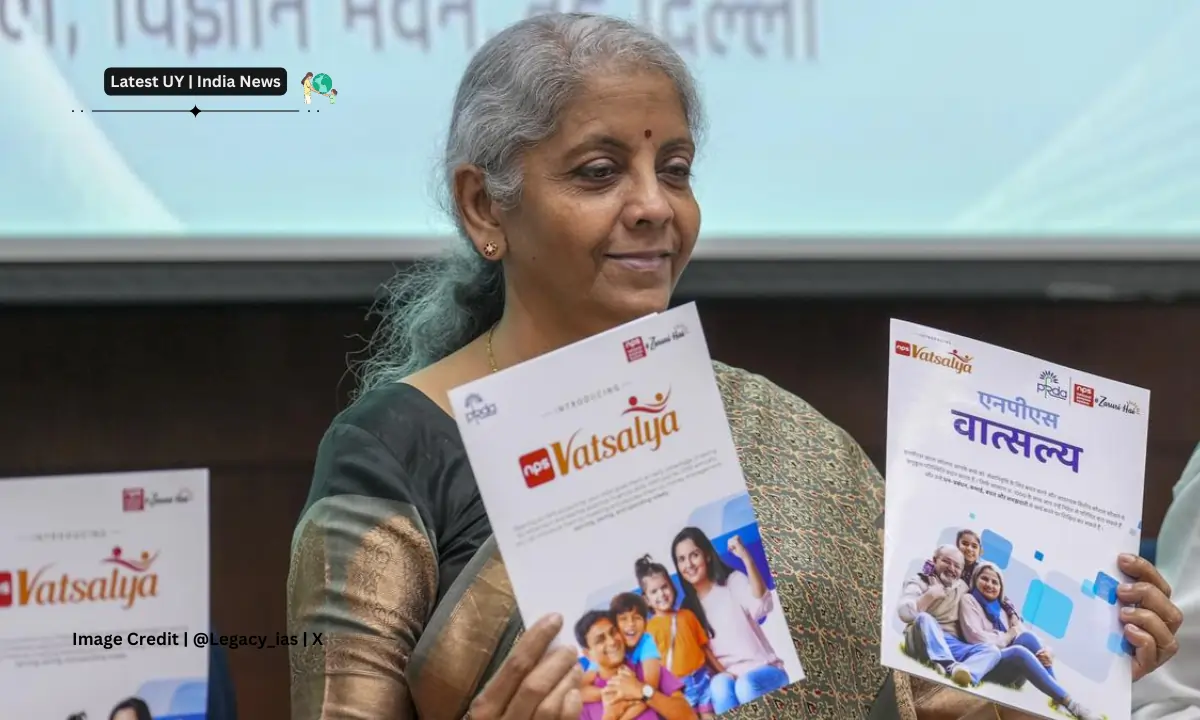

India is once again pushing forward with innovative financial schemes in an era of rising economic uncertainties and the need for long-term financial planning. However, this scheme will not only secure the future of the adults but also look after the next generation. The launch of the National Pension System (NPS) Vatsalya scheme is one of the most innovative developments in this direction. Moreover, the NPS Vatsalya is a revolutionary pension and savings initiative, which was announced by Finance Minister Nirmala Sitharaman, and specifically designed for minors.

However, this scheme will focus on providing financial security as well as an early investment advantage to the children. Therefore, the scheme makes a pivotal shift in the method of Indian financial literacy and future planning. Therefore, the details of this scheme will be unveiled shortly at an event in Delhi and many school children will attend this. However, the government is organizing launch events at 75 locations across the country.

Overview of the NPS Vatsalya Scheme

As introduced by the Finance Minister NPS Vatsalya, is an extension of the highly popular national pension system in India. It has historically focused on the adults and the working professionals preparing for their retirement. Moreover, this new scheme, which was launched by the financial minister recently, has focused on individuals under the age of 18. It has given an opportunity to the parents to start investing and saving for their children’s future from a very young age. The NPS Vatsalya scheme has given the structure to offer long-term benefits by joining the benefits of early savings with the power of compounding.

This will help minors build a solid financial foundation over time and ensure that by the time they reach adulthood. However, this scheme was announced in Budget 2024. It has also been analyzed that the Financial Minister will distribute PRAN membership to the new minor subscribers in the 75 locations across the country. Additionally, this scheme’s tax welfares make it even more attractive for parents and guardians looking to make a monetarily safe future for their children.

Key Features of NPS Vatsalya

As we know the Finance minister has offered a unique scheme for the minor, the NPS Vatsalya scheme. Its main aim is to provide long-term benefits to children by opening their accounts under the age of 18. However, the contributions that are made to the account are usually invested in government securities, corporate bonds and the balanced portfolio of equities. Through the power of compounding, it is ensuring a steady growth of funds.

