Key Highlights:

- Economic Offences Wing issued Lookout Circular against Shilpa Shetty and Raj Kundra on September 5, 2025, preventing them from leaving India during the Shilpa Shetty Raj Kundra cheating case investigation worth ₹60.48 crore

- Mumbai businessman Deepak Kothari alleges the couple misappropriated funds between 2015-2023 that were meant for business expansion of their now-defunct Best Deal TV Private Limited in this Shilpa Shetty Raj Kundra cheating case

- The Shilpa Shetty Raj Kundra cheating case involves allegations of converting a ₹75 crore loan deal into an investment scheme to avoid taxation while promising guaranteed returns

Initial Context and Legal Framework

The Shilpa Shetty Raj Kundra cheating case represents one of the most significant financial fraud allegations in the entertainment industry this year. The Economic Offences Wing (EOW) of Mumbai Police registered the Shilpa Shetty Raj Kundra cheating case on August 13, 2025, following a detailed complaint by Deepak Kothari, a 60-year-old director of Lotus Capital Financial Services. The Shilpa Shetty Raj Kundra cheating case has escalated to include travel restrictions through a Lookout Circular, highlighting the seriousness of the allegations against the celebrity couple.

The legal framework surrounding this Shilpa Shetty Raj Kundra cheating case operates under multiple sections of the Indian Penal Code, including Section 403 for dishonest misappropriation of property, Section 406 for criminal breach of trust, and Section 34 for common intention. Since the disputed amount in the Shilpa Shetty Raj Kundra cheating case exceeds ₹10 crore, the investigation was automatically transferred to the Economic Offences Wing, which specializes in high-value financial crimes. The Shilpa Shetty Raj Kundra cheating case has attracted significant attention due to the involvement of high-profile personalities and the substantial amount allegedly misappropriated from a legitimate business transaction.

The Lookout Circular mechanism serves as a critical tool for preventing suspects from fleeing the country during ongoing investigations. In this Shilpa Shetty Raj Kundra cheating case, the EOW issued the circular citing the couple’s frequent international travels, ensuring they remain available for questioning throughout the investigative process.

Business Deal Structure and Financial Transactions in Shilpa Shetty Raj Kundra Cheating Case

The alleged fraud in the Shilpa Shetty Raj Kundra cheating case centers around Best Deal TV Private Limited, a home shopping and online retail platform where Shilpa Shetty held approximately 87.61% equity shares at the time of the transactions. The company operated in lifestyle, fashion, health, and beauty products through online channels, representing a significant business venture for the celebrity couple during 2015-2016.

Deepak Kothari’s complaint in the Shilpa Shetty Raj Kundra cheating case details a sophisticated financial arrangement that began in 2015 when he was introduced to the couple through intermediary Rajesh Arya. Initially, Raj Kundra sought a loan of ₹75 crore at 12% annual interest for business expansion purposes. However, according to the Shilpa Shetty Raj Kundra cheating case allegations, the arrangement was restructured as an “investment” to avoid higher taxation while promising monthly returns and repayment of the principal amount.

The financial transfers in the Shilpa Shetty Raj Kundra cheating case occurred in two major installments: ₹31.95 crore in April 2015 under a share subscription agreement, followed by an additional ₹28.53 crore in September 2015 under a supplementary agreement. The total amount transferred reached ₹60.48 crore plus ₹3.19 lakh in stamp duty, all credited to Best Deal TV’s HDFC Bank accounts. In April 2016, as documented in the Shilpa Shetty Raj Kundra cheating case, Shilpa Shetty provided a written personal guarantee assuring Kothari that the money would be returned with 12% annual interest, making her individually liable for the debt beyond her role as company director.

The business relationship deteriorated when Shilpa Shetty resigned as director in September 2016 without informing Kothari, shocking the complainant who had invested based on her personal guarantee in what would later become the Shilpa Shetty Raj Kundra cheating case. This resignation occurred shortly before the company faced insolvency proceedings, raising questions about the timing and motivations behind the decision.

