Key Highlights:

- Trump announces 100 percent tariff China policy starting November 1, potentially escalating to 155% without trade deal

- China controls 69% of global rare earth production, creating critical supply vulnerabilities for US industries

- US-China trade volumes decline 19% to $35.8 billion in July 2025 amid escalating Trump 100 percent tariff China tensions

President Donald Trump has escalated his confrontation with Beijing through his Trump 100 percent tariff China policy, defending the unprecedented trade action as a forced response to China’s strategic positioning in critical materials markets. Speaking in a Fox Business interview, Trump acknowledged the severity of his Trump 100 percent tariff China decision while maintaining it was necessitated by Beijing’s aggressive rare earth export controls and trade manipulation tactics. The Trump administration announced these sweeping penalties on October 10, 2025, implementing the Trump 100 percent tariff China measure starting November 1, representing the most aggressive trade action against Beijing in decades.

China’s Strategic Rare Earth Market Dominance

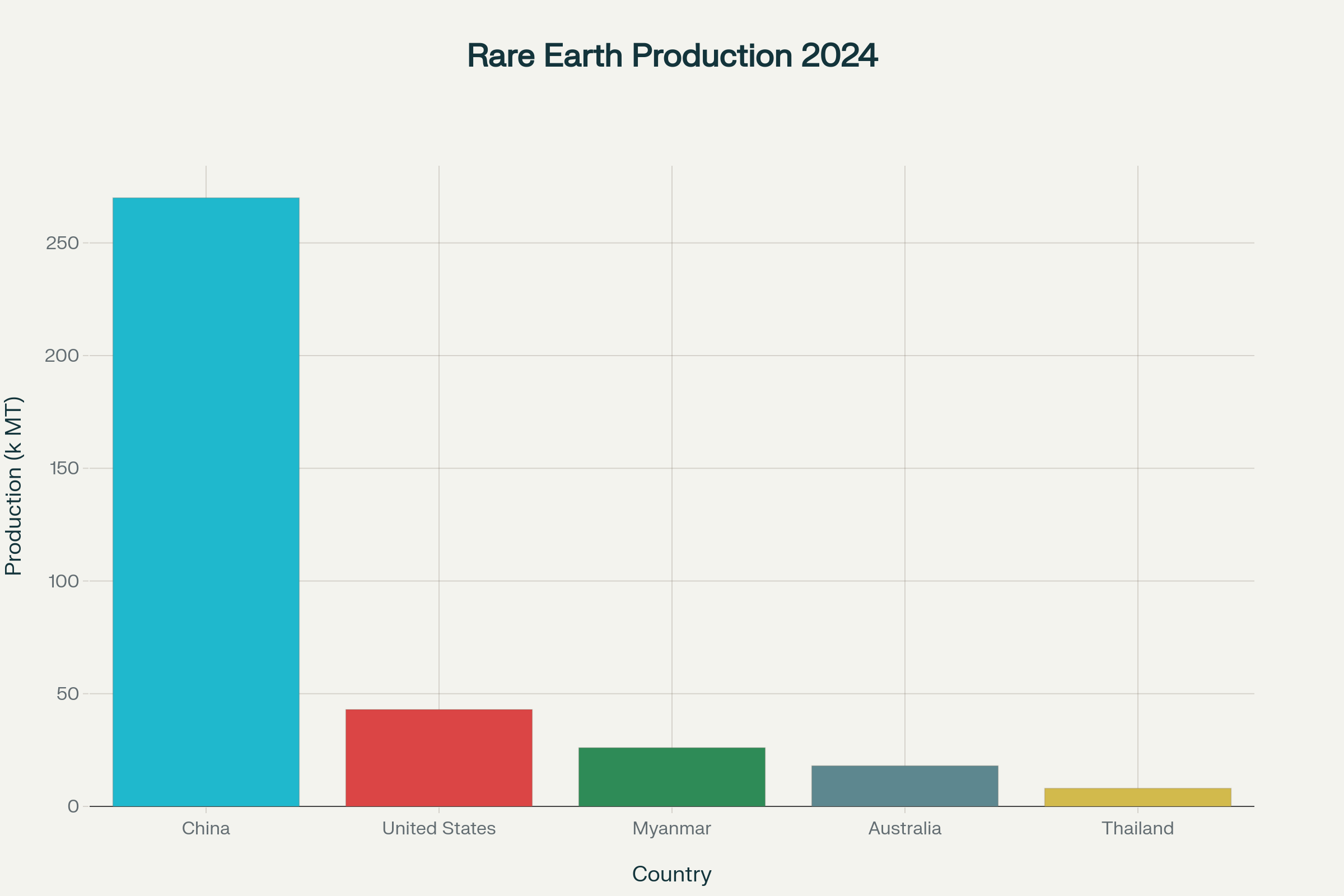

China’s overwhelming control of rare earth production forms the foundation of current Trump 100 percent tariff China tensions, with Beijing accounting for 270,000 metric tons of global production in 2024, representing 69.2% of worldwide output. The Chinese Ministry of Commerce implemented expanded export controls on October 9, 2025, targeting 12 out of 17 rare earth elements including holmium, erbium, thulium, europium, and ytterbium, directly triggering the Trump 100 percent tariff China response.

