Key Highlights:

- President Trump threatens Trump cooking oil embargo against China, targeting $1.2 billion trade relationship over Beijing’s soybean boycott

- China halted US soybean purchases entirely since May 2025, redirecting $12.6 billion in annual agricultural trade to South American suppliers

- Trump cooking oil embargo would impact minimal economic leverage as Chinese UCO exports to US already declined 65% in 2025

The Trump administration’s latest escalation in the China trade war has taken an unexpected direction with the Trump cooking oil embargo threat, as President Trump announced potential termination of American purchases of Chinese used cooking oil in retaliation for Beijing’s complete boycott of US soybeans. This Trump cooking oil embargo represents a new tactical approach in the deteriorating economic relationship between the world’s two largest economies, though industry analysts question the practical impact of such measures.

The Trump cooking oil embargo controversy emerged after China implemented what Trump characterized as an “Economically Hostile Act” by refusing to purchase American soybeans, a strategic move that has devastated US agricultural communities during the critical harvest season. China’s deliberate shift away from US agricultural products has forced American soybean producers to desperately seek alternative markets while facing storage shortages and collapsing prices.

China’s Strategic Soybean Boycott Creates Agricultural Devastation

China’s complete halt of US soybean purchases represents the most catastrophic disruption to American agricultural exports in modern history, with the Trump cooking oil embargo serving as a relatively weak counter-response to Beijing’s agricultural warfare. The world’s largest soybean importer traditionally purchases more than half of all US soybean exports, but shipments to China have dropped to zero since May 2025, prompting consideration of the Trump cooking oil embargo as retaliation.

