establishing consumer-centric governance standards for major policy reforms.