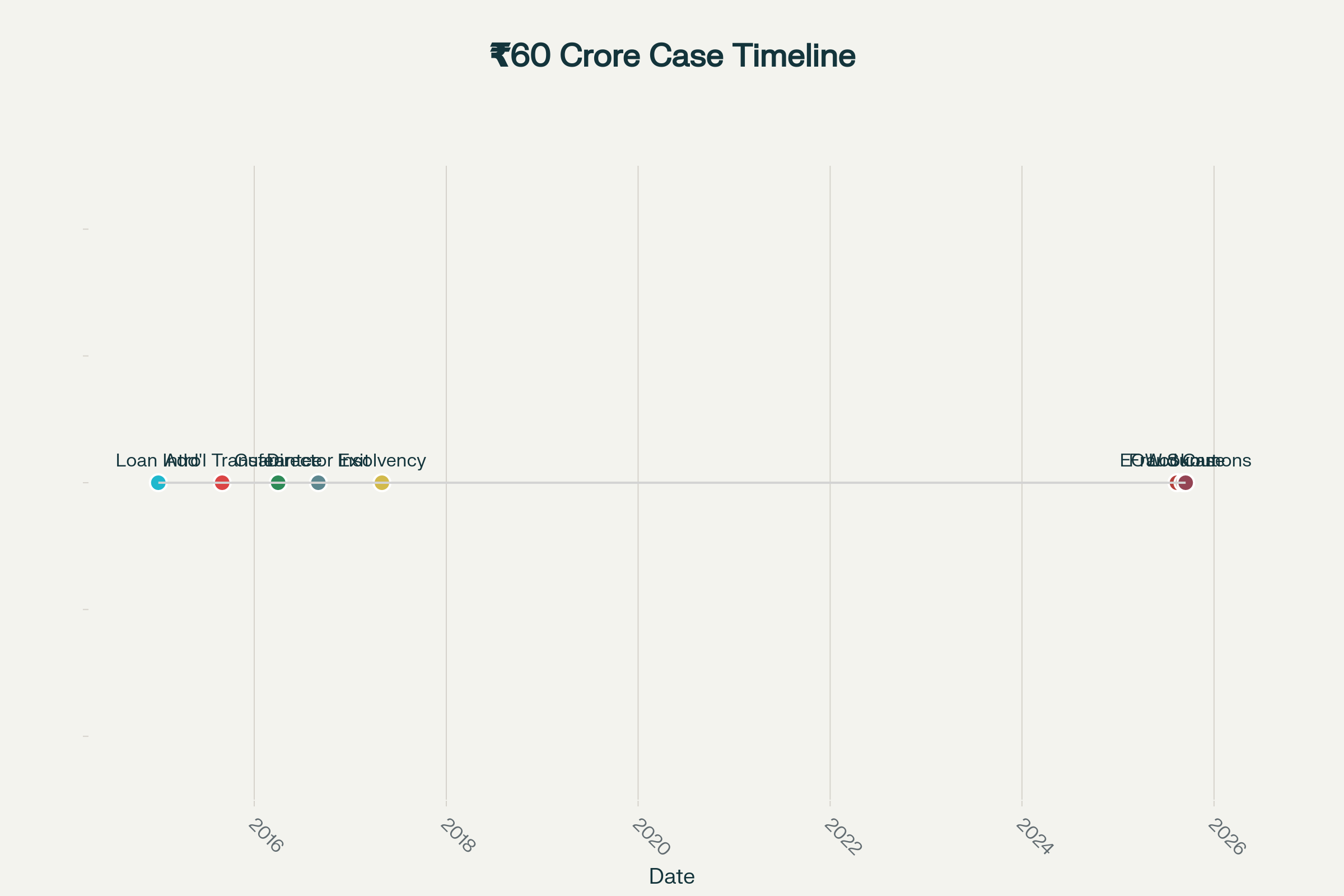

Chronological events in ₹60 crore cheating case against Shilpa Shetty and Raj Kundra

Insolvency Proceedings and Corporate Collapse

The corporate structure of Best Deal TV Private Limited became increasingly complex following the investment, leading to eventual insolvency proceedings that exposed the underlying financial problems central to the Shilpa Shetty Raj Kundra cheating case. In 2017, Kothari discovered that vendor Aesthetique Solutions had filed insolvency proceedings worth ₹1.28 crore against Best Deal TV under Section 9 of the Insolvency and Bankruptcy Code 2016. The National Company Law Tribunal Mumbai admitted this case in May 2017, marking the beginning of a lengthy legal battle that would continue for several years and eventually lead to the Shilpa Shetty Raj Kundra cheating case.