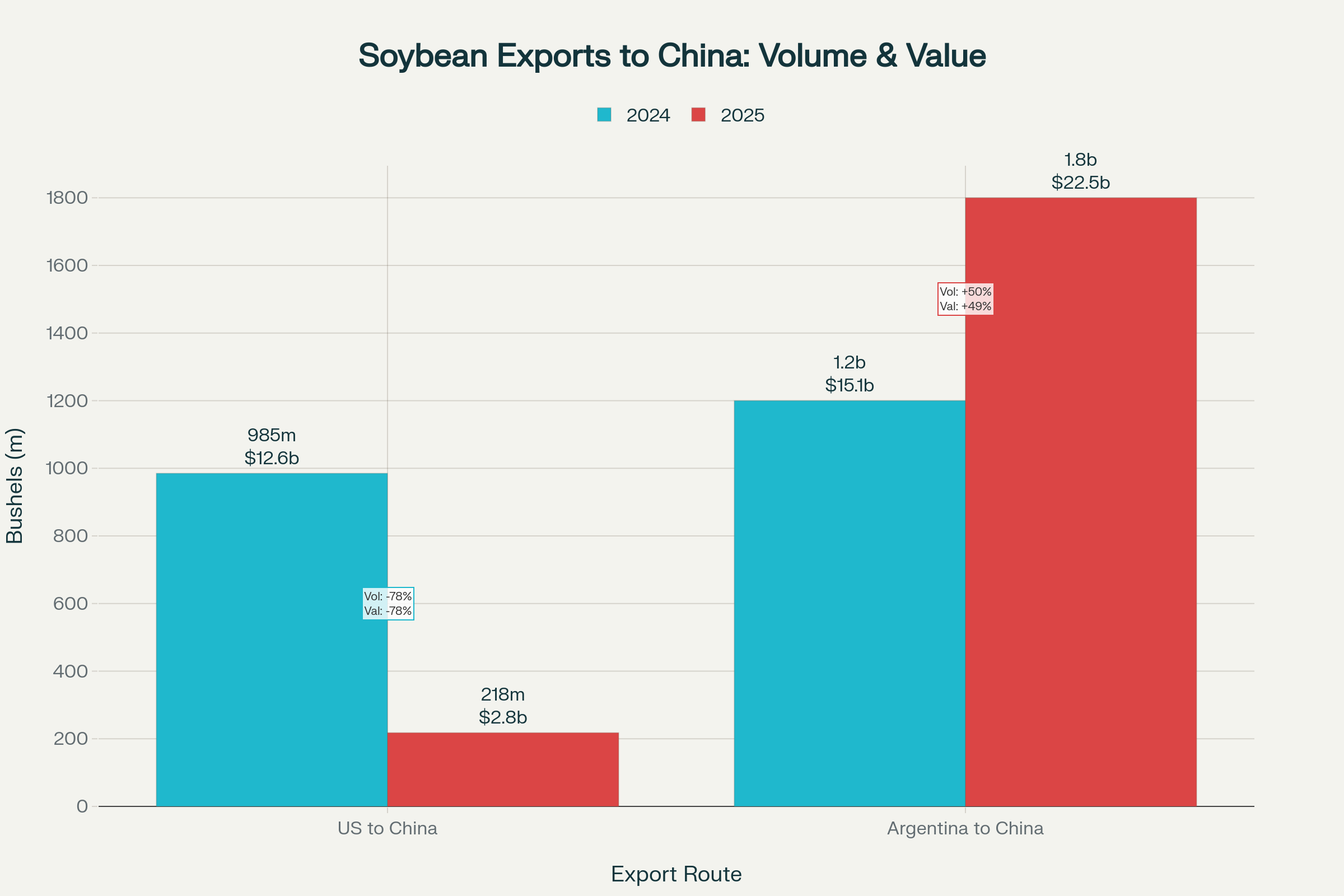

Soybean export comparison showing Argentina’s gains as China boycotts US suppliers

- US soybean exports to China collapsed from 985 million bushels in 2024 to just 218 million bushels through August 2025, representing a 78% decline

- China’s 34% total tariff rate on US soybeans, including retaliatory measures, has completely priced American crops out of the Chinese market

The economic devastation on American farmers has been unprecedented, with the US losing approximately $12.6 billion in annual soybean trade to China, far exceeding the potential impact of any Trump cooking oil embargo. Storage capacity shortages across the Midwest are creating additional agricultural crisis as farmers struggle to warehouse their crops while hoping the Trump cooking oil embargo or other measures might restore trade relations. The American Soybean Association’s warnings to the White House about the futility of tariff-based agricultural policy have gone unheeded, leaving farmers to bear the consequences while the Trump cooking oil embargo offers little substantive relief.

Argentina Capitalizes on US-China Trade War Through Strategic Maneuvering

Argentina has emerged as the primary beneficiary of the US-China agricultural trade breakdown, securing massive soybean contracts with Beijing through strategic tax eliminations that render the Trump cooking oil embargo largely irrelevant. Chinese buyers have committed to at least 10 major Argentine soybean shipments, each comprising 65,000 metric tons, for November delivery following Buenos Aires’ elimination of grain export taxes.

- Argentina’s soybean exports to China increased 50% in 2025, reaching projected volumes of 1.8 billion bushels worth $22.5 billion

- The strategic timing of Argentina’s tax cuts coincided with the Trump administration’s $20 billion currency swap commitment to Buenos Aires

This complex geopolitical maneuvering has created an paradoxical situation where US financial support for Argentina indirectly subsidizes competition against American farmers, making the Trump cooking oil embargo appear more symbolic than strategic. President Javier Milei’s White House visit occurred just hours before Trump announced the Trump cooking oil embargo threat, highlighting the contradictory nature of current US trade policy. Trade analysts note that American taxpayer support for Argentina’s economy is effectively funding the capture of US agricultural market share, while the Trump cooking oil embargo addresses a relatively minor trade relationship.

Trump Cooking Oil Embargo Targets Limited Economic Leverage

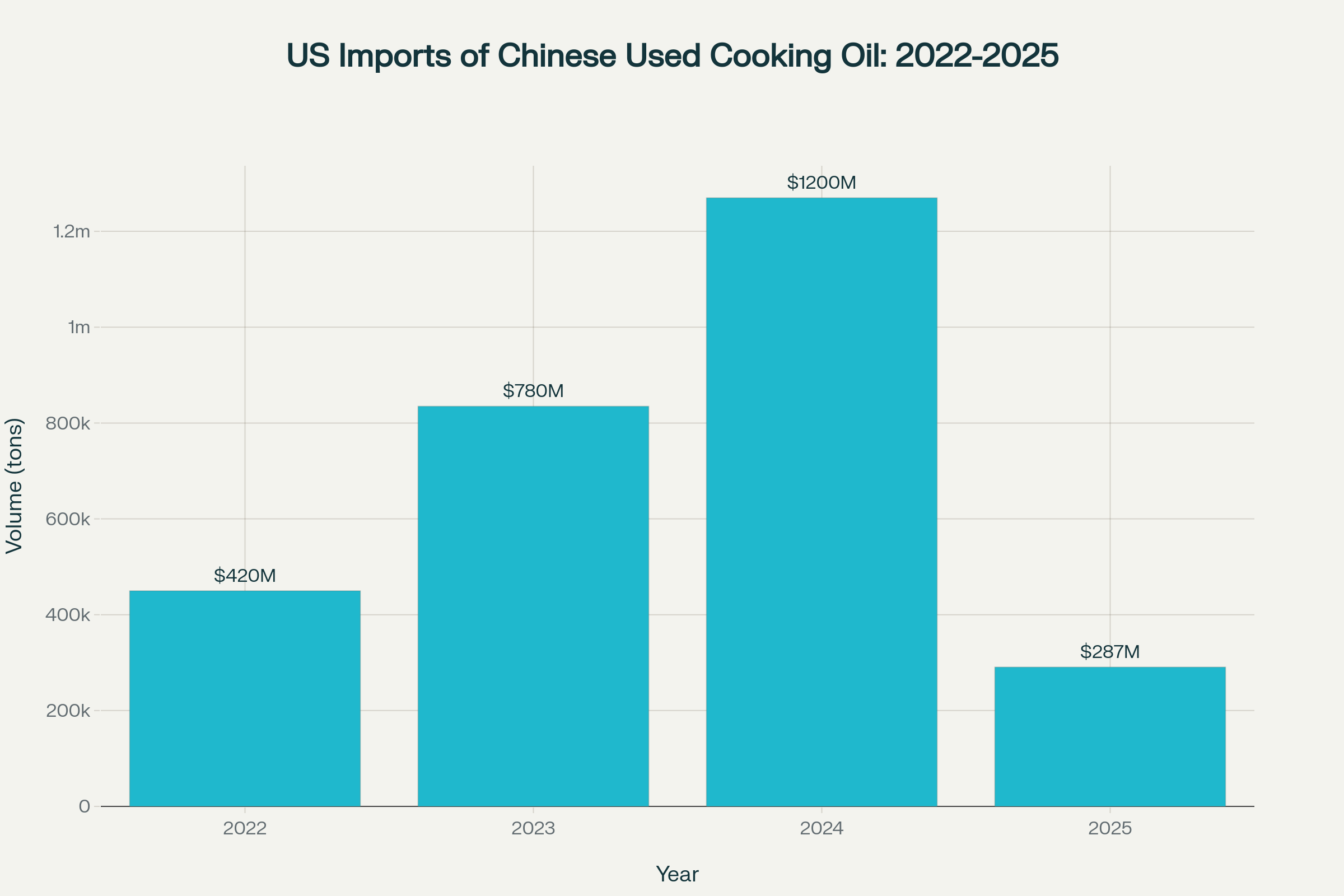

Despite the aggressive rhetoric surrounding the Trump cooking oil embargo, the used cooking oil trade between China and the US represents minimal economic leverage compared to the massive soybean trade dispute that prompted this retaliation. China exported a record 1.27 million metric tons of used cooking oil to the US in 2024, valued at approximately $1.2 billion and accounting for 43% of China’s total UCO exports, making the Trump cooking oil embargo a relatively small economic weapon.finance.

US imports of Chinese used cooking oil peaked in 2024 before plummeting 65% in 2025

- US imports of Chinese UCO already plummeted 65% in January-August 2025, falling to 290,690 tons worth $286.7 million before the Trumps cooking oil embargo threat

- The cooking oil trade represents less than 10% of the value of the abandoned soybean trade, limiting the effectiveness of the Trump cooking oil embargo

Industry analysts suggest the Trump cooking oil embargo would deliver minimal practical impact, as Chinese producers have already pivoted toward European markets following earlier trade restrictions and tax policy changes. Two unnamed UCO traders in China characterized the potential Trump cooking oil embargo impact as “hollow threats,” noting that Chinese exporters are no longer prioritizing the US market regardless of the embargo. The Trump cooking oil embargo appears designed more for domestic political messaging than delivering meaningful economic consequences to China.finance.

Market Volatility Reflects Broader Trade War Uncertainty

Financial markets have responded with significant turbulence to the Trump cooking oil embargo announcement and broader trade escalation, with agricultural commodity stocks experiencing dramatic swings based on trade rhetoric. The Trump cooking oil embargo threat contributed to renewed uncertainty about the economic relationship between the US and China, particularly as both sides continue implementing export controls and threatening additional tariffs.

- Bunge Global shares soared following the Trump cooking oil embargo announcement as investors anticipated domestic production opportunities

- Stock markets experienced massive volatility throughout October 2025, with agricultural commodities particularly sensitive to trade war developments

The timing of the Trump cooking oil embargo announcement coincides with rising inflation concerns and consumer price pressures that could be exacerbated by additional trade restrictions. Trade negotiators from both countries continue meetings ahead of critical November deadlines, but the Trumps cooking oil embargo rhetoric suggests limited progress toward resolving fundamental economic disputes. The Trump cooking oil embargo controversy represents another example of how the trade war has expanded beyond traditional manufactured goods to encompass specialized agricultural and energy products.

Closing Assessment

The Trump cooking oil embargo threat represents both the desperation and limitations of current US trade strategy, where relatively minor products become symbolic weapons in a larger economic conflict that American farmers are losing. While the immediate economic impact of the Trumps cooking oil embargo would be negligible given that Chinese exports were already declining, the escalation demonstrates how trade disputes create unpredictable cascading effects throughout global supply chains. American agricultural producers remain the primary casualties of this trade strategy, facing an uncertain harvest season without their largest export market while the Trump cooking oil embargo offers little substantive relief from the billions in lost Chinese demand.