Moreover, one of the key features of this scheme is the tax benefits. The scheme offers tax benefits under section of 80C of the Income Tax Act. It means that the parents are allowed to deduct their contribution, and further improve the appeal of the scheme. However, the parents are not allowed to withdraw this amount whenever they feel like, it until the children reach 18 years of age, ensuring that the funds remain untouched and will continue to grow for them. Moreover, partial withdrawals are allowable in precise cases, such as higher education or medicinal emergencies, providing suppleness when needed.

In addition, the individual will receive a lifelong pension, upon reaching retirement age, safeguarding financial constancy post-retirement. By contributing both early savings and long-term pension benefits, this feature sets NPS Vatsalya apart from other child-centric savings schemes. Overall, NPS Vatsalya offers an all-inclusive method to secure a child’s future. Therefore, making it a comprehensive financial tool for families by joining savings, investments, tax compensations, and a healthy pension agenda.

Addressing Financial Literacy in Young India

Among the younger generation, the most commendable aspect of the NPS Vatsalya scheme is its role in promoting financial literacy. The government is motioning the importance of starting financial planning early in life by presenting a pension and savings plan precisely for minors. However, the financial literacy rate is low in India, especially among young individuals, the scheme aims to educate and inspire parents and children to prioritize investment and saving from a young age. Moreover, this scheme will help young people to create discipline among them to save and invest in practices from their early years. Through this, they will likely grow up with a stronger sympathy for monetary management, making them for future financial challenges.

NPS Vatsalya: A Long-Term Solution to Economic Uncertainty

Many countries including India are grappling with economic uncertainties and rising inflation rates. However, this economic uncertainty has a direct impact on the financial future of its citizens. By offering a comprehensive savings and pension plan for minors, the NPS Vatsalya scheme serves as a proactive solution to these challenges. Moreover, the scheme aims to alleviate future financial risks for individuals with its focus on long-term investment and pension benefits.

However, this scheme makes sure that the children are monetary secure in their adult lives and also after retirement, by enabling parents and guardians to capitalize on the future of their children from an early age. In an increasingly volatile global economy, this long-term vision is especially relevant. Therefore, securing financial individuality has become more critical than ever.

A Comparative Look at Other Child-Focused Schemes

In India, the NPS Vatsalya scheme is not the first child-focused saving initiative launched. The government has introduced several schemes aimed at securing the financial future of minors over the years. For minors, various schemes were launched like Sukanya Samriddhi Yojana and the Public Provident Fund (PPF). However, this NPS Vatsalya scheme is more important and beneficial due to its comprehension of pension benefits, which other child-focused schemes do not offer.

If we compare that past scheme with the NPS Vatsalya then we can see that the sukanya samriddhi yojana has been targeted for the girl child and there were no longer pension benefits like NPS Vatsalya provides. Similarly, if we look after that PPF for minors then it allows the parents to save for their child’s future. However, it does not offer the same level of flexibility and long-term security as NPS Vatsalya. Thus, the scheme fills a vital gap in India’s fiscal landscape by contributing both savings and pension welfare in one package.

Potential Challenges and Criticism

The scheme of NPS Vatsalya scheme offers numerous benefits but it is not without challenges. To lower-income families, the accessibility of the scheme is the primary concern. There is still an important portion of the population that does not have access to banking or monetary services despite the government’s efforts to promote financial inclusion. However, for these families, it may not be the priority or feasible option to invest in a long-term pension plan for their children.

The scheme will depend on the financial literacy of the parents so that they can invest and save for their child, which will give success to this scheme. It may take time for the general population to fully comprehend and rise, while the scheme aims to endorse financial awareness and the welfare of early investment in a pension plan for minors. Therefore, to ensure the scheme reaches its full potential the government may need to invest in financial education campaigns to ensure.

FAQ

What is NPS Vatsalya?

NPS Vatsalya is a pension and savings scheme launched by the Government of India for minors. It lets parents or guardians open a “National Pension System (NPS)” account for children under 18, providing long-term monetary security through savings and future pension benefits.

Who can open an NPS Vatsalya account?

Parents or legal godparents of minors under 18 years of age can open an NPS Vatsalya account on behalf of the child.

Can the child withdraw money from the account before turning 18?

No, the account remains protected until the child turns 18. However, incomplete withdrawals are allowable for exact purposes such as higher education or medical difficulties

What tax benefits does NPS Vatsalya offer?

Contributions to the NPS Vatsalya scheme are qualified for tax deductions under Section 80C of the Income Tax Act, providing tax savings for parents or guardians.

What happens when the child reaches 18 years of age?

Once the child reaches 18, they can start handling the account themselves. The funds endure to grow until retirement, when the individual will be qualified for a lifelong pension.

Is NPS Vatsalya only for children in India?

Yes, the scheme is designed for Indian citizens, and parents or guardians who exist in India can open accounts for their children.

What if the account holder passes away before reaching retirement?

In the unlucky event of the account holder’s death before retirement, the collected corpus can be transferred to the nominee chosen in the account.

How can I open an NPS Vatsalya account?

Parents or guardians can visit the official NPS website or method any official financial organization to open an NPS Vatsalya account for their child.