The insolvency proceedings revealed a pattern of financial distress within the company, with multiple hearings at NCLT Mumbai extending well into 2024. As recently as November 2024, there were still proceedings related to the dissolution of the corporate debtor, indicating the complex nature of the company’s financial obligations and the unsuccessful resolution attempts that form the backdrop of the Shilpa Shetty Raj Kundra cheating case. The company eventually went into liquidation after all efforts to revive the business failed, leaving creditors including Kothari without recourse to their investments.

During this period, according to the Shilpa Shetty Raj Kundra cheating case allegations, Kothari’s repeated attempts to recover the money were met with delays and excuses, particularly during the COVID-19 pandemic when Kundra cited the global crisis as a reason for non-repayment. The complainant claims in the Shilpa Shetty Raj Kundra cheating case that the funds were diverted for personal expenses rather than the promised business expansion, violating the terms of both the loan agreement and the subsequent investment arrangement.

The collapse of Best Deal TV Private Limited serves as a critical element in the current Shilpa Shetty Raj Kundra cheating case, as investigators examine whether the company’s financial problems were known to the directors at the time of accepting Kothari’s investment. The timing of Shilpa Shetty’s resignation just months before the insolvency proceedings began has raised questions about potential advance knowledge of the company’s deteriorating financial condition.

Current Investigation Status and Legal Proceedings

The Shilpa Shetty Raj Kundra cheating case investigation has entered a crucial phase with the Economic Offences Wing actively pursuing multiple lines of inquiry to establish the money trail and determine criminal liability. Raj Kundra has been summoned to appear before EOW investigators on September 15, 2025, after initially seeking an extension from the original September 10 date in the Shilpa Shetty Raj Kundra cheating case proceedings. The couple was previously called for questioning three times during the preliminary inquiry but did not appear, citing their stay in London and instead sending legal representatives.

The EOW has also summoned the auditor of the National Company Law Tribunal who examined the firm’s books before liquidation proceedings in the Shilpa Shetty Raj Kundra cheating case, indicating a comprehensive approach to understanding the company’s financial operations. Investigators are scrutinizing detailed cash flow statements and all supporting documents provided by the couple’s auditors to trace how the invested funds were utilized.

An audio recording between Raj Kundra and complainant Deepak Kothari has surfaced on social media related to the Shilpa Shetty Raj Kundra cheating case, though its authenticity remains unconfirmed. In this recording, Kothari allegedly refers to the money as an “equity investment,” while a voice purported to be Kundra’s responds that he had not taken any loan from Kothari, highlighting the dispute over the nature of the financial arrangement in the Shilpa Shetty Raj Kundra cheating case.

The couple’s legal team, led by advocate Prashant Patil, has dismissed all allegations in the Shilpa Shetty Raj Kundra cheating case as “baseless and malicious,” arguing that the matter is “purely civil in nature” and was already adjudicated by the National Company Law Tribunal Mumbai on October 4, 2024. Their defense maintains that the company went into financial distress and was involved in lengthy legal battles at the NCLT, with no criminality involved in the business transactions related to the Shilpa Shetty Raj Kundra cheating case.

Closing Assessment and Industry Impact

The Shilpa Shetty Raj Kundra cheating case represents a significant test of India’s financial crime enforcement capabilities, particularly regarding celebrity involvement in complex business fraud allegations. The issuance of Lookout Circulars against high-profile personalities in the Shilpa Shetty Raj Kundra cheating case demonstrates the Economic Offences Wing’s commitment to treating financial crimes seriously regardless of the accused’s social status or celebrity standing.

The Shilpa Shetty Raj Kundra cheating case has broader implications for the entertainment industry’s business practices, particularly regarding celebrity endorsements and business ventures that seek investments from private individuals. The allegations in the Shilpa Shetty Raj Kundra cheating case highlight the need for greater transparency in celebrity-backed business ventures and the importance of proper due diligence by both investors and celebrity entrepreneurs. The involvement of a sophisticated financial arrangement that allegedly converted loans into investments to avoid taxation raises questions about the regulatory oversight of such transactions.

As the Shilpa Shetty Raj Kundra cheating case investigation progresses toward the scheduled September 15 appearance, the case will likely set important precedents for how financial crimes involving celebrities are prosecuted and how investor protection mechanisms can be strengthened in high-profile business ventures. The outcome of the Shilpa Shetty Raj Kundra cheating case may influence future regulatory approaches to celebrity business investments and the standards of disclosure required when public figures seek private funding for their ventures.