China dominates global rare earth production with 270,000 metric tons in 2024, accounting for over 69% of world output

The United States remains critically dependent on Chinese rare earth supplies, importing 70% of its requirements from China between 2020 and 2023, according to US Geological Survey data. China’s dominance extends beyond mining operations, with the country processing approximately 90% of the world’s refined rare earth elements and maintaining the largest separation and purification capacity globally. This dependency creates significant vulnerabilities for US defense, technology, and renewable energy sectors that rely heavily on these critical materials for manufacturing.

China’s rare earth market generated $2.8 billion in revenue in 2024, with projections indicating growth to $4.46 billion by 2030 at an 8.7% compound annual rate. The country’s state-controlled mining operations, led by China Northern Rare Earth High-Tech, operate under a quota system designed to maintain production discipline while maximizing strategic leverage. Recent export data shows China shipped 44,355 tons of rare earth products in the first eight months of 2025, representing a 14.5% increase over the same period in 2024.

Trump’s Escalating Trade Response Strategy

The Trump 100 percent tariff China policy represents an escalation from existing trade measures, building upon a complex tariff structure that already subjects Chinese goods to average duties of 51.1% as of August 2025. President Trump warned of potential increases to 155% duties on Chinese imports if Beijing fails to reach a “fair trade deal” by November 1, 2025, stating that China was already paying “tremendous amounts of money” under current 55% tariffs. This represents a significant increase from the initial Trump 100 percent tariff China announcement, bringing total potential duties to unprecedented levels that Trump himself acknowledged as “not sustainable”.

| Current US Tariff Structure on Chinese Goods (October 2025) |

|---|

| Tariff Category |

| Liberation Day |

| Fentanyl |

| Section 232 |

| Section 301 Lists 1-3 |

| Section 301 Four-Year Review |

| Trump 100 Percent Tariff |

Despite aggressive trade posturing, diplomatic channels remain active between Washington and Beijing, with US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng conducting “candid, in-depth and constructive exchanges” on October 17-18. These preliminary discussions established groundwork for in-person negotiations expected in Malaysia, serving as preparation for a highly anticipated meeting between Trump and Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation summit in South Korea.

Economic Impact and Trade Volume Decline

The Trump 100 percent tariff China policy has already begun affecting bilateral trade flows, with US-China trade volumes declining significantly throughout 2025 as tensions escalated. July 2025 trade data reveals a sharp contraction to $35.8 billion, representing a 19% decline from previous periods and highlighting the immediate impact of trade tensions on commercial relationships.

US-China trade volumes show volatility with a sharp decline to $35.8 billion in July 2025 amid escalating tariff tensions

Global companies have flagged more than $35 billion in costs from US tariffs heading into the third quarter of 2025, with combined financial impacts of $21.0-22.9 billion calculated for 2025 and nearly $15 billion projected for 2026. The Trump 100 percent tariff China policy threatens to exacerbate these costs significantly, potentially doubling the financial burden on companies maintaining supply chains dependent on Chinese manufacturing.

Tariff revenues have contributed to a 2% reduction in the US budget deficit for fiscal year 2025, with all current tariffs projected to raise approximately $2.5 trillion over the 2026-2035 period, though slower economic growth may reduce overall revenue collection. China’s economy has demonstrated resilience despite trade pressures, posting 5.2% GDP growth in the first three quarters of 2025, potentially reducing the effectiveness of the Trump 100 percent tariff China strategy.

Strategic Implications and Supply Chain Diversification

The Trump 100 percent tariff China policy reflects broader US efforts to reduce critical material dependencies and strengthen domestic supply chains in strategic sectors. The United States has accelerated diversification initiatives, with domestic rare earth production increasing consistently since 2018 through operations at the Mountain Pass mine in California and planned development at Round Top Mountain in Texas. Australia has emerged as a key alternative supplier, with the two countries signing an $8.5 billion agreement on October 20 to expand cooperation on defense technology and critical minerals.

Market analysts indicate that the Trump 100 percent tariff China measures have begun triggering supply chain adjustments, with China’s rare earth magnet exports falling 6.1% in September 2025 following three months of gains. The timing coincides with Beijing’s announcement of expanded export controls, suggesting Chinese manufacturers are adjusting production strategies in anticipation of further trade restrictions under the Trump 100 percent tariff China framework.

Closing Assessment

The Trump 100 percent tariff China policy represents a critical juncture in US-China economic relations, highlighting the strategic importance of secure mineral supply chains in national security planning. As negotiations continue ahead of the November 1 deadline, both nations face the challenge of balancing economic interests with geopolitical positioning in an increasingly competitive landscape. The outcome of upcoming trade discussions will determine whether diplomatic solutions can prevent implementation of the potentially devastating Trump 100 percent tariff China escalation that threatens to reshape global trade relationships fundamentally.

With China controlling nearly 70% of global rare earth production and the US importing $462.62 billion worth of goods from China in 2024, the Trump 100 percent tariff China confrontation extends far beyond bilateral relations to affect global economic stability.