Summary

- India warns the new US tariff measures could affect over half of its merchandise exports to America.

- Combined 50% duties target major sectors like textiles, pharmaceuticals, and engineering goods.

- WTO and IMF projections indicate risks for GDP and supply chain stability.

First Signs of Strain from Trump Tariffs on Indian Exports

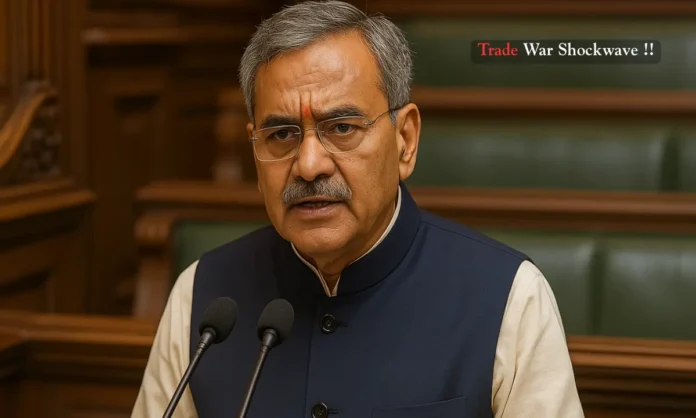

The announcement of Trump tariffs on Indian exports has triggered a wave of concern across New Delhi’s trade corridors. On August 11, 2025, Minister of State for Finance Pankaj Chaudhary informed Parliament that 55% of India’s merchandise exports to the United States will be impacted by the combined 50% duty scheduled to take full effect by late August. This includes an initial 25% reciprocal tariff imposed from August 7 and an additional 25% penalty tariff coming into force on August 27.

The United States remains India’s largest single-country export destination, accounting for approximately $87.3 billion in goods trade in 2024, according to data from the Office of the United States Trade Representative (USTR). The Ministry of Commerce notes that in FY 2024–25, India’s total merchandise exports stood at $820.93 billion, making the U.S. market vital to sectors like pharmaceuticals, textiles, engineering goods, and gems and jewellery.

WTO economists warn that tariff shocks of this magnitude could shave up to 0.6 percentage points off India’s GDP growth over the next fiscal year if left unmitigated. With the Trump tariffs on Indian exports targeting key trade flows, businesses are bracing for cascading disruptions in contracts, shipping schedules, and supply chains that extend well beyond the export sector itself.

Pressure Points in Commerce from Trump Tariffs on Indian Exports

- The combined tariff rate will double duties on several Indian products, from 25% to 50%.

- Key sectors such as textiles, engineering goods, gems, jewellery, and pharmaceuticals are directly in the crosshairs.

At the heart of the Trump tariffs on Indian exports is the American administration’s stated aim to pressure India over its continued import of discounted Russian crude oil. The penalties have been structured to affect goods in which India holds strong market share in the U.S., including hand-knotted carpets, organic chemicals, auto parts, and processed foods.

According to the Directorate General of Foreign Trade (DGFT), engineering goods alone contributed $16.2 billion to India’s exports to the U.S. in FY 2024–25. Textiles and apparel brought in another $12.4 billion, while pharmaceuticals were valued at $8.7 billion. The 50% tariff rate is expected to hit these segments hardest, leading to reduced price competitiveness and potential loss of market share to countries not facing similar duties.

The IMF’s July 2025 World Economic Outlook adds that in a scenario where tariffs remain in place for over 12 months, India’s goods export growth could slow from 6.3% to under 4%, with the heaviest impact felt by labour-intensive industries.

Ripple Effects Beyond Ports of Trump Tariffs on Indian Exports

- MSMEs in the export supply chain could see reduced order volumes and cash flow strains.

- Shipping and logistics firms warn of higher freight rates due to disrupted container flows.

While headlines focus on the headline trade figures, the Trump tariffs on Indian exports have consequences that ripple far beyond customs clearances. Thousands of micro, small, and medium enterprises (MSMEs) supply intermediate goods to larger exporters. With reduced orders from U.S. buyers, many face the prospect of delayed payments or cancelled contracts.

Export credit agencies such as the Export Credit Guarantee Corporation of India (ECGC) warn that payment delays could rise by 8–10% in high-exposure sectors over the next six months. Meanwhile, freight forwarders note that uncertainty over shipment volumes is already causing volatility in container availability and rates.

There are also implications for India’s logistics infrastructure. The Sagarmala project’s planned expansions in western ports like Mundra and Nhava Sheva were partly designed to handle increased U.S.-bound cargo. If Trump tariffs on Indian exports persist, throughput forecasts may need revision, potentially affecting private investment in port terminals and inland logistics hubs.

Perspectives from the Frontlines

- Exporters’ associations call for targeted government support to maintain competitiveness.

- WTO officials caution against an unchecked spiral of retaliatory measures.

Industry bodies have been quick to voice their concerns over the Trump tariffs on Indian exports. The Federation of Indian Export Organisations (FIEO) has urged the government to expand the Remission of Duties and Taxes on Export Products (RoDTEP) scheme for affected sectors. Pharmaceutical exporters, represented by the Indian Drug Manufacturers’ Association (IDMA), warn that U.S. buyers may look to shift contracts to other low-cost manufacturing nations like Vietnam or Mexico.

From the multilateral perspective, WTO trade economists highlight that India could seek consultations under the Dispute Settlement Understanding if the tariffs are deemed inconsistent with WTO commitments. However, such proceedings can take months, if not years, to resolve, and may not offer immediate relief to exporters facing reduced margins.

The Reserve Bank of India (RBI) in its August trade bulletin noted that services exports, especially IT and business process outsourcing, might partially offset merchandise losses, but warned that the overall current account could still widen by up to $8 billion if the tariff measures persist for a full fiscal year.

Strategic Moves in Play Against Trump Tariffs on Indian Exports

- India is assessing legal options at the WTO and exploring bilateral talks with the U.S.

- Exporters are being encouraged to diversify into European, ASEAN, and African markets.

In the face of the Trump tariffs on Indian exports, the Indian government’s trade strategy is moving on multiple tracks. On one hand, officials are considering a formal challenge at the WTO, building on past cases where punitive tariffs were successfully contested. On the other, there is a push to engage U.S. trade representatives directly, using forums like the Trade Policy Forum to seek partial exemptions or phased rollbacks.

The Ministry of Commerce is also intensifying outreach to other major markets. Preliminary talks are under way to accelerate free trade agreements with the European Union and the United Kingdom, while exporters are being incentivised to tap into fast-growing African consumer markets. The Department of Commerce has indicated that sector-specific trade fairs and buyer-seller meets will be expanded in ASEAN nations, which have lower tariff regimes and growing import demand for many Indian goods now penalised in the U.S.

Looking Beyond the Horizon

The Trump tariffs on Indian exports are more than a temporary trade skirmish, they represent a stress test for India’s export resilience in a world of shifting geopolitical alliances. If these measures become entrenched, India will need to rethink not only its market strategies but also its energy procurement policies, which are at the core of the current dispute.

The WTO and IMF both caution that global trade is entering a period of heightened fragmentation, with major economies increasingly using tariffs as tools of foreign policy. For India, which has worked to diversify both its export basket and its market reach, this episode may accelerate long-term structural shifts toward regional supply chains and domestic value addition.

As the Trump tariffs on Indian exports continue to shape trade patterns, exporters and policymakers alike face the challenge of adapting to a less predictable and more politically charged trade environment. What remains clear is that the stakes extend well beyond numbers on a customs ledger. At risk is not only billions in export revenue but also the credibility of the rules-based trading system. How India navigates this moment will help define its role in the global economy for the